Disrupting Income & Employment Verifications with Atomic’s Verify

Salina Jivani

Director of Brand Content

Paper and manual processes are more obsolete today than they were five and ten years ago. It should be no surprise, then, that the landscape for verification of income and employment (VOI/E) is undergoing a major transformation–for the better, of course. To help you stack traditional verification methods against Atomic’s Verify API capabilities, we tapped Atomic Product Manager Zach Lee to take us through answers to common questions on why payroll connectivity is the way to go.

Q: What’s VOI/E? And what do I need to know?

Let’s start at the beginning. VOI/E stands for Verification of Income and Employment. You may need to verify income and employment data for various use cases, like when you’re hiring or lending. For example, imagine your friend is applying for a personal loan to consolidate debt. On the loan application, they’ll typically disclose their current income and employer. During the underwriting process, lenders verify stated information to establish the level of risk on the loan. That underwriting process is what determines whether or not your application is accepted–and what your loan interest rate will be. That’s why verifying income and employment status is critical in the lending environment.

Q: Before Atomic came along, how did banks/lenders/financial institutions traditionally verify income and employment?

During the typical underwriting process, lenders examine three key things: credit, capacity, and collateral. Verification of income and employment is one of the key inputs that help underwriters understand a borrower’s capacity to repay. Historically, lenders have employed one of four methods to verify income/employment:

- Paper: The old-school way is to have the borrower provide copies of W2s and paystubs to prove income and active employment.

- Employer Partners: A common one is The Work Number. Employers furnish income and employment information of employees to The Work Number, who then–for a substantial fee–handles all verification requests.

- Bank Transaction Data: Companies leverage bank transaction data to verify incoming deposits and determine income levels.

- Not Verifying: Some lenders rely solely on a credit report. Although this isn’t a true verification of income, if a borrower’s credit score is high enough to determine the level of risk, some lenders are okay with using this approach and forgoing a real verification.

