Consumer Banking is at a Crossroads—Bill Management is the Path to Profitability

Jordan Wright

Co-founder and CEO

It’s 2025, and if you’re in consumer financial services, you’re likely thinking about the same challenges as everyone else: acquiring deposits, driving engagement, and managing the rising costs of delivering a great customer experience—all while profitability in consumer banking continues its decade-long decline.

Here’s my big prediction on how consumer banking is about to become much more profitable in the next few years – reversing the downward trend. If you work in consumer financial services you’re going to be at the heart of it!

Consumer banking isn’t what it once was

The decline in consumer banking profitability – for the largest segment of consumer banking – began in earnest with the passing of Dodd Frank. Research shows anywhere from 40-70% of consumer financial accounts are unprofitable banking relationships.

Why is this happening? It’s due to a combination of factors: regulations reducing interchange revenue for large banks, caps on NSF and other fees, and rising costs to deliver a great consumer banking account. While most of us as consumers—and many merchants—welcome these changes, financial institutions and fintechs aren’t celebrating.

Chase went as far as to fire a warning shot in a Wall Street Journal article, “JPMorgan Warns Customers: Prepare to Pay for Checking Accounts.” While top banks continue to generate strong revenue (Chase had $4.7 billion in revenue in Q4 2024), the reality is that rising costs to serve consumers and declining revenue streams are making traditional checking accounts less profitable. The question becomes: what’s to be done to ensure consumer banking remains sustainable?

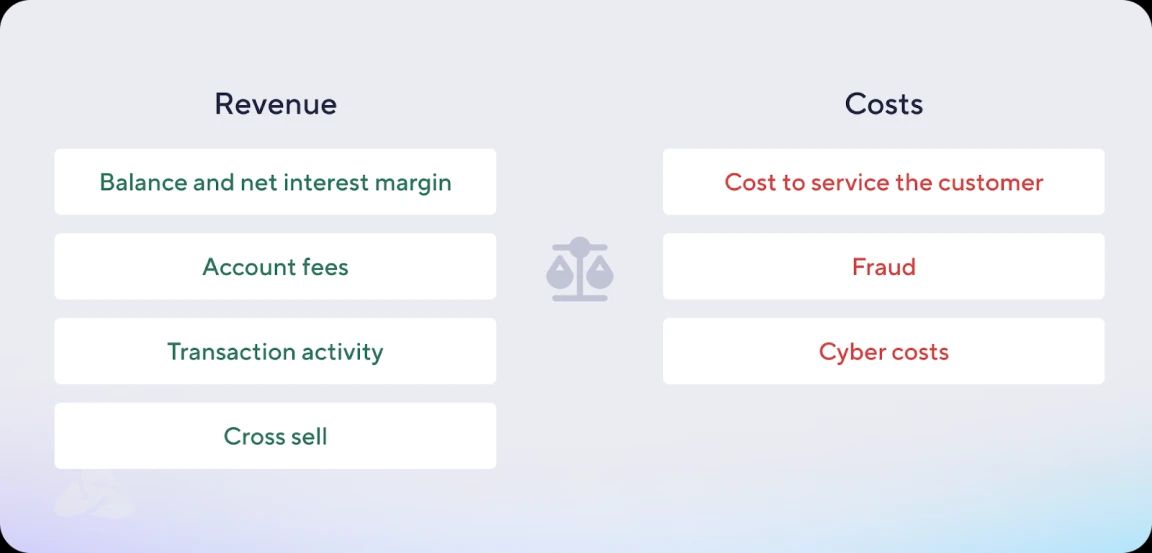

The following factors are the biggest drivers for a profitable consumer banking relationship:

On the revenue side:

- Balance and net interest margin

- Account fees

- Transaction activity

- Cross sell

On the cost side:

- Cost to service the customer

- Fraud

- Cybersecurity costs

TL;DR Unprofitable customers have a “shallow” relationship with the bank. Profitable customers are primacy customers which means they have higher balances, transact regularly, and use multiple products from the financial institution or fintech.

How do we boost profitability?

Boosting profitability starts with the fundamentals: increasing deposits, driving transaction activity, and improving cross-sell.The building blocks for these products have been in place for several years, and the Atomic product suite is coalescing around solving for the most significant drivers of account profitability.

