Buy Now, Payroll Later

Lindsay Davis

Head of Markets

Hi there,

This month fintech and tech giants took bold bets that cement buy now, pay later (BNPL) as an essential point-of-sale payment option for consumers.

Affirm announced partnering with Amazon to power POS installment loans for shoppers. Earlier in the month, Affirm and Shopify also announced the general availability of Shop Pay Installments allowing all US merchants to offer BNPL. Affirm topped 5.4M active users in FYQ3’21 earnings and with the Amazon and Shopify partnerships, poised to grow BNPL adoption among e-commerce shoppers.

Earlier in the month Square revealed plans to acquire Afterpay in a $29B all-stock deal. The combination is a rare trifecta that Square’s CFO has referenced as the “three horizons” to grow both Square’s Merchant and Cash App Ecosystems. The third horizon, connecting the ecosystems, is where Afterpay could have significant impact. Long-term, BNPL can be the connective tissue across the ecosystems and spawn new opportunities to scale each ecosystem and create cross-sell services. One we’re watching is the potential to repay Afterpay loans from the paycheck utilizing Square’s patent for instant payroll deposits. This could make Cash App more sticky as a bank account and Square’s payroll unique for merchants.

How does payroll fit in?

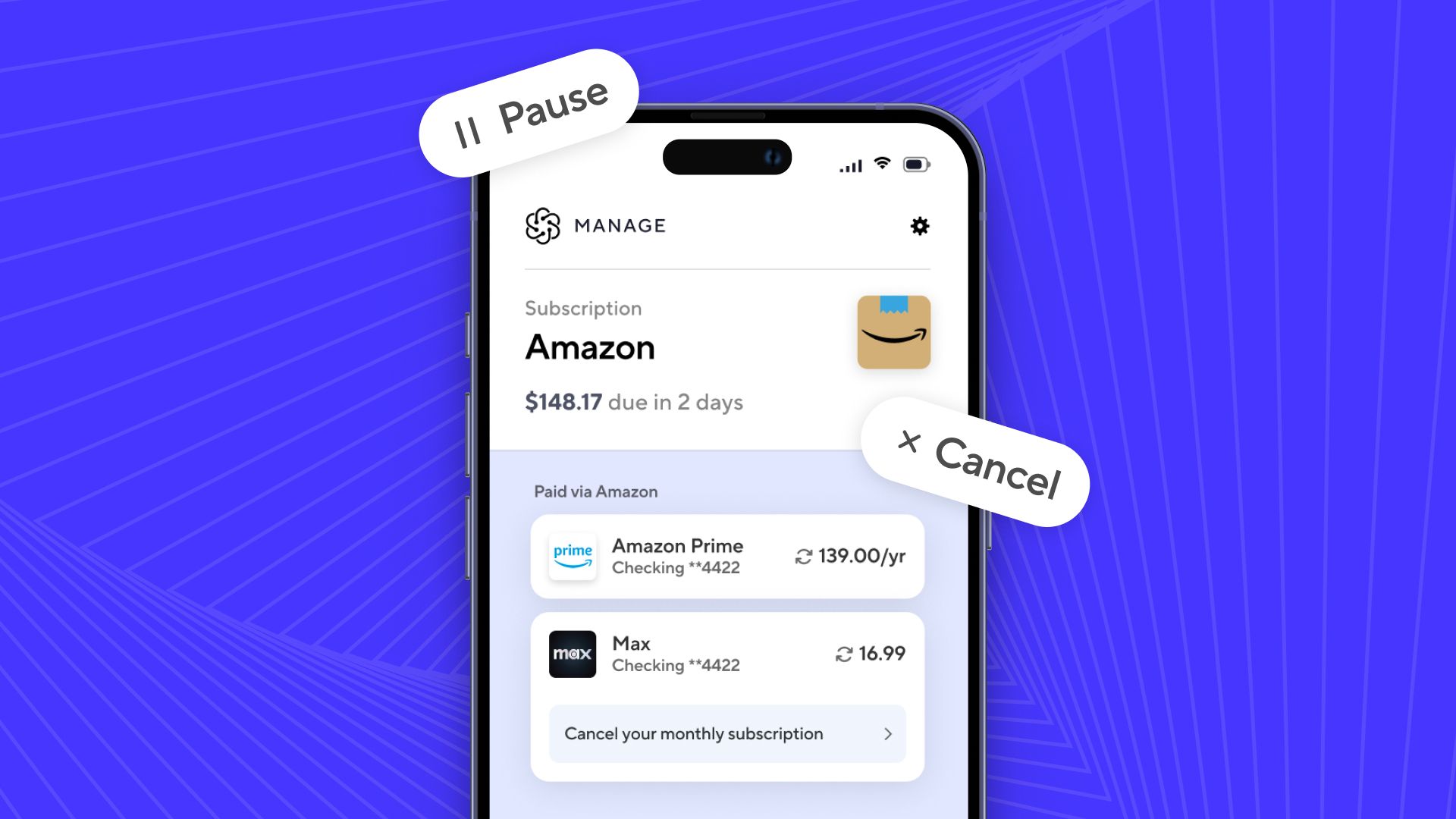

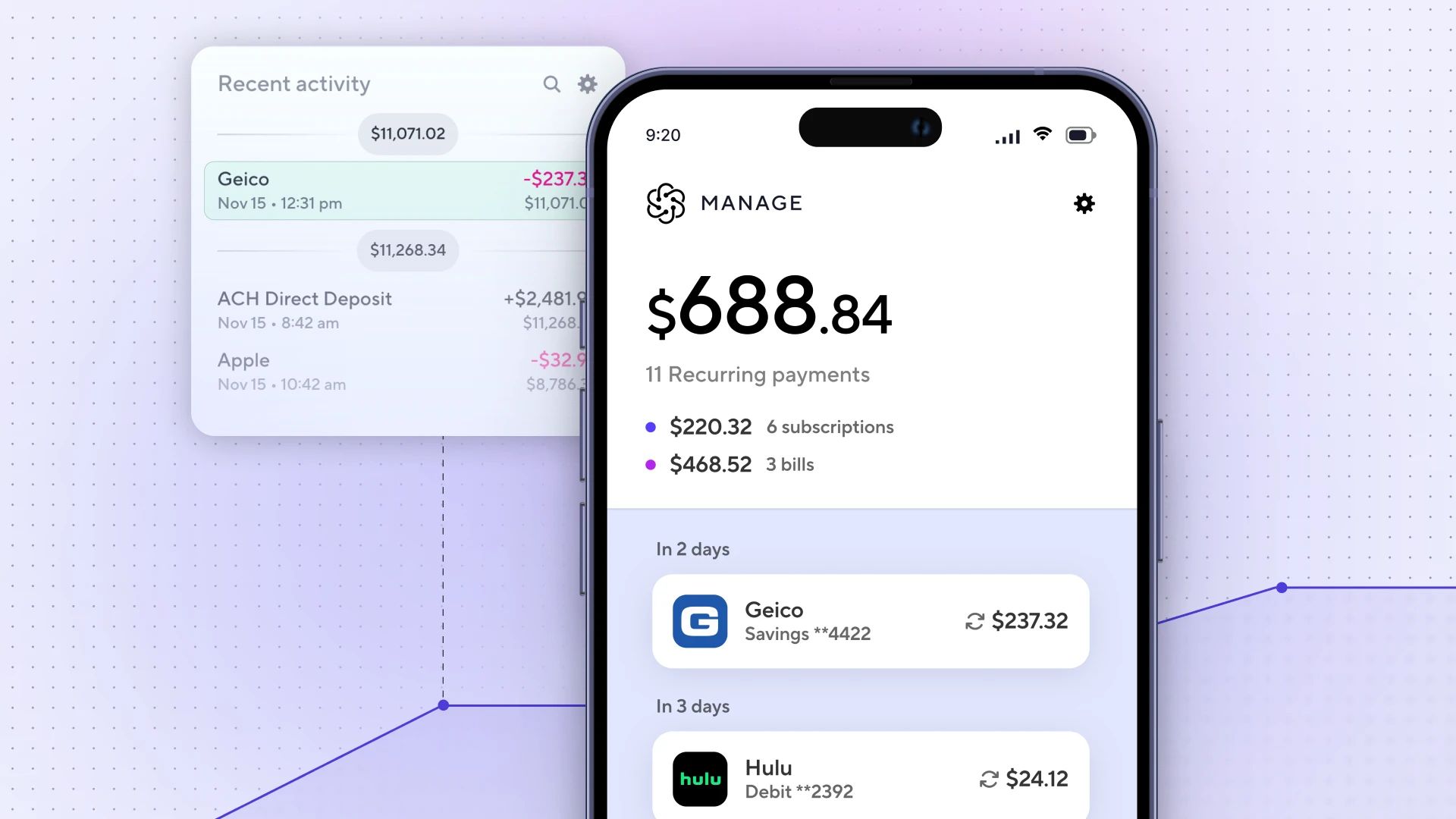

One use case for payroll connectivity we’ve been working on is the ability to repay loans from the paycheck. This month we went live with our first customer in the BNPL space.

Payroll connectivity offers a rare win-win for both borrowers and lenders. For borrowers, integrating payroll connectivity can unlock lower interest rates and more flexible repayment plans when opting to repay the loan from their payroll. Linking their payroll accounts is also a positive indicator for lenders of borrowers willingness to repay their debt. Lenders also benefit from payroll connectivity as an alternative source of income and employment (VOI/VOE) data to augment underwriting.

