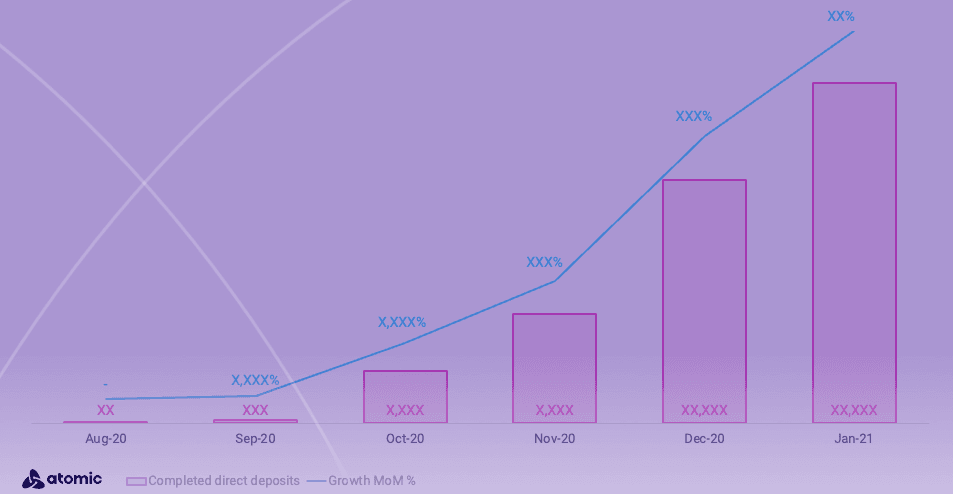

On a monthly basis, over 10,000 consumers set up or update direct deposits using Atomic’s payroll APIs. Six months ago, we completed less than 100 updates.

At the current pace, Atomic will complete over 100,000 total direct deposit updates by Q2’21.

To enable more financial services providers to use payroll APIs, we are sharing redacted metrics of how customers use Atomic to grow deposits and reduce consumer friction to setup or update their direct deposit information.

In this brief, we explain what coverage and conversion metrics are, why they matter to customers, and how we’ll top the first 100,000+ milestone and beyond.

What are coverage and conversion?

Broadly, we define coverage and conversion metrics in the following terms:

- Coverage, which measures the universe of employees and percentage of the US workforce covered by our integrations with payroll providers and mapping of public and private sector employers.

- Conversion, which measures the ability and success rate at which a consumer logs-in or “authenticates” into their employer’s HR system or payroll provider to set up or update direct deposits.

How we grow coverage and conversion

Insights on growing coverage and conversion came from our first customers.

To launch, we tailored our initial product coverage to our customers’ use cases, resulting in better conversions.

Our coverage rate compounds with each payroll integration we add because they unlock a pool of employers. Conversion rates improve with the volume of consumers identifying “who pays them,” either their employer or payroll provider and Atomic’s mapping of either.

Both increase exponentially as we add new financial services customers.

Referring to the chart of consumers who update direct deposit using Atomic’s payroll API above, in January we started working with three neobanks which increased the number of completed direct deposit updates by a multiple of 10,000+.

On the conservative, we estimate we cover ~60% of the US workforce, including the private sector and unemployment. We base this estimate on our employer and payroll coverage.

What we’re focused on next?

(Spoiler alert, coverage, conversion, and customers)

Improving and upkeeping our coverage and conversion are an ongoing priority.

Unlike bank accounts, the payroll landscape is shifting multiple ways as employers switch HR providers, employees switch jobs, and the job market remains volatile during the pandemic.

To scale, we continue to prioritize building payroll integrations and mapping employers based on customers’ use cases versus the largest or total addressable market.

Ultimately, we believe there are millions of opportunities for Atomic’s payroll APIs to drive further fintech adoption and better outcomes for consumers who want to easily update direct deposit.

For more data behind our direct deposit coverage and conversion metrics email lindsay@atomicfi.com or request access during a demo.