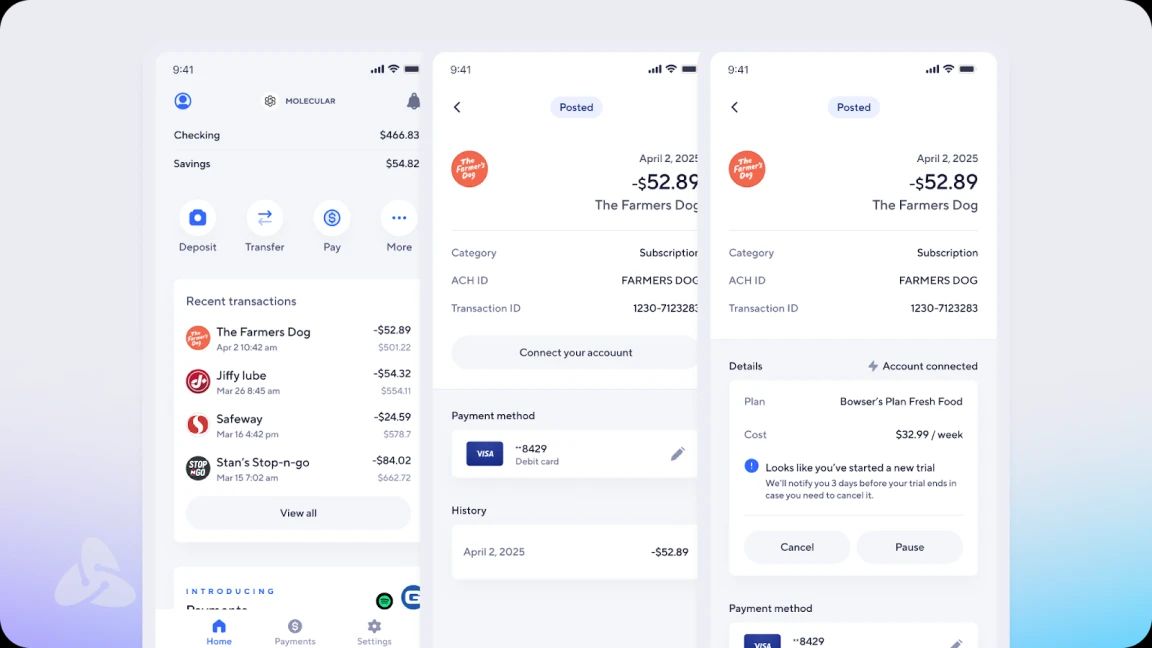

Direct deposit increases the depth of customer relationships, leading to deposit growth of 10% or more for enterprise customers. This, in turn, increases balances and net interest margin. Payment switching increases transaction activity on the account by making it easier to switch payments to the newly opened account.

Traditionally, that’s where most solutions have stopped- this is where Bill Management enters the scene. Bill management as a category refers to the ability to:

- Identify, pause, and cancel subscriptions

- Negotiate for better pricing on bills

- Eliminate unutilized sub products from recurring billing

- Refer a consumer to a better service and perform the transition to the new service

