Dave Leverages Atomic to Advance the Cause of Financial Fairness and Help Drive Growth

Lindsay Davis

Head of Markets

At one time or another, most people have experienced the pain of running short of cash when bills are due and getting dinged with bank overdraft fees. For Jason Wilk, co-founder and CEO of Dave, it happened when he was an American student in China. As he recalls,

" It was really hard to manage a US bank account from overseas, and I was getting hit with all these penalties every time my account would go negative. It was costing me hundreds of dollars a month. "

Jason Wilk

Co-founder and CEO, Dave

Jason’s partner, Dave CTO Paras Chitrakar, had a similar struggle.

" When I immigrated to the U.S., I struggled to make ends meet for a long time and often incurred overdraft fees. It wasn’t until years after I “made it” as an engineer and entrepreneur that I was able to pull myself out of poverty. "

Paras Chitrakar

Co-founder and former CTO, Dave

Dave takes on Goliath

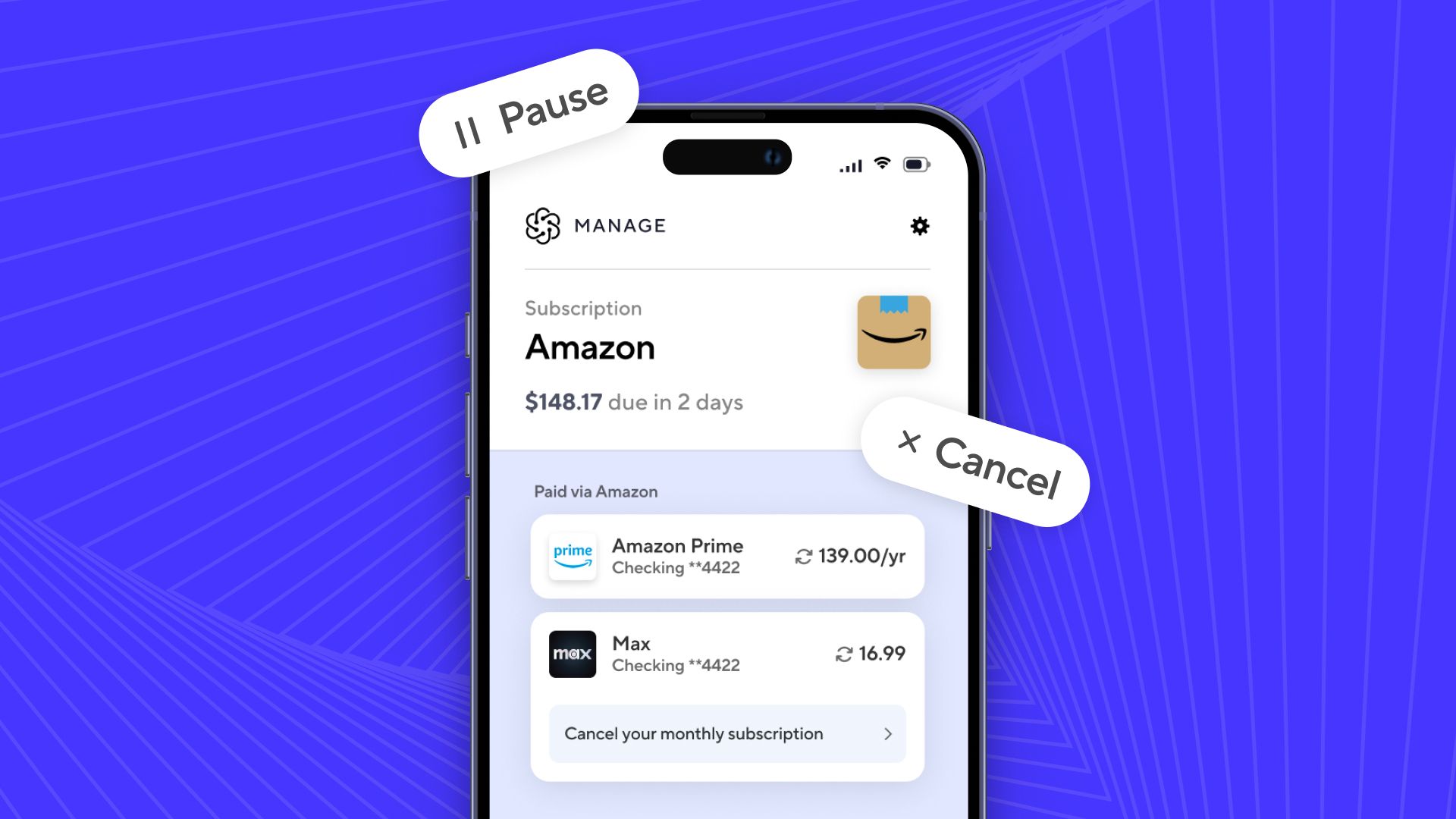

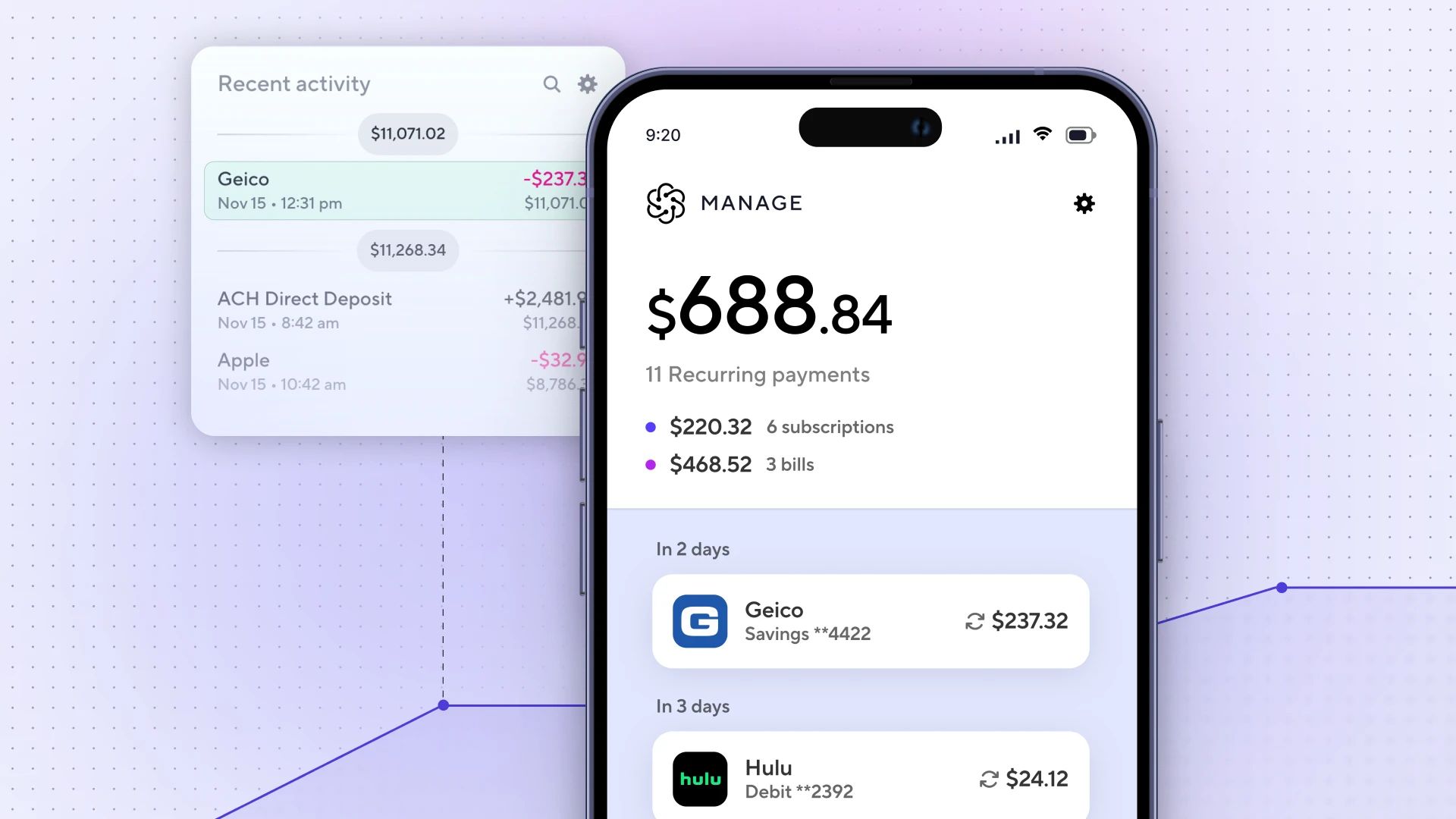

Those shared pain points became the chief drivers behind the founding of Dave, the personal finance app that turned into one of the fastest-growing, publicly listed banking apps in the country. Deriving its name from the story of David and Goliath (or the average consumer versus the big banks), Dave began as a money management app designed to free consumers from the tyranny of banking fees. Linked to their bank accounts, the app would track their expenses and alert them when their balances got perilously low. Dave would then offer them an interest-free advance to cover basic expenses until payday. Dave pre-qualified customers for these short-term loans based on their paychecks and spending habits.

In just four years, Dave acquired 10 million registered users. The founders’ vision appealed to prominent VC firms and helpful investors like Mark Cuban. In 2022, Dave went public through a SPAC and reached nearly $4 billion in

