Cancel culture, reimagined: A closer look at how users are engaging with bill and subscription management

Emily Flinders

VP of Markets

We know the demand is real: subscription and bill management has quickly climbed to the top of consumers’ must-have features in banking apps. With the average American juggling 4.5 subscriptions and spending over $900 a year on them, it’s no surprise this product is popular.

But knowing the need exists is just the beginning—how are users engaging with these tools when they’re available? What do they find most useful, and where are they taking action? At Atomic, we have been watching these questions play out in real time with our bill and subscription management product.

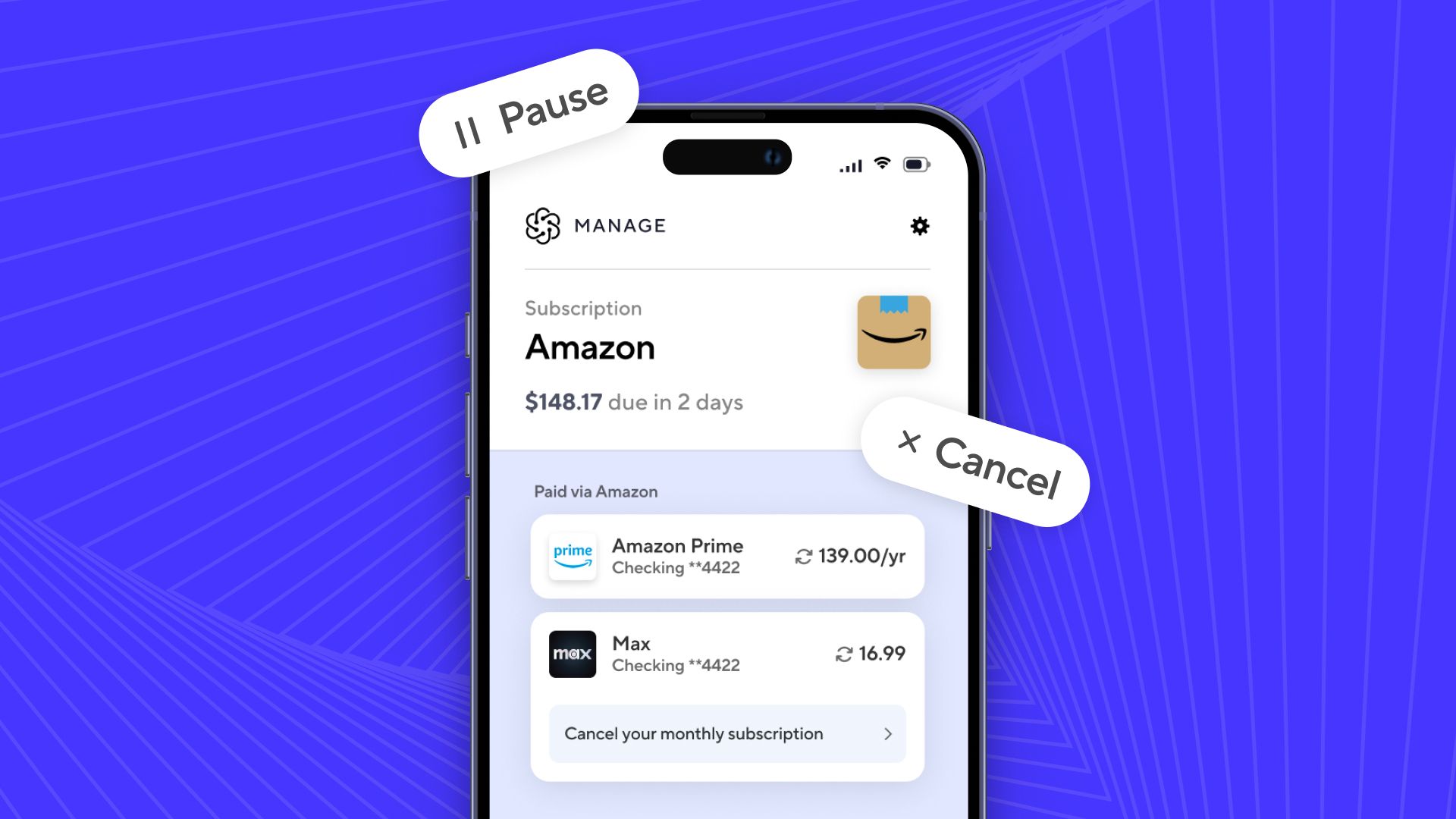

One of the clearest indicators of user intent comes from how they engage with Amazon. When users link their Amazon accounts, Atomic reveals a surprisingly broad range of subscriptions — from major streaming services to niche content bundles and unexpected one-offs — giving users a comprehensive view of their recurring spend, including charges they may not have realized they were paying for. We see cancellation rates for Amazon-linked subscriptions increase by 1.5x compared to other merchants. The message is clear: when users are given a fast, intuitive way to take action on recurring expenses, they do. Just as Amazon set the standard with one-click shopping and overnight delivery, Atomic is setting a new bar for action-based bill management.

Atomic’s bill and subscription management product is built on that very philosophy. It allows users to track, manage, and act on recurring expenses directly within their existing financial app—no need to switch between platforms or open countless browser tabs. From uncovering hidden subscriptions to enabling real-time cancellations and plan changes, Atomic is transforming awareness into action.On average, users connect three merchants to get a full view of their recurring payments, and 75% of all connection attempts successfully return authenticated, active plan information. It's not just about seeing the problem—it's about solving it in seconds.

By embedding this capability directly into your app, you don’t just drive engagement—you build trust, deepen loyalty, and position yourself as your user’s primary financial hub. After all, clarity and control aren’t just features—they’re fundamental to how people want to manage their money.