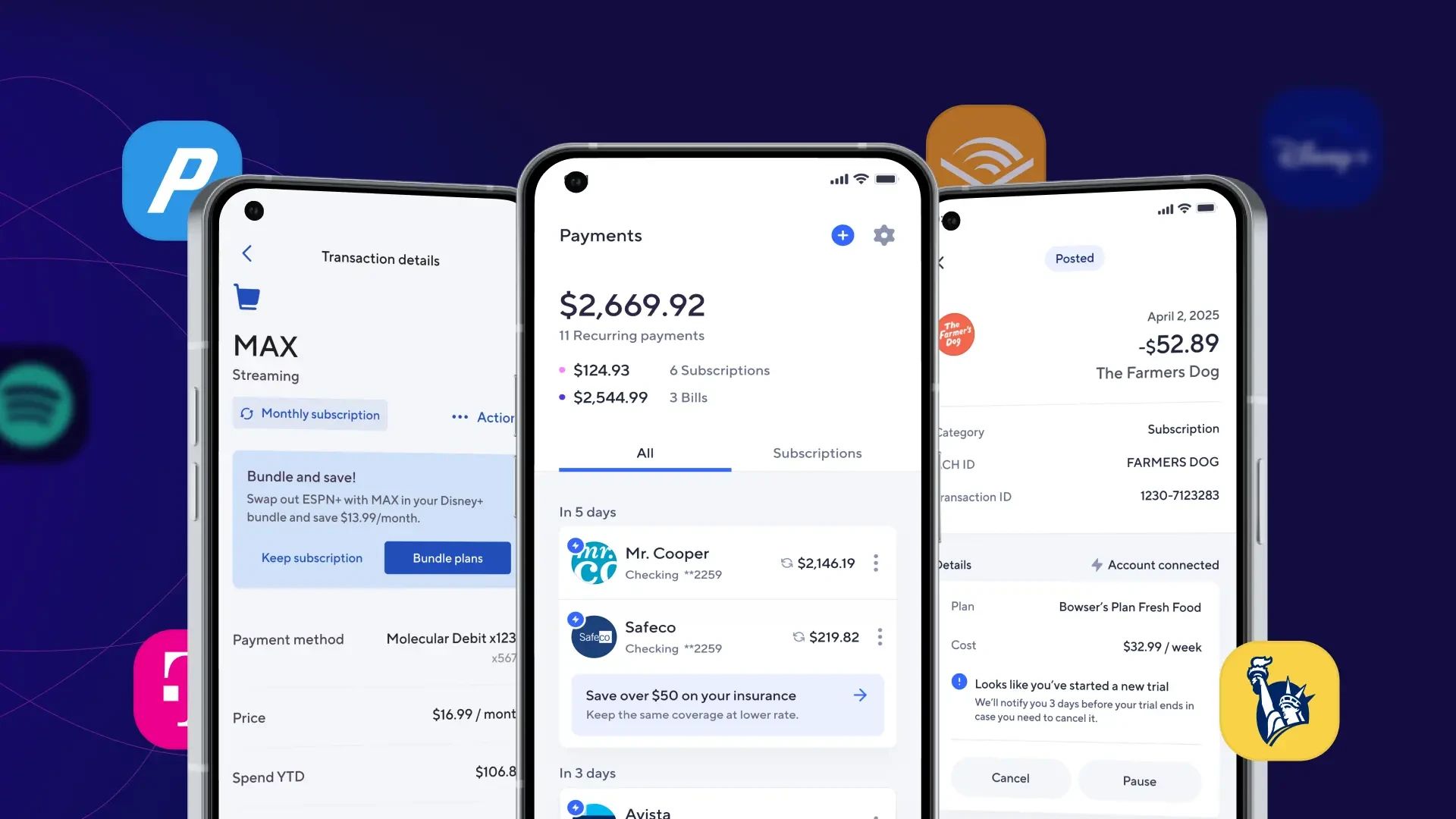

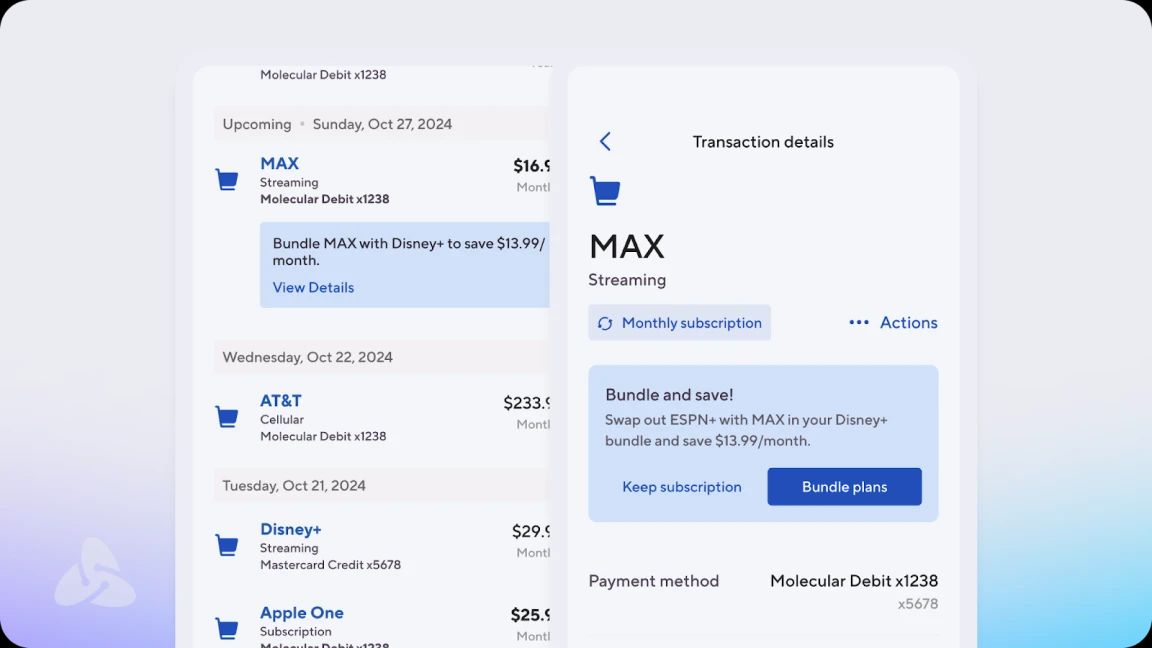

Through Bill Management, financial services providers can make their app the central hub for a consumer’s financial life. When the consumer identifies a transaction that looks odd, they’ll be able to dive directly into the service in question without ever leaving the financial app.

Consumers can receive notifications about potential savings by switching to another merchant and can seamlessly make that change through a guided flow—without ever leaving the financial app.

Bill Management offers financial institutions a win-win. The financial institutions introduce their customer to a better service offering, increase the revenue on the account as the customer moves more of their banking relationship to that account (increasing deposits and transactions), and refers products and services to improve the customer’s financial well-being.

