Atomic Provides Solution to Fifth Third Bank to Enhance Digital Banking Experience with Advanced Direct Deposit Technology

Becky Ross

Head of Marketing

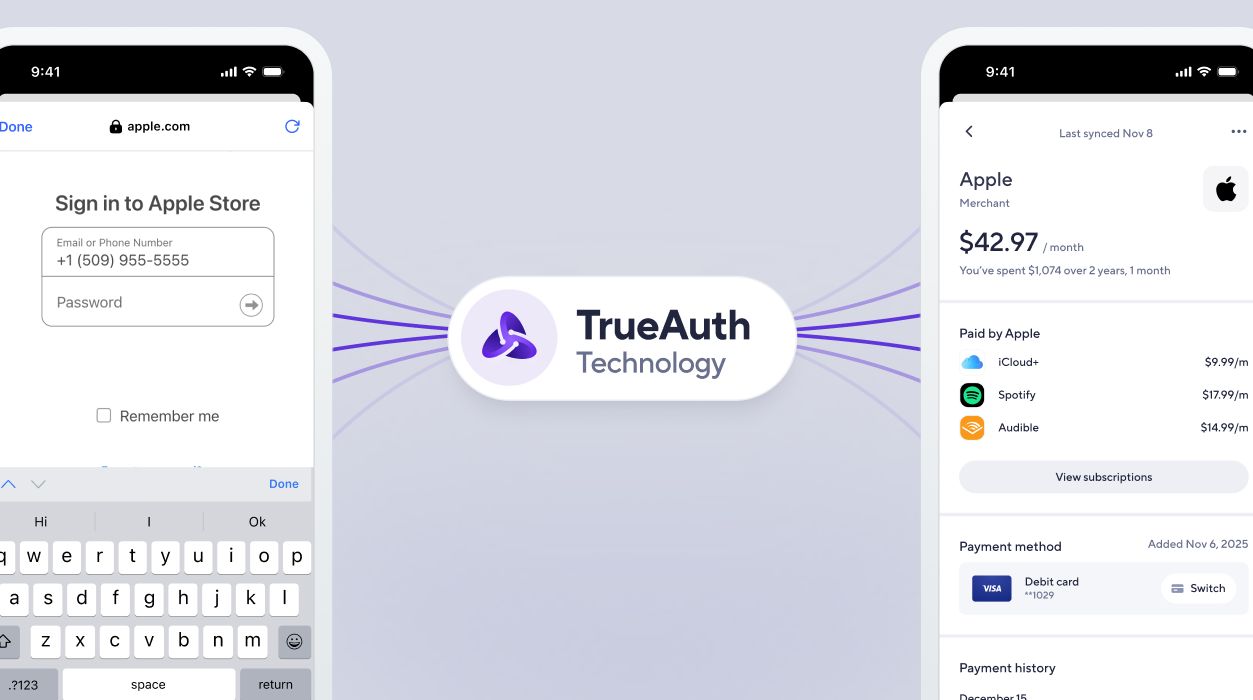

Atomic is pleased to announce a collaboration with Fifth Third Bank to leverage Atomic’s cutting-edge deposit solution within its mobile banking applications. This provides account holders with a secure, fast, and hassle-free method to manage their direct deposits. Read the full release on Businesswire here.

“Like with other digital products, in banking it isn’t enough to have a great product – getting set up has to be easy,” said Ben Hoffman, head of consumer product at Fifth Third. “We believe getting started with Fifth Third should be as easy as upgrading your iPhone. As part of that commitment, we partnered with Atomic to deliver a best-in-class digital direct deposit solution for our everyday banking customers that takes the time and stress out of setting up a new bank account.”