market cap. More gratifying to the founders, Dave has issued over 50 million advances to save its customers from overdraft fees, and the banking world has taken notice – a number of big-name banks have now announced that they are changing their overdraft policies.

Differentiating in an increasingly crowded field of neobanks

Direct deposits are critical to grow primary banking relationships. Dave needed a competitive position in an increasingly crowded field of neobanks. It was using another payroll API vendor that delivered underwhelming customer conversion rates. Dave turned to Atomic for its market-leading coverage and conversion rates.

Leveraging payroll connectivity to reach and help more customers

Dave engaged with Atomic for payroll connectivity in 2021 to help strengthen its competitive position. This became necessary in an increasingly crowded field of neobanks. Atomic’s industry-leading consumer coverage – reaching some 125 million workers through 450 unique payroll integrations – gives Dave access to a vast pool of potential customers. Recognizing that direct deposits are critical to growing primary banking relationships, Dave is leveraging Atomic’s Deposit solution for a fast, friction-free and paperless direct deposit conversion experience. Atomic’s Verify is expected to enable Dave to increase cash advance service with fast and accurate employment and income verification.

“Atomic shares our vision of helping historically underserved consumers access modern banking services and improve their financial lives without getting crushed by fees,” says Paras. “Teaming with Atomic will enable us to expand our reach and deliver an even more seamless and satisfying experience for our customers.”

Jason agrees.

“It’s no exaggeration to say Dave is reinventing banking. By empowering consumers to share their payroll data, Atomic is a helpful partner in the fintech ecosystem that is driving greater fairness and equity in the banking system.”