Capture Spend: Turning New Accounts into Primary Payment Hubs

Atomic Team

The transition from account opening to regular usage is a pivotal moment—one that determines whether your platform becomes a customer’s primary payment hub. Research shows that customers who conduct 10–15+ payment transactions per month, particularly with recurring payments, are significantly more likely to consider that institution their primary bank.

Strategic Incentives: Moving Beyond One-Time Bonuses

Traditional acquisition bonuses often act as short-lived perks with little impact on long-term engagement. Forward-thinking institutions are reimagining incentives by directly linking them to sustained payment behavior.

How It Works:

- Reward early engagement – Offer targeted cash bonuses for setting up multiple bill payments within the first 30 days.

- Encourage payment diversity – Structure tiered incentives that promote a mix of payment types.

- Prioritize recurring transactions – Focus on building lasting payment relationships rather than one-off transactions.

- Make progress tangible – Use milestone tracking to reinforce continued usage.

For instance, a promotion like Get $150 cash back when you set up and pay 3 bills within 30 days drives immediate action while fostering habits that extend beyond the initial incentive.

And the data supports this approach: Customers who engage in multiple payment activities early on demonstrate significantly higher lifetime value. Research shows that a 5% increase in customer retention can boost profitability by 25% to 85%, and companies that prioritize customer experience see up to a 30% increase in CLV. By incentivizing sustained payment behaviors, financial institutions can drive long-term engagement and maximize customer value beyond the initial bonus.

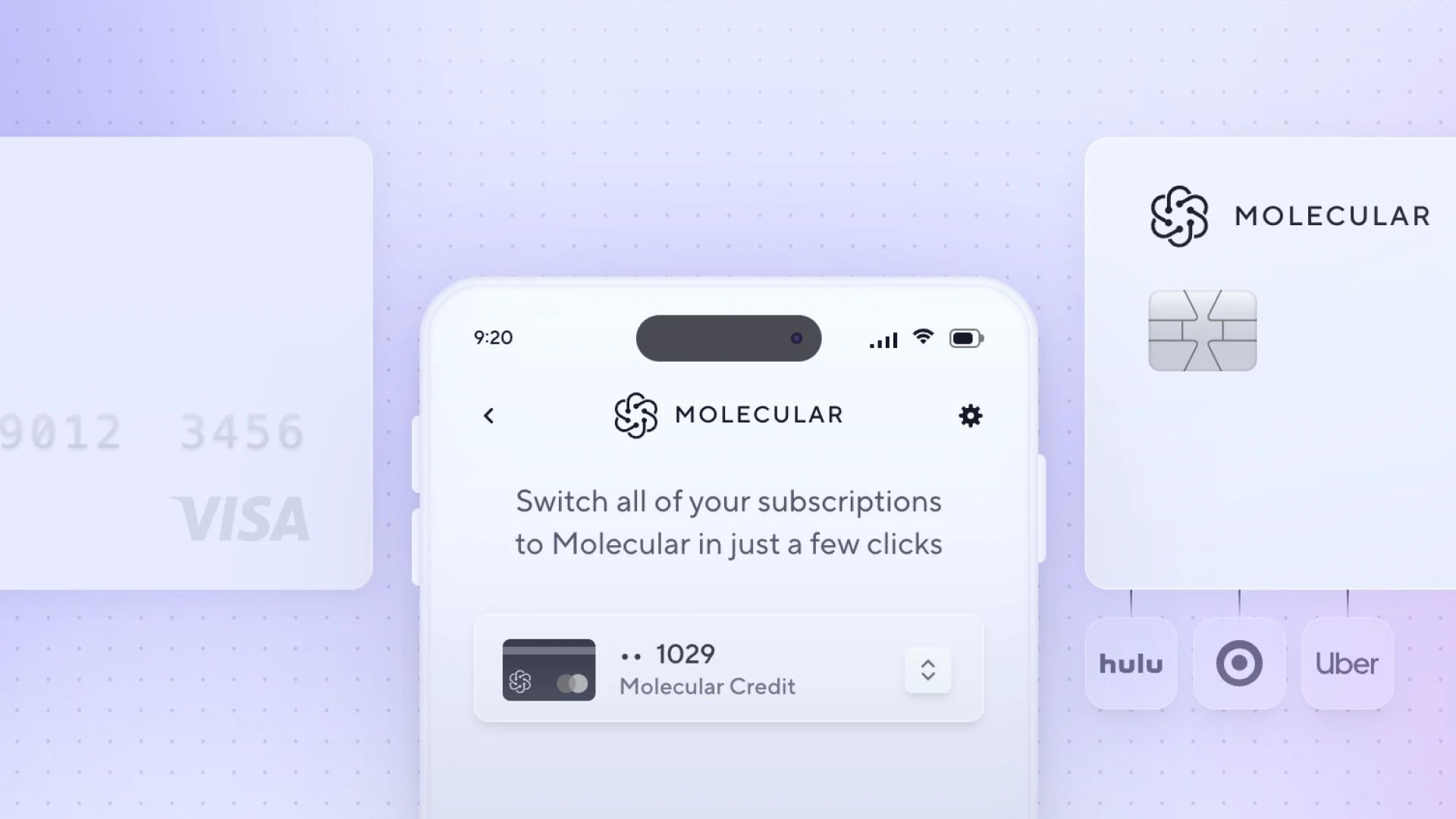

Tying Payment Switching to Payment Notifications

Payment notifications provide a seamless trigger for payment switching, guiding customers naturally from awareness to action.

How It Works:

- The system detects upcoming payment obligations from connected accounts.

- Contextual notifications alert customers ahead of due dates: Your electric bill is due in 3 days.

- Each notification includes a simple prompt: Would you like to update this payment to come from your new account?

- A one-click pathway walks customers through updating their payment method.

- Customers complete both the immediate payment and the long-term switch in a single, frictionless flow.

This strategy addresses two key objectives at once: driving immediate transaction activity while embedding long-term payment relationships that enhance retention.

The most effective implementations segment payment types for targeted switching:

- Essential bills (mortgage, utilities, insurance) establish recurring, high-value transactions.

- Subscription services generate predictable, frequent activity with minimal ongoing effort.

- Everyday merchants drive consistent transaction volume through habitual spending.

The key to securing long-term customer retention lies in activating meaningful transaction behavior early. Industry data shows that customers who establish recurring payments within the first 90 days are 2.5x more likely to remain engaged users one year later.

Building primary banking relationships isn’t about driving a single transaction—it’s about embedding your institution at the core of a customer’s financial habits. By capturing spend early through strategic incentives and payment switching, financial institutions can turn new accounts into engaged users. Those that successfully own the payment relationship can secure long-term primacy, higher lifetime value, and a deeper share of wallet—outpacing competitors still focused on one-time conversions.

This post is the first in a four-part series exploring how modern payment management transforms banking relationships across the customer journey.Check out our previous post on Creating Value From Day One and watch our latest webinar to see these concepts in action with live demonstrations of customer experiences that drive transaction engagement.