Three Ways Credit Unions Can Compete In Fintech Today

Lindsay Davis

Head of Markets

Credit unions are well positioned to help communities in need by taking their high-touch membership models digital. This was one of the key themes of Curql’s 2021 VentureTech conference, or “Credit Union Bonnaroo,” (although Journey was not the headliner, one of our favorite highlights from the Money 20/20 conference).

Below we share

- Key takeaways for credit unions’ fintech strategies

- Three ways credit unions can use payroll connectivity to thrive

- What we’re watching in credit union tech

- How to grow direct deposits by up to 75%

You can also listen to highlights from our session at VentureTech on the Best Innovation Group’s podcast featuring Marcy Allen, Atomic’s Director of Financial Institutions starting at minute 32.

Key takeaways for credit unions from VentureTech 2021:

- Use personalization to bring physical communities online: Credit unions (CUs) are primed to take their mission of “people helping people” from offline communities to an online digital experience. Most fintech industry peers and partners we heard from at the conference are betting on personalizing the customer journey to reduce friction for members and to build digital communities.

- Come together, right now, to help those in need: The remarks from Rodney E. Hood, Chairman at the NCUA stood out. The NCUA is focused on helping CUs work hand in hand with fintech companies. Chairman Hood’s presentation was an open invitation for the industry to come together to find new ways to lift up and protect communities in need.

- Partner bank? What about partner credit union? Community banks hold the lion’s share of fintech partnerships as the deposit taking institution. Partner banking is not just a bank’s jam, and credit unions should remember they have charters, too.

Three ways payroll connectivity can help credit unions thrive:

