Why fintech infrastructure is key killing fees and consumer friction

Lindsay Davis

Head of Markets

Over the course of the last three decades, Rahul Gupta has been a part of the convergence between finance and technology. He’s been a leader and advisor in the payments and financial services sectors as they’ve gone through massive changes. However, Gupta sees plenty of untapped opportunities for fintech companies, in particular in the plumbing and infrastructure spaces.

Gupta spent time at Fidelity Investments in the 1990s and then moved to the technology sector, as President of the U.S. Operations for eFunds Corp. — a $500 million payments and risk management solutions provider. Later, he served as the Executive Vice President and Group President at Fiserv, a $13 billion financial technology and core infrastructure provider.

Today, Gupta serves as a board member and advisor for multiple public and private companies, not-for-profits, and private equity and VC funds. He recently joined the advisory board at Atomic.

What drew him to accept the position?

“It was a combination of the mission, the people, and the products that you guys are building,”

We caught up with Gupta to learn more about his view of the changing financial landscape and the way that innovation, scale, and a willingness to disrupt from within must work in concert when building a game-changing company.

Q: You’ve spent more than 35 years in the payments and financial services sectors. What’s the most surprising change you’ve seen in how consumers interact with their money?

That consumers are much more financially aware now. For example, growing up 25 or 30 years ago, people had never heard of credit reports. Today, everybody knows what’s on their credit report. Everybody is starting to know what banks are charging them for their interest rates and fees. My son, who is 28 years old, is highly aware of the different rewards that the different card and loyalty systems give him and what a late payment could do to his credit report. He’s an optimizer in terms of using financial services. So, I would say people are much more involved and engaged. It’s all the modern tools that have made that available to them — social media, of course, but certainly the more modern fintech apps as well.

Q: What is something in the payments or financial services sector that you’re surprised has not yet been “disrupted?”

All kinds of things! There is still too much friction in the financial experience. I’m still surprised, for example, that in the low and moderate income groups of the country, we still have such a preponderance of payday loans, check cashing and very high-fee products.

I’m surprised that despite the success of neobanks, banks are still charging very high overdraft fees.

In the B2B space, businesses transacting with other businesses still have a very high incidence of checks and paper transactions back and forth. And I’m surprised that the average bank still is taking 10-plus days to approve a new account application. So, things are progressing, but there’s still a lot of runway and opportunity left.

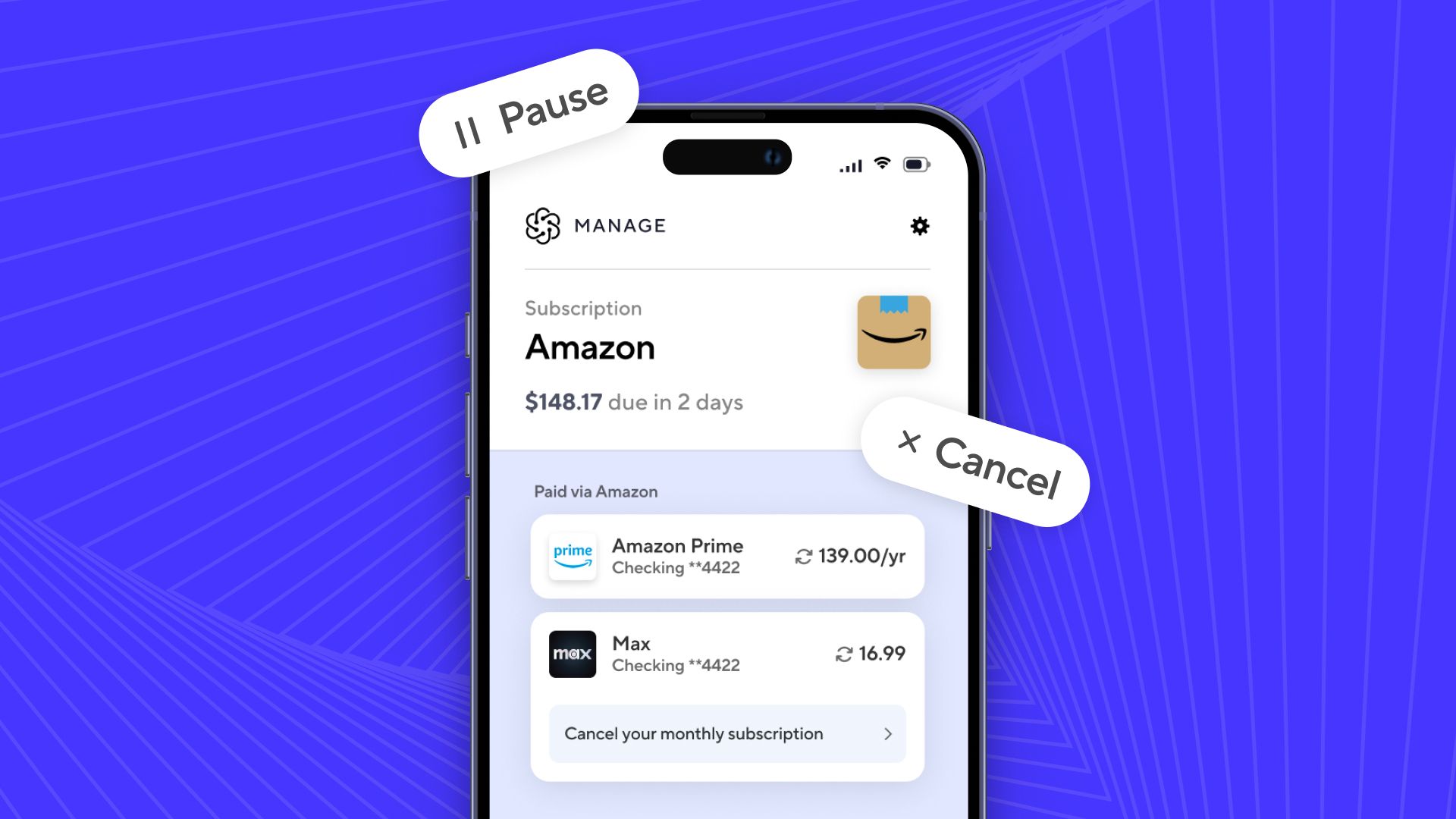