Now that BNPL is more competitive than ever, we may see broader rejection rates increase under pressure to keep default rates low. Deducting BNPL installments from the paycheck is a unique repayment option that could curb the risk of default or accidentally missing repayments. Since BNPL relies on a soft credit pull, supplementing income and employment verification with payroll connectivity offers a more robust source of identity verification. A softer point, it may also indirectly prevent consumers from overdrafting if autopay is enabled but funds are not available due to a misalignment in bill pay and pay day.

What’s next? Crypto checkout.

BNPL is just one bet e-commerce giants are making on the future of payments. This month also saw Walmart open a role for a digital asset product expert. The role follows Amazon’s opening for a Digital Currency and Blockchain Product Lead in July. While crypto is already available for select e-commerce checkouts including Starbucks and Home Depot, it’s not a reliable alternative for most consumers. A move from Walmart, Amazon, or other e-commerce platform could be a catalyst for mainstream consumer adoption.

Why are Walmart and Amazon hiring crypto currency product leaders?

In the current war for talent though, their hiring moves can best be summed up by the adage that “it is better to have and not need it, than to need it and not have it.”

Whether it’s crypto, BNPL, or pay with payroll, the ultimate winners are consumers who have more choices at checkout.

In this edition of Atomic Intelligence we share insights on:

- FIS Venture Center Founder Feature with Jordan Wright, our CEO and Co-founder

- Career advice on pivoting from internal audit to fintech on the NYC Fintech Women podcast

- Replay of the our fintech news livestream with LendIt covering neobank valuations, bad survey data on PPP, cryptocurrency checkouts, and more

- Recent features in Protocol, FedFis, the Fintech Revolution report, and Finopotamus

Stay well,

Lindsay

P.S. Are you tentatively headed to DevCon, Finnovate, or AFT? We’ll have Atomic teammates at each and would love to connect with customers, newsletter subscribers, and future teammates interested in joining Atomic.