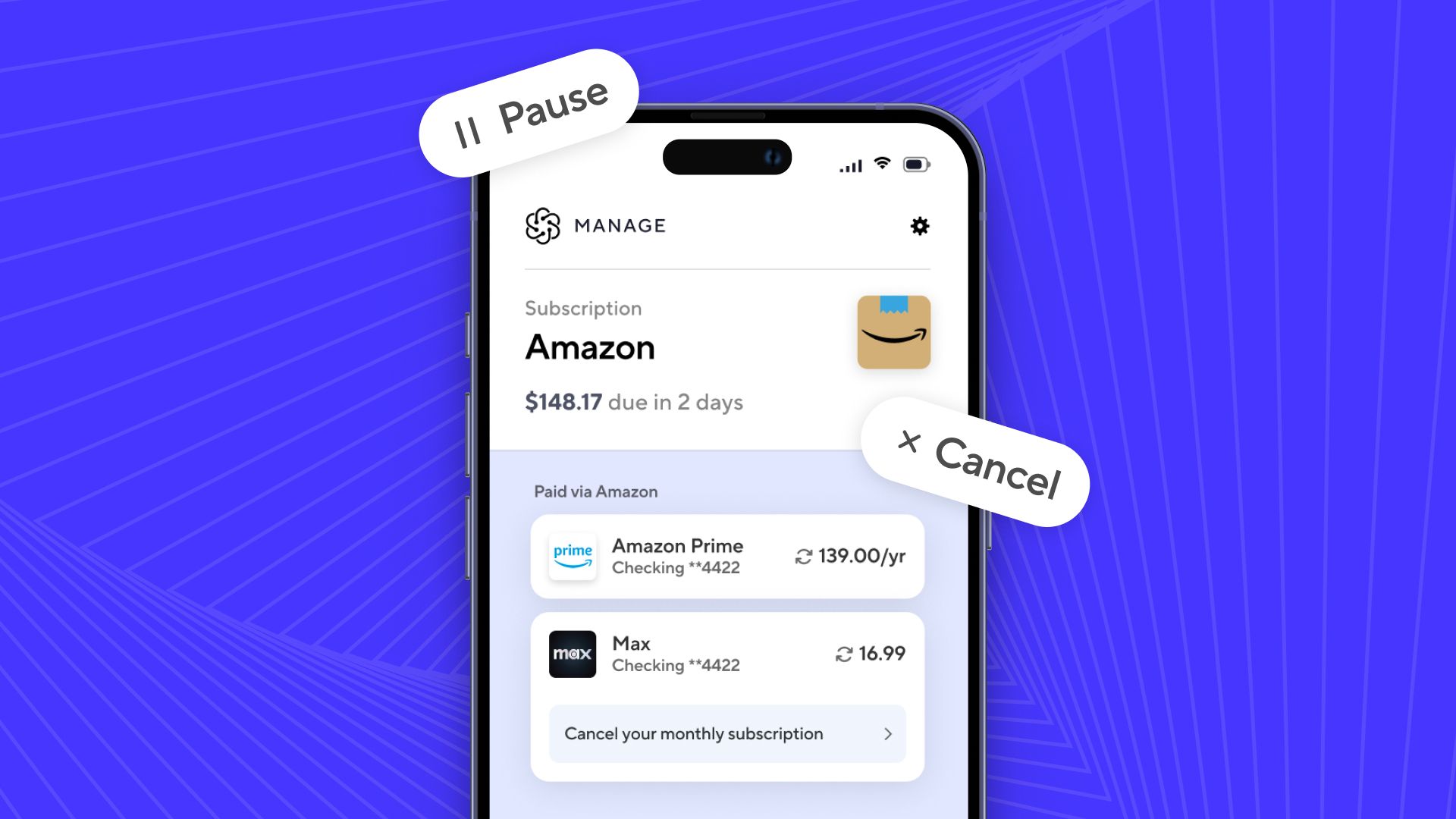

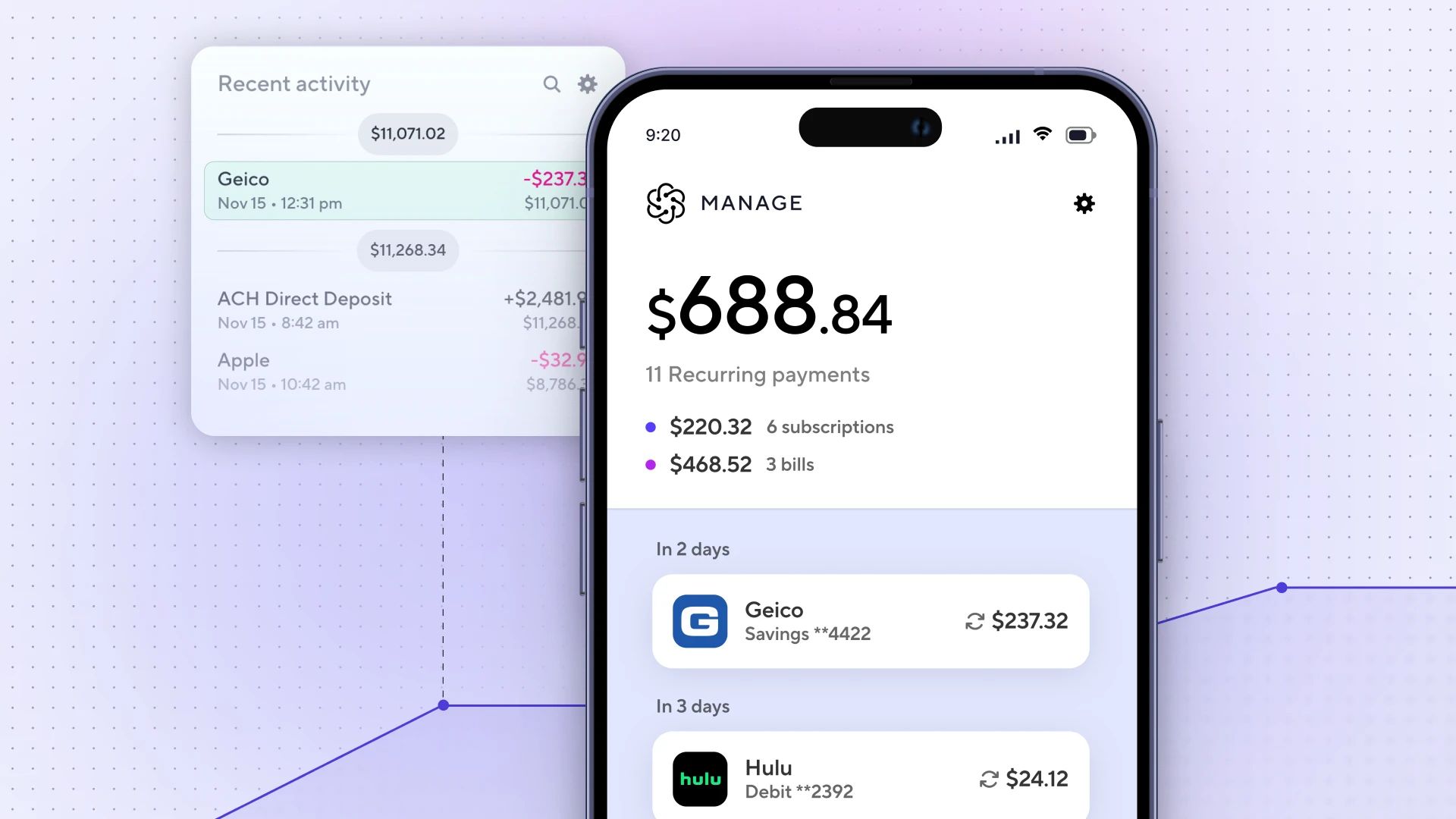

Atomic presented on how payroll connectivity can digitize setting up or switching direct deposits and verification of income (VOI) or employment (VOE).

Aligned with the takeaways for credit union:

- On-demand for payday: Payroll connectivity enables credit unions to personalize the member experience by differentiating their offerings for younger and digitally forward members.

- Credit-unions-as-a-Service, “CuaaS”: There are over 5,000 federally insured credit unions in the United States, according to the NCUA. Credit unions can flex their charters, boost direct deposits, and increase member retention by digitizing a traditionally paper-based process.

- Don’t stop believing: Community banks hold approximately $3.32 trillion in assets, but credit unions are not far behind, holding $1.88 trillion, as of February 2021. We believe there are still untapped opportunities for credit unions to launch their own digital brands or license their charters as partners to fintech providers. Embedding payroll connectivity can jump-start either experience by reducing friction for members to set up and switch direct deposits and streamline income and employment verification (VOI/VOE) for underwriting loans.

What we’re watching in credit union tech:

We’re watching out for credit union partnerships with fintech companies to aggressively digitize in-branch services, such as automating direct deposit switching. We also see CUs borrowing from the partner-bank playbook popularized by industry peers. Credit unions have an opportunity to grow their reach with consumers beyond the geographical limits of their communities to populations in need of fairer financial services.

Want to grow direct deposits by up to 75%?

If you’re a credit union, meet with our financial services team to learn more.