Turning a net negative customer into a net positive customer only takes $80-$150 per year. Banks and fintechs have been sitting on one of the highest value revenue opportunities for years and are only barely taking advantage of it. They have the ability to see how much someone is paying for a service and refer them to other services, based on that data. With a Bill Management solution in place, they will also be able to understand the deeper context of the billing relationship that consumer has with the merchant in question and offer them far better services than they were previously capable of doing.

Bill Management in action

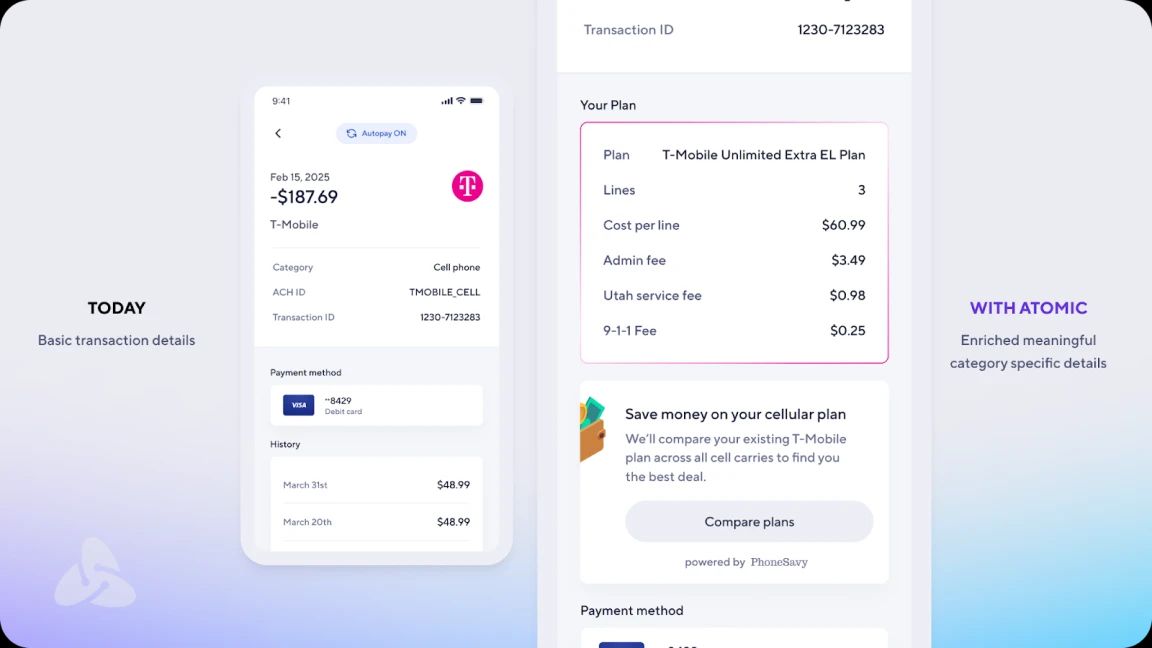

Below is an example of my cell phone bill payment data from my bank account alongside the data Atomic pulled from my cell phone bill, with details on each of my individual lines, one of which is shown on the right.