Q: How does Atomic make verification easier?**

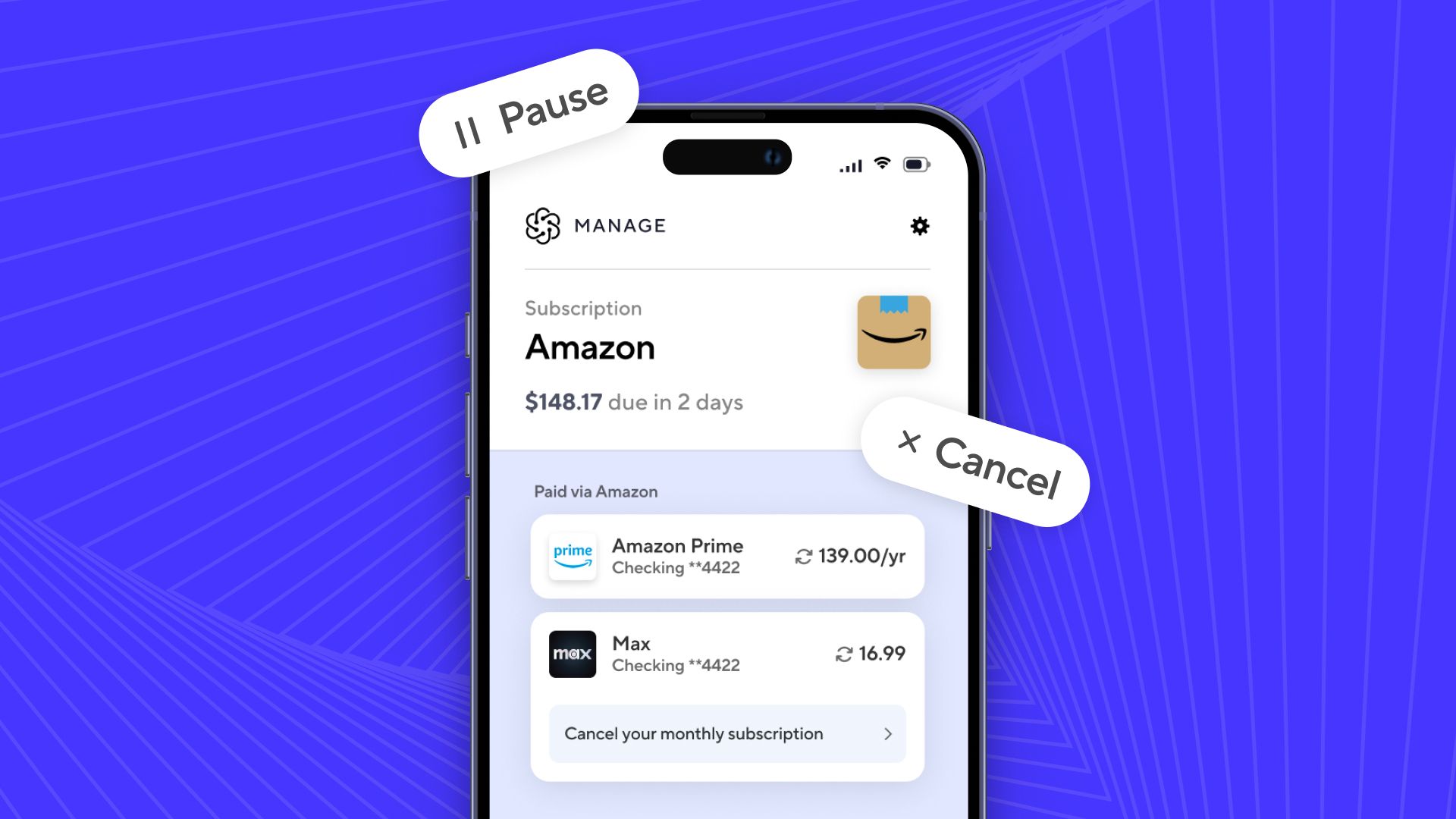

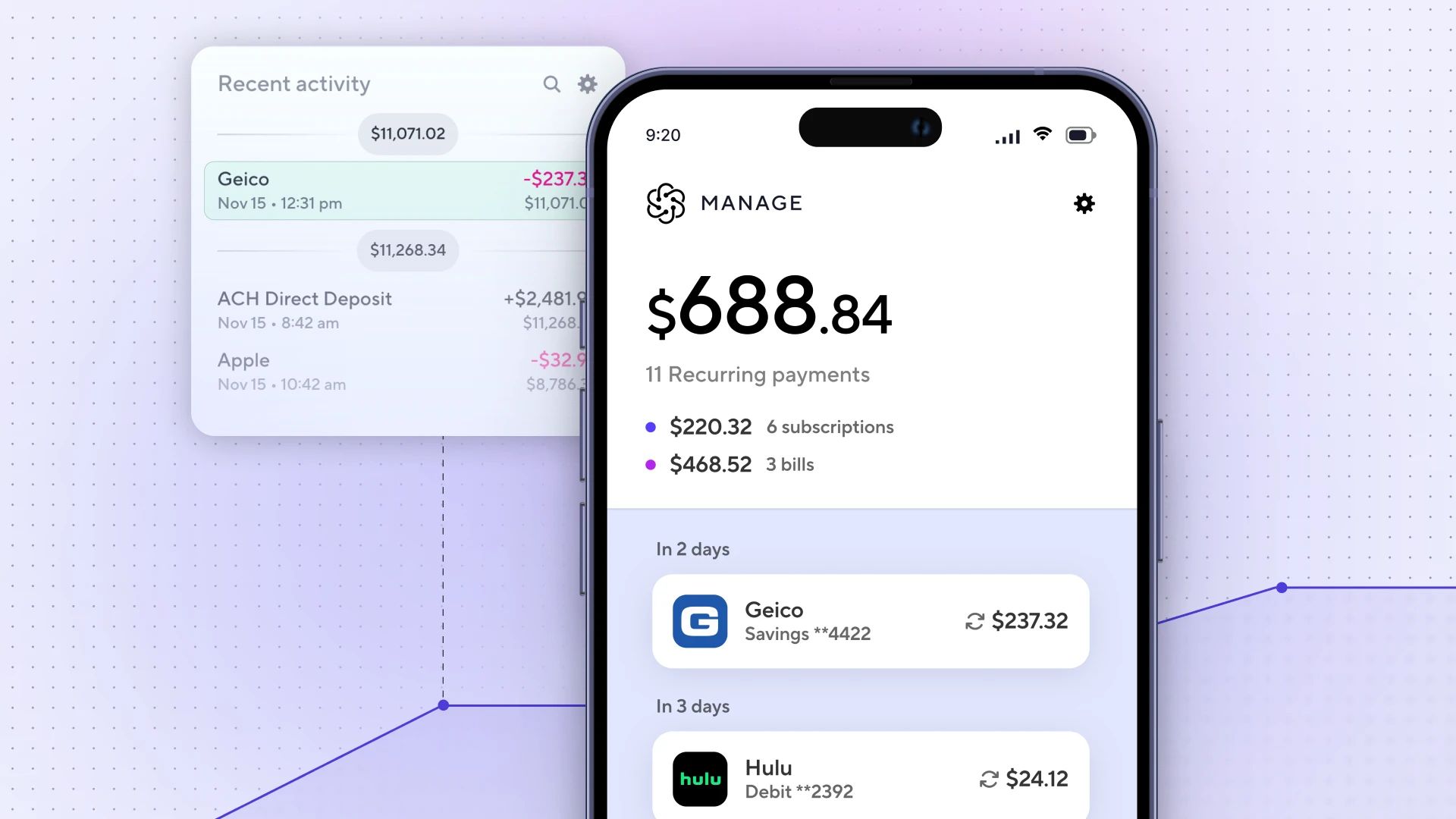

Atomic’s Verify solution streamlines verification by giving front-end access to consumers’ payroll data, which lenders can then use to validate income and employment.

