Bill Pay Is Dead; Long Live Bill Management

Jordan Wright

Co-founder and CEO

Bill Pay, a service offered by banks through services like CheckFree, has been declining in use since the mid-2000s. Consumers are increasingly choosing to pay their bills directly through the merchant or biller’s website or app, giving them more control and flexibility over their payments. This shift makes consumer banking less sticky but also presents an opportunity for banks to evolve Bill Pay into a more comprehensive and valuable service: Bill Management.

Bill Management offers all the advantages of Bill Pay, such as stickiness and ease of use, while also providing powerful tools to help consumers optimize their spending and improve their financial health.

Why Bill Pay is Losing Ground

- Direct-to-biller payments are more convenient: Consumers can simply store their payment information with the biller and have their bills automatically charged when due. This is especially true in the growing subscription economy, where many services only accept payments via a card on file.

- Biller websites and apps have improved: Billers have made it easier for consumers to access their billing information and manage their accounts online or through mobile apps, which gives them the ability to login and make payments whenever convenient.

- Consumers want more payment options: Direct-to-biller payments often offer a wider range of payment methods, including ACH, credit cards, and debit cards.

Bill Management: The Next Generation of Bill Pay

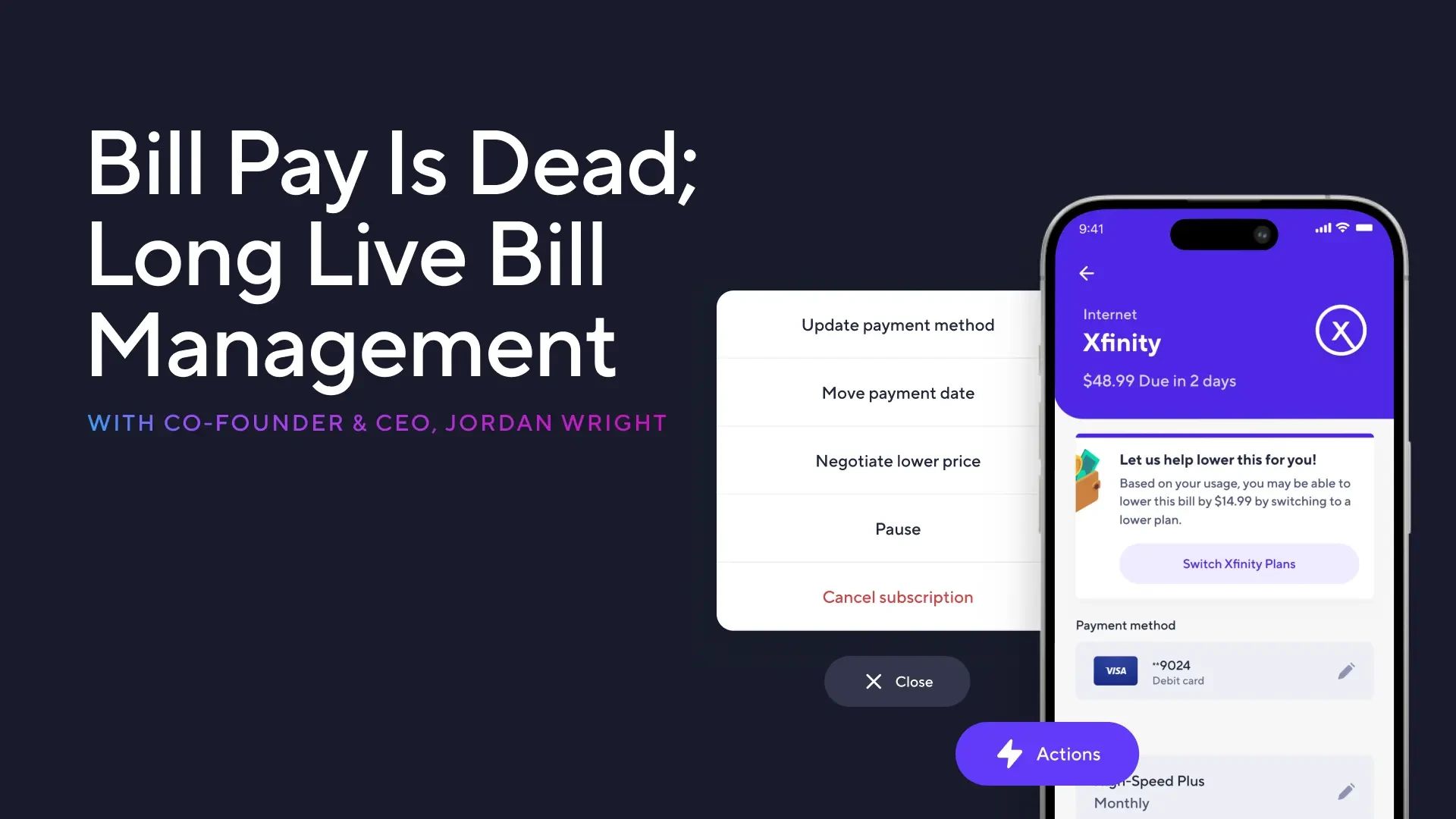

Bill Management goes beyond simply paying bills. It empowers consumers to take control of their finances by providing:

- Spend Optimization: Bill Management solutions can analyze a consumer’s spending patterns and identify opportunities to save money. For example, a Bill Management solution could suggest switching to a premium subscription service if it determines that the consumer would save money in the long run based on their usage.

- Subscription Management: Consumers can easily pause or cancel subscriptions they are not using, preventing unnecessary spending.

- Personalized Financial Insights: Bill Management solutions can provide consumers with tailored recommendations and insights to help them make better financial decisions.

By offering Bill Management, banks can truly help the consumer be better with their finances and operate from the role of a trusted financial advisor, providing a valuable service that helps consumers improve their financial well-being.

The Benefits of Bill Management

- For Consumers:

- Save Time and Money: Automated payments and personalized insights help consumers optimize their spending and avoid late fees.

- Increased Control and Flexibility: Consumers have more control over their bills and subscriptions, with the ability to manage them all in one place.

- Improved Financial Health: Personalized insights and recommendations empower consumers to make informed financial decisions.

- For Banks:

- Increased Customer Engagement: Bill Management provides a valuable service that keeps customers coming back to their bank’s app or website.

- Stronger Customer Relationships: By helping consumers improve their financial health, banks can build trust and loyalty and increase the stickiness of their customer relationships.

- New Revenue Opportunities: Bill Management solutions can offer premium paid features or partner with merchants to generate revenue.

Below is a view of the evolution of the offerings in this space at a glance.

Additional thoughts

First, PFM applications have largely fallen short of the “self driving car for my finances” concept. This is largely due to their inability to take action. Bill Management solves this problem.

Secondly, the recent ruling by the FTC – referred to as ‘Click to Cancel’ – was recently finalized and has created a mandate that the services make it as easy to cancel as it was to sign up. This ruling is a wind at our backs that will make user-permissioned access to cancel and adjust biller relationships staple to the future of banking.

Read more about that ruling here.

Conclusion

The way consumers pay their bills is changing, and the banks that adapt will be positioned for a huge uptick in customer stickiness, loyalty and brand affinity. Bill Management represents a natural evolution of Bill Pay, offering a more comprehensive and valuable service that benefits both consumers and banks. By embracing Bill Management, banks can not only keep pace with consumer expectations but also differentiate themselves in a competitive market.