Empowering consumers with personalized recommendations

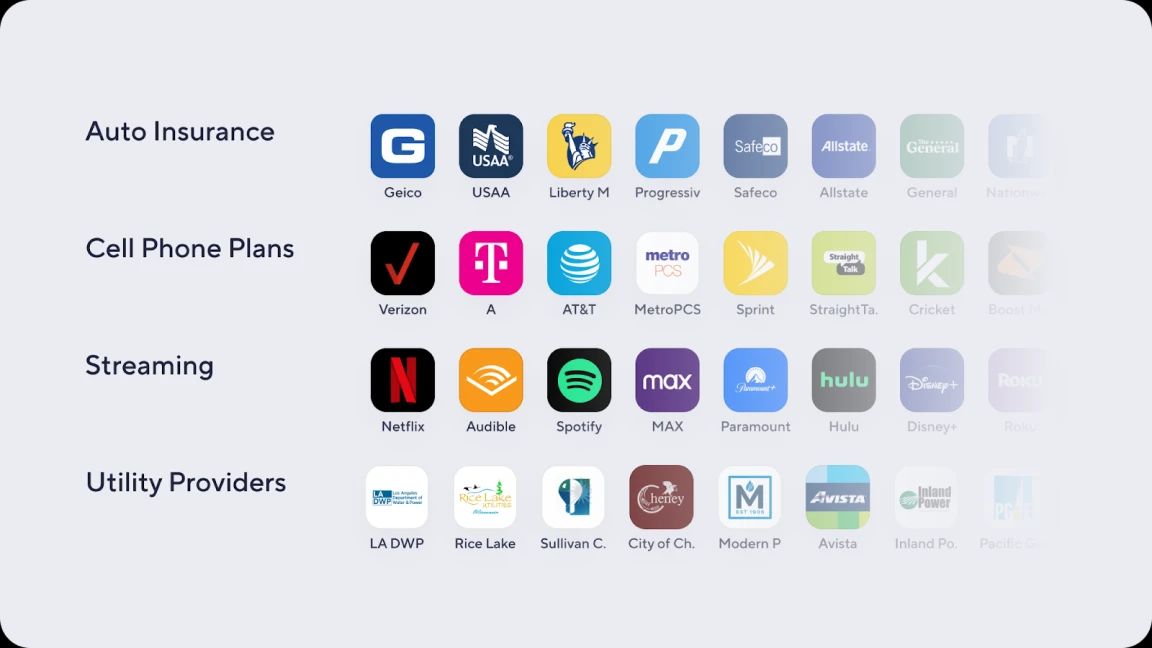

The wealth of data offered through Atomic’s user-permissioned access to user accounts will unlock a whole host of resell options. This will give Atomic the opportunity to further deliver on our mission to champion upward financial mobility for all by recommending various services to the customer that will give them savings opportunities.

Examples include, but are not limited to: auto insurance, cell phone plans, streaming services, utility providers in deregulated markets, refinancing and debt consolidation.

Imagine the experience a consumer will have when their financial institution can not only recommend a service based on their bill amount, but also ensure that the recommended service has the exact same plan and coverage of their existing policy! That’s the experience I want as a consumer and that’s the promise of Bill Management.

Sources

For financial institutions, anywhere from 40-70% of consumer financial accounts are unprofitable banking relationships. (Sources Understanding Profitability of Accountholders, Profitability of the Average Checking Account)

Average losses are approximately $80-150 of losses per account per year. (Free Checking Isn’t Cheap for Banks, The Profitability of the Average Checking Account)

However, revenue on profitable customer accounts can produce over $1,000 per year, with super profitable customers contributing $6,000+ annually. (The Profitability of the Average Checking Account)

Profitability of the average consumer checking account has been squeezed in the last 15 years. Since the Durbin amendment approximately $5 billion in annual revenues from consumer banking has been taken out of the system. (Free Checking Isn’t Cheap for Banks)

As the global macroeconomic environment remains uncertain, retail banks should focus on the fundamentals of customer primacy and margin protection while embracing digital technologies and gen AI. (The state of retail banking: Profitability and growth in the era of digital and AI)