Lending

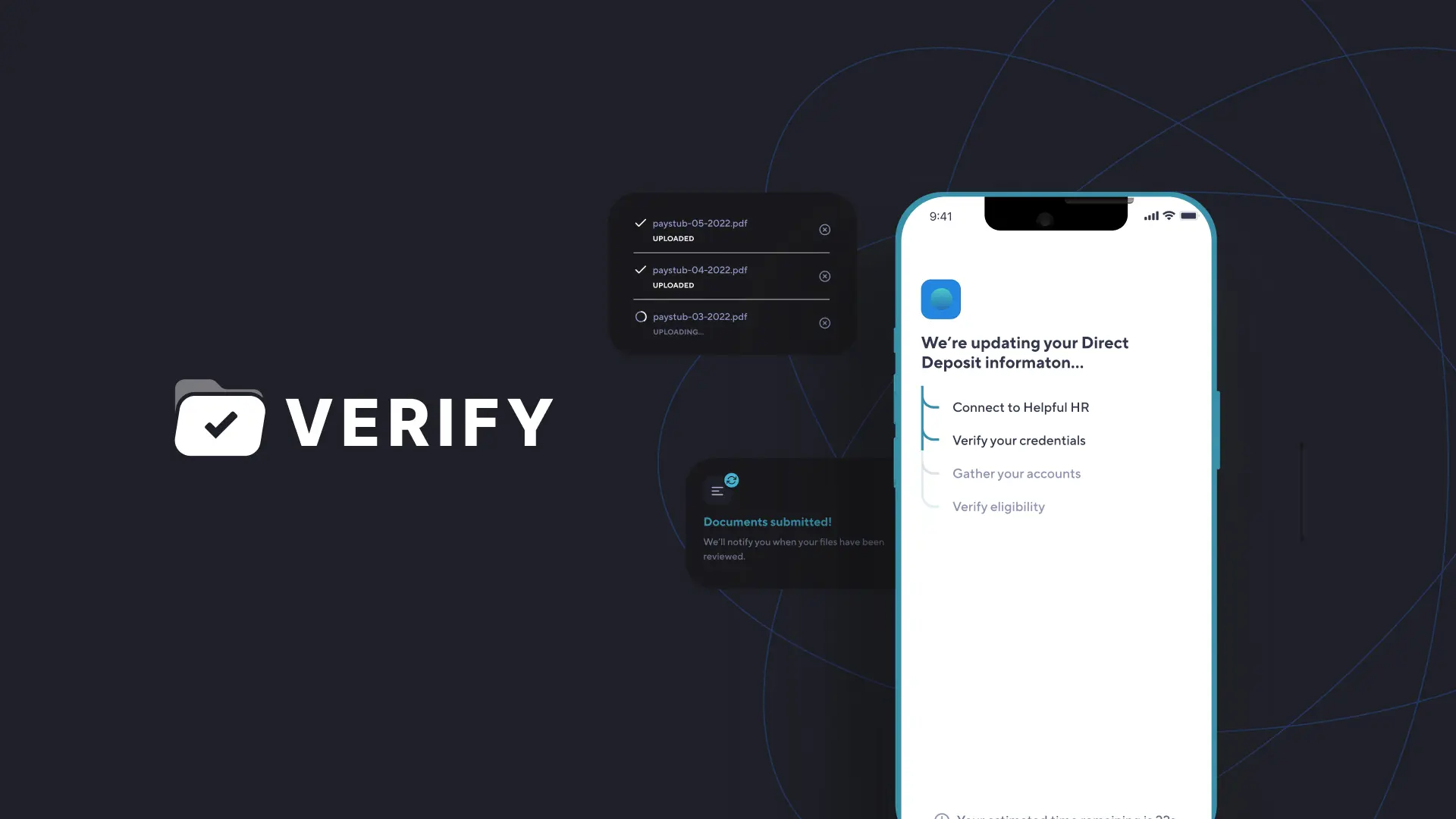

Verify an applicant’s income and employment quickly and accurately.

The Problem

Gaining a complete picture of an applicant’s creditworthiness requires accurate and up-to-date income and employment verification. The process of obtaining this information is cumbersome and time-consuming, often delaying underwriting and approval. It also leaves room for application fraud.

Our Solution

Assess creditworthiness and reduce fraud risk with quick, complete, and reliable income and employment data. Using Atomic’s Verify solution , you can receive detailed, up-to-date data directly from the applicant’s employer or payroll service in real-time, whether their income is from gig work or traditional employment. Atomic payroll connectivity supports the full range of loan and credit products – student debt, home, auto, medical, credit cards.

Let’s Connect

Learn more about Atomic