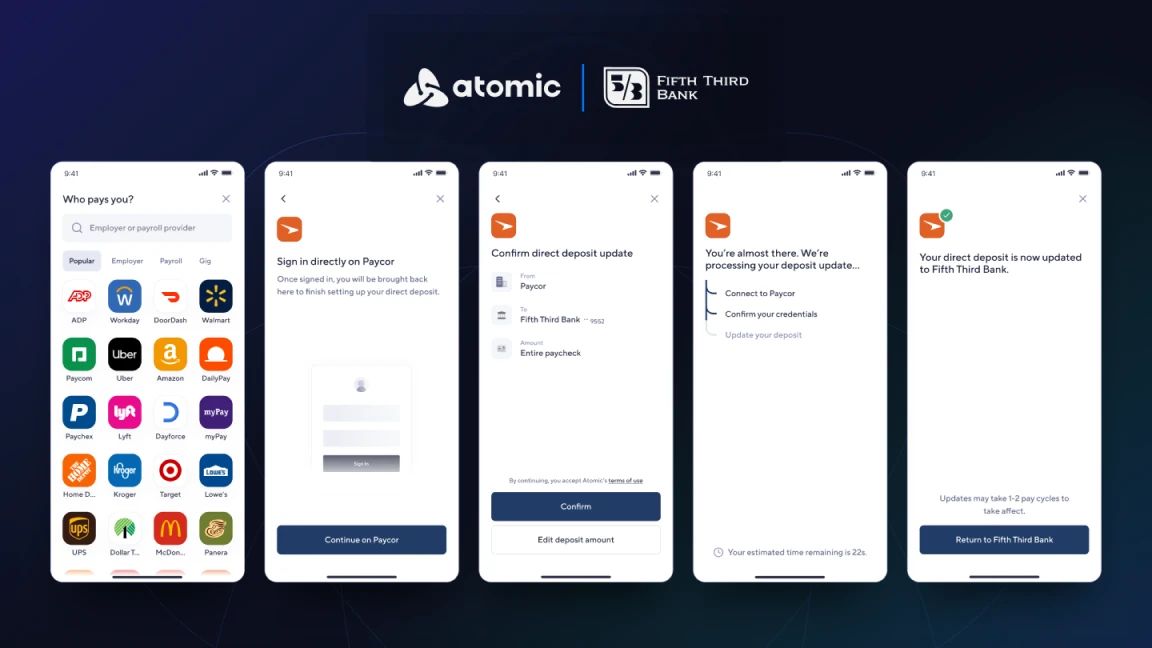

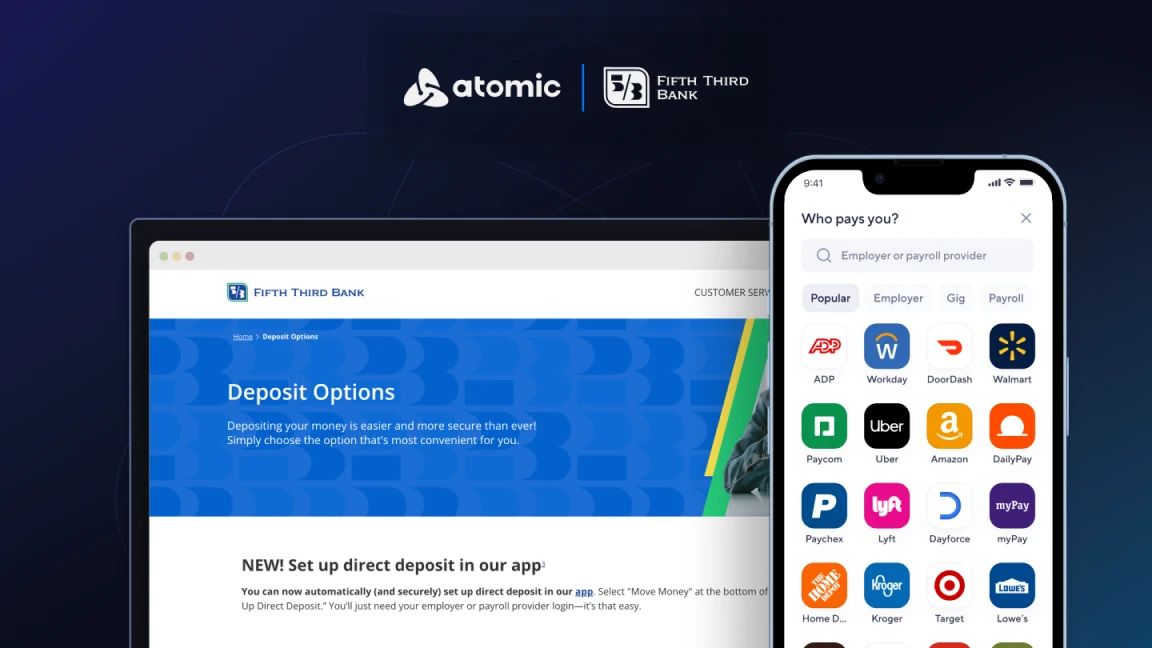

When you switch banks, one important task is to ensure your paychecks are deposited into your new account to pay your bills and make purchases. Atomic’s technology makes it easier to switch your direct deposit within the mobile or online banking app in minutes. Fifth Third is now one of the few large banks that supports this advanced technology.

“Fifth Third’s collaboration with Atomic signifies a shared commitment to redefining banking standards,” stated Jordan Wright, Co-founder and CEO of Atomic. “Their choice of Atomic underscores our dedication to transparency and innovative solutions. Together, we are working to enhance the digital banking landscape, offering customers a secure, and seamless financial experience.”

Direct deposit switch is part of Fifth Third Momentum® Banking and is another way that the Bank is helping its customers access their pay as soon as possible. The bank has offered Early Pay since 2021, allowing customers to receive their paychecks up to two days early. This service was later expanded to gig workers and government payments, as well as receiving federal tax refunds up to 5 days early. The integration of Atomic’s Deposit solution will bring additional financial tools inside the Fifth Third Bank mobile app, making it easier for consumers to control their paycheck and financial lives.