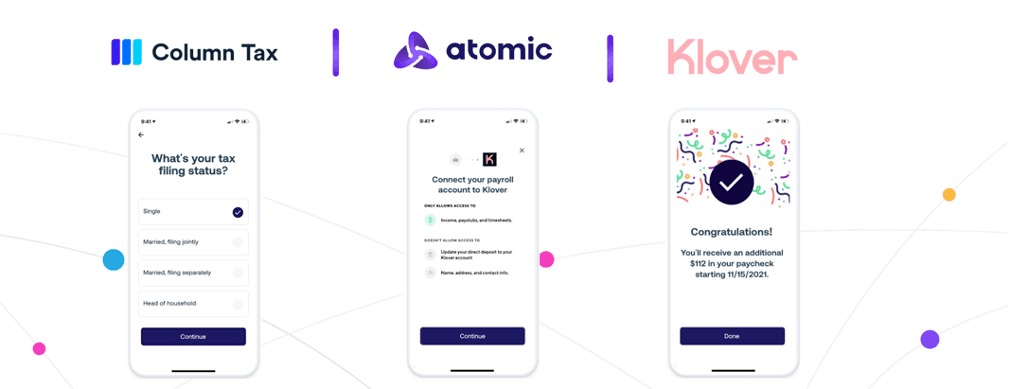

To help consumers unlock their tax refunds when they need it most, we are excited to share our latest partnership with Column Tax to launch Tax Refund Unlock. Below, we spotlight how customers, including Klover, integrate the product to help users access their tax data, simply tax forms, and tap into tax refunds year-round. You can read the full press release here.

Congratulations to our partner Column Tax on also announcing a $5.1 million seed round led by Bain Capital Ventures with participation from Core Innovation Capital, also an early investor in Atomic, as well as South Park Commons, and Operator Partners.

Giving Americans Year-Round Access to Tax Refunds

Column Tax provides an API that enables mobile banking and fintech companies to offer powerful tax products to their account holders. By unlocking year-round access to tax refunds and advice, Column Tax and its partners, including Atomic, are enabling consumers to optimize tax returns in a fundamentally new way.

Column Tax is also announcing its first commercial product, Tax Refund Unlock, enabling all Americans to get advance access to their tax refunds in monthly payments, as well as file their taxes with just a few clicks.

“Taxes are a stressful but critical part of the financial year for the 122 million Americans that receive a refund. By helping every American access their refunds year-round, people can save, invest, pay off debt, and meet ongoing obligations throughout the year, all with greater peace of mind.”

Why now? As Column Tax references in the TechCrunch‘s coverage of the announcement,

“Before Atomic, it wouldn’t be possible to understand someone’s tax position mid-year without them downloading a pay stub and sending it to you via email.”

In partnership with Klover, the free financial services platform, users can opt in to immediately unlock access to their future refunds through the Klover app. By optimizing tax withholdings, Klover users will receive more of their earnings in each paycheck, reducing the need for loans or credit cards, and stop overpaying in taxes.

“Americans should be able to access their money when they need to. Increasing your paycheck by a couple hundred dollars can be life changing for millions of people.

At Klover, we want to level the playing field by helping consumers get access to fair financial services. We already offer free access to your paycheck, real-time price comparisons, money management and saving tools, and a lot more. This is the next logical step in doing right by our consumers.”

From Atomic’s perspective, every year, tax payers receive more than $350 billion of their own money back in the form of a tax refund. That would be the thirteenth largest bank by consolidated assets, untouched by tax payers who may need that money in a pinch. Our access product is a unique solution and is yet another way Atomic’s payroll connectivity is unlocking the power of the paycheck.

A New Approach to Tax Filing

In the upcoming tax season, Column Tax is rolling out a modern income tax filing product to complement its year-round platform. With Tax Filing, Column Tax enables partners to seamlessly offer an embedded income tax filing product to end users, a major step forward for the filing experience. By connecting directly with financial accounts, Column Tax makes it possible to significantly increase accuracy and reduce the amount of money and time (an estimated seven billion hours annually) spent preparing tax returns.

“Figuring out and meeting income tax obligations is an experience that 140 million Americans face each year,” said Kevin Zhang, Partner at Bain Capital Ventures. “With Column Tax, developers can build new experiences powered by trusted personal tax calculations. By embedding with the financial services that we interact with throughout the year, Column Tax has the most compelling vision we’ve seen for helping millions of Americans avoid excessive withholding and year-end surprises, and stay continuously up-to-date throughout the tax year.”

Featured coverage: TechCrunch

Column Tax announces $5.1M seed round to launch mobile tax-prep products

Want to simply and unlock tax refunds for users?

Looking ahead to the 2022 tax season, we will expand product adoption and support other tax filing product use cases.

To learn more, please reach out here.