Some of the largest neobanks are integrating Atomic’s payroll APIs to strengthen customer experience and direct deposit acquisition.

In 2020, neobanks evolved from solutions targeting niche pain points to full-service digital banking platforms for the mass market.

Neobanks, including fintech companies that started as a mobile-first “challenger bank” or bolted on a checking or savings product, or mobile wallet, saw account openings top new milestones, driven in part by the pandemic. The competitive landscape also widened amid record consumer adoption.

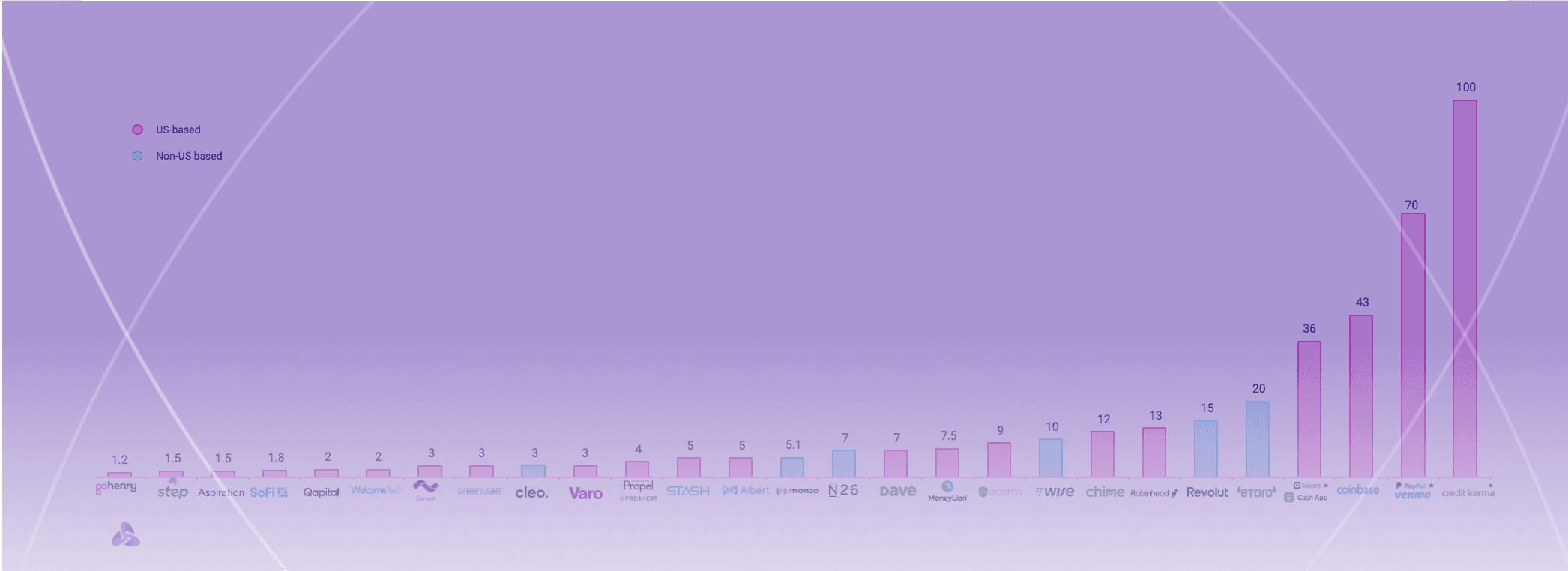

Today, there are over 25 neobanks either based or with operations in the US that have topped 1 million+ accounts or users. For reference, in 2019, only seven challenger banks had reported crossing this milestone, according to previous research I led at CB Insights.

[Disclaimer: The information and data visualization is not exhaustive and is for informational purposes only. Citation does not mean the firm is a customer of Atomic]

Combined, these select neobanks have opened upwards of 385 million total accounts across verticles and jurisdictions with zero branches.

To maintain momentum in the market, ten of the leading neobanks are integrating Atomic’s payroll APIs to strengthen their digital banking platforms.

By innovating on the process enabling consumers to set up and make changes to direct deposits via mobile apps, instead of calling their employer or sending a physical form to their HR departments, neobanks can increase the utility consumers get from their banking relationships.

The pandemic was an inflection point for neobanks

The COVID-19 pandemic accelerated the evolution of neobanks as many consumers transitioned from engaging with their banks in-branch to in-app.

In extreme scenarios, neobanks became a safe haven for excess cash for medium- and higher-income households and a financial lifeline for lower-income households.

Hungry to invest amid market volatility, consumers with cash on the side and extra time during stay-at-home guidance flooded the capital markets.

Consumers opened a record 10 million brokerage accounts last year, with Robinhood reportedly scooping 60% of them, growing to 13 million total accounts.

Lower-income consumers flocked to neobanks for the opposite reason.

For over 40 million consumers in the Supplemental Nutritional Assistance Program or SNAP (commonly known as food stamps), companies such as Propel provided relief from actual hunger. The Fresh app, which serves as mobile wallet to access electronic benefits transfers (EBT), now helps 4 million users access their SNAP benefits and has over 10 million downloads on Google Play Store.

What’s next for neobanks?

In either extreme scenario, increased consumer adoption drives greater active usage, and creates momentum for consumer engagement with other financial products.

Robinhood and Propel, among others shown in the accompanying chart, have expanded from their initial charters into neobanking, albeit most don’t hold bank charters.

How Atomic works with neobanks

Neobanks that integrate Atomic’s payroll APIs are reducing the friction for users to try new features. Because Atomic integrates directly into payroll systems and embeds the experience in the neobank’s app, conversion rates for consumers attempting to and successfully setting up direct deposit with their neobanks have increased.

By reducing artificial barriers and creating options for consumers to fund accounts with direct deposits, neobanks are well positioned to see adoption improve.

Looking ahead, by enhancing their ability to attract and retain direct deposits, neobanks are steadily taking on the role of traditional financial intuitions as the primary banking relationship for more consumers.

If you’re building a neobank and want to be featured in Markets’ insights or to learn more about Atomic’s payroll APIs for direct deposit acquisition, use the contact form below or request a demo here.