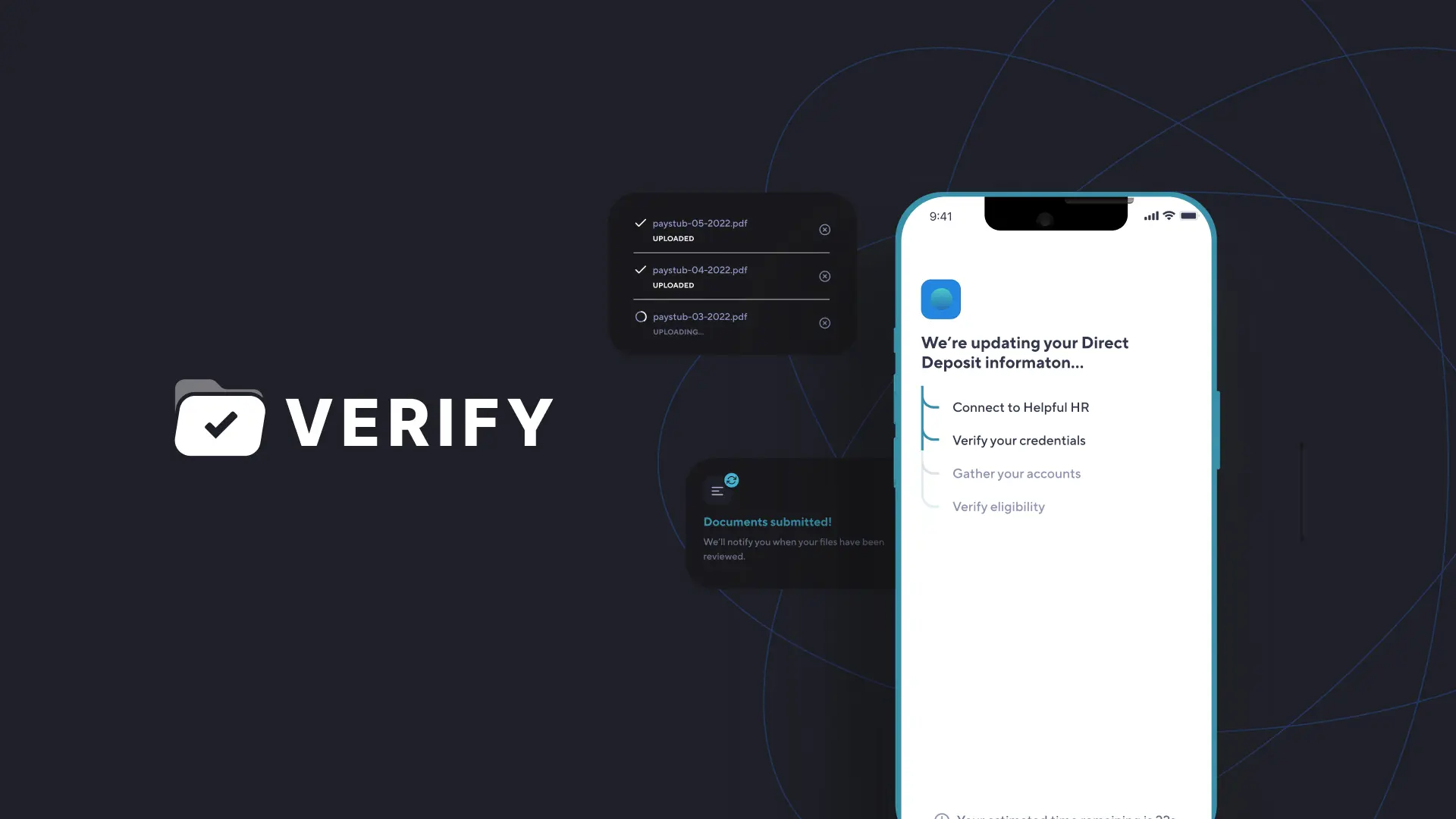

Verify income and employment quickly and accurately

The problems Verify solves

Confirming income and employment information is essential to qualify customers for credit and other financial services, but getting information from employers is time-consuming and costly. The process invites the risk of fraud.

01

Search for employer or payroll provider

02

Connect and log in to payroll portal

03

Securely verify credentials

Our solution

By allowing customers to connect their payroll accounts to your application with Atomic, you can obtain quick, complete and reliable income and employment data in real-time, whether their income is from gig work, government benefits or traditional employment.

Let’s Connect

Learn more about Atomic