Why digital mortgage verifications are Better for homeowners – Part II

Lindsay Davis

Head of Markets

The “great reshuffling” set off by the COVID-19 pandemic led to $4.4 trillion in mortgage originations in 2020, a record. In Part I of this post, we discussed how some of the biggest winners were digital-first homeownership companies, including Better.com. Next, we’ll look at other beneficiaries, including e-signature companies such as Notarize, and explore opportunities Atomic sees for payroll APIs.

Macro-drivers: The market, migration, regulations

Mortgages represent a $15 trillion market opportunity. Economists anticipate new home sales will continue if the new administration passes tax credits to boost homeownership rates.

During the 2020 pandemic, mortgage loan originations nearly doubled 2019’s $2.4 trillion. The surge in originations was driven in part by new home sales as consumers fled from high-cost to low-cost communities, eager to take advantage of fully remote work environments. Near 0% interest rates also drove existing borrowers to refinance at record rates.

Regulations, including remote online notarization (RON) legislation also opened the market for digital-first platforms to capture consumer demand while bank branches remained closed during lockdowns.

Pre-COVID, some states required parts of the mortgage application to be completed at a physical branch. States quickly adopted RON legislation to instate e-signature policies in response to a surge in refinancing applications. This was a big win for digital notary services such as Notarize, as well as document digitization companies including Ocrulus.

Open opportunities for payroll APIs in mortgage

Driving mortgage volume

Better’s tech-first strategy to drive efficiencies in the mortgage market has been consistently to reduce the operational costs and time of processing physical documents. A few ways digital mortgage lenders could boost origination volumes is further automation by using payroll APIs.

Use cases include verification of assets (VOA), verification of income (VOI) and verification of employment (VOE) processes which are expensive and manual.

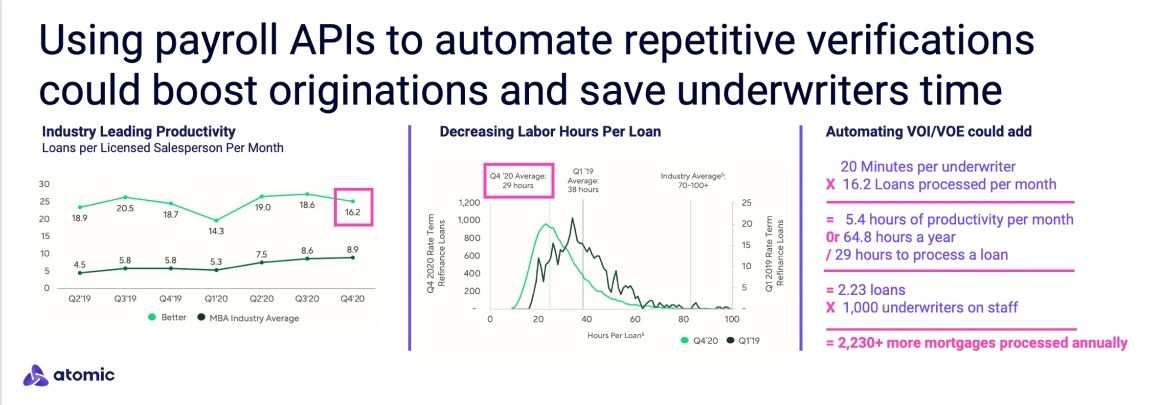

Better’s team close an average of 16.2 loans per month, compared to the industry average of 7.1 reported by the Mortgage Bankers Association (MBA).

For underwriters, automating verifications can save approximately 20 minutes per loan. Multiplied by Better’s average volume, an underwriter could add 5.4+ hours of productivity a month or 64.8 hours a year. Assuming one in seven employees are underwriters at Better could add 648 hours of productivity. Reallocating that time to processing, with Better’s average processing time of 29 hours per loan, each processor could complete 2.23 additional loans or 2,230 per 1,000 processors annually, noting the processing time will fall when manual tasks are replaced by automation via APIs.

Payroll APIs could also drive higher data integrity and reduce the risk for lenders of borrowers losing their job after the second VOI and VOE verifications. In time, this could narrow the 10-day window lenders are on the hook if the borrower in unemployed.

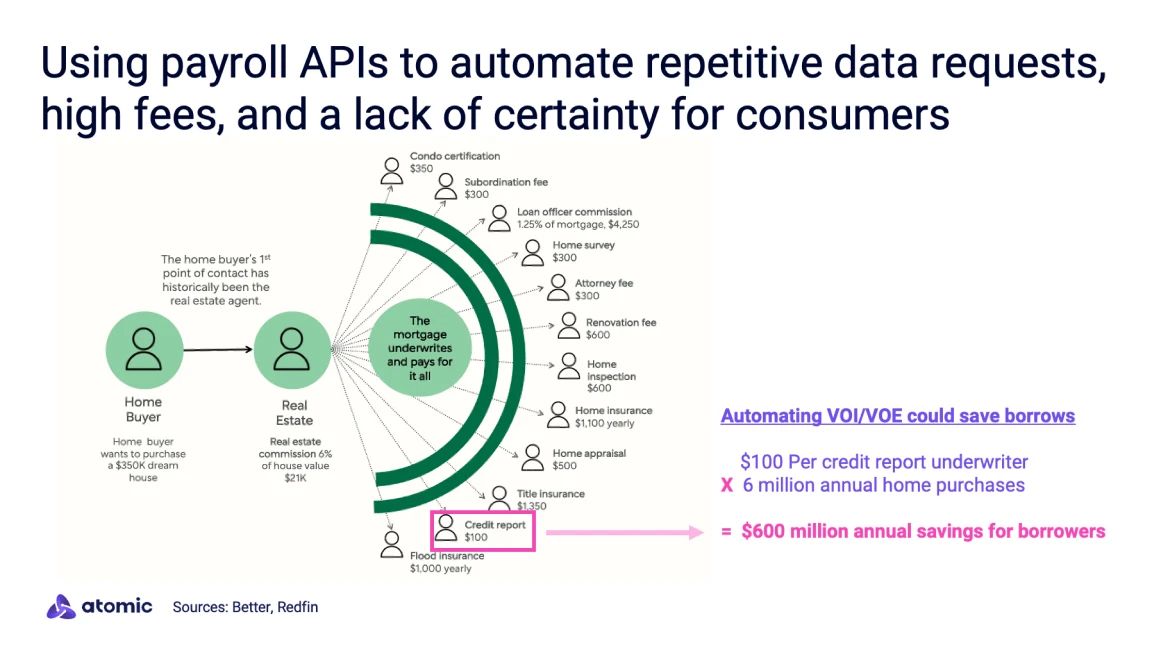

Cutting consumer costs

For consumers, verifications can require pulling multiple years of documents several times during the mortgage and refinance processes. In addition to friction, they are not free.

Verifications can cost between $20 to $100 per credit check. There are approximately 6 million homes purchased annually in the US. Automating credit checks could save borrowers up to $600 million annually. The addressable opportunity can also fluctuate as it did during 2020, when there were an estimated 7.5 million transactions, according to Redfin.

The addition of new vendors, like Atomic, would also introduce competition to Equifax’s The Work Number (TWN) and its quasi-monopolistic position as the preferred vendor for verifications.

For more coverage of Better’s SPAC and ways fintech companies are digitizing mortgage processes, check out Part I of this post or our podcast episode of For Fintech Sake with the Head of Mortgage at Ocrolus.