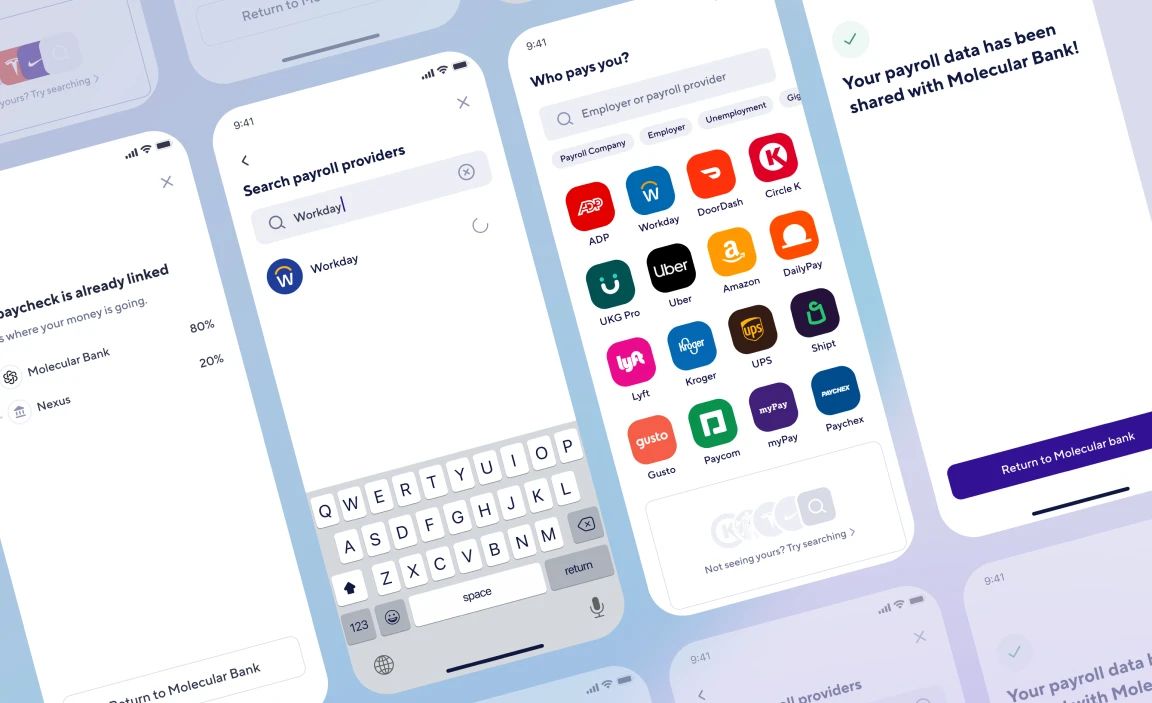

The data is consumer-permissioned. This means once you code our API into your website or app, the borrower can use the credentials they established with their payroll provider to log into their payroll system directly. We ask their permission to access their payroll data through a secure connection. This is to make sure to let them know which information we will and will not retrieve. After the borrower agrees to our terms, the lender is able to leverage the Verify solution to begin validating borrower income and employment information in real-time.

Our team has built out secure integrations with hundreds of different payroll providers enabling us to read and extract information like total annual income, status of employment, hours worked and much more. This data is subsequently made available for consumption by our customers via a simple API integration empowering customers to leverage that data to better serve their end users.

The benefits of this automated approach include a streamlined process and mitigation of document fraud among many other advantages.

However, let’s be clear that lending is not the only area where VOI and VOE can be beneficial. Hiring employees, working with rental properties, and providing earned wage access are just a handful of other things payroll data could come in handy for.

Q: Are there any limitations to the type of employment or income data that can be verified?

If a small company is currently paying its employees manually through spreadsheets and paper checks, Atomic will not be able to automatically pull the payroll data needed for verification. However, this represents a small percentage of the overall workforce. In these cases, if the employer were using a payroll system, we can also support pulling the physical PDFs of W2s, 1099s, and paystubs, when available.

Q: What if someone has more than one job or works multiple gigs? Will Atomic’s Verify solution still work?

Yes, the Atomic solution is designed with the gig economy in mind. Once the user initially connects through Atomic’s API, the system will ask them if they have other sources of income. This would include gigs. To help cover all bases, if someone selects Uber as their first income source, the system will automatically ask them if they also work for Lyft or DoorDash.

Q: How would a company know they’re ready to partner with Atomic for VOI/E?

If you’re looking to reduce fraud, cut user experience friction and curb operations costs in your lending process, Atomic is a great solution. For companies that currently experience delays in verifying income and employment, we can also significantly speed up the process for you.

Thank you, Zach, for walking us through traditional VOI/E and teaching us how Atomic’s Verify solution is an industry game-changer. Interested in learning how your company can benefit from our Verify product? Schedule a demo with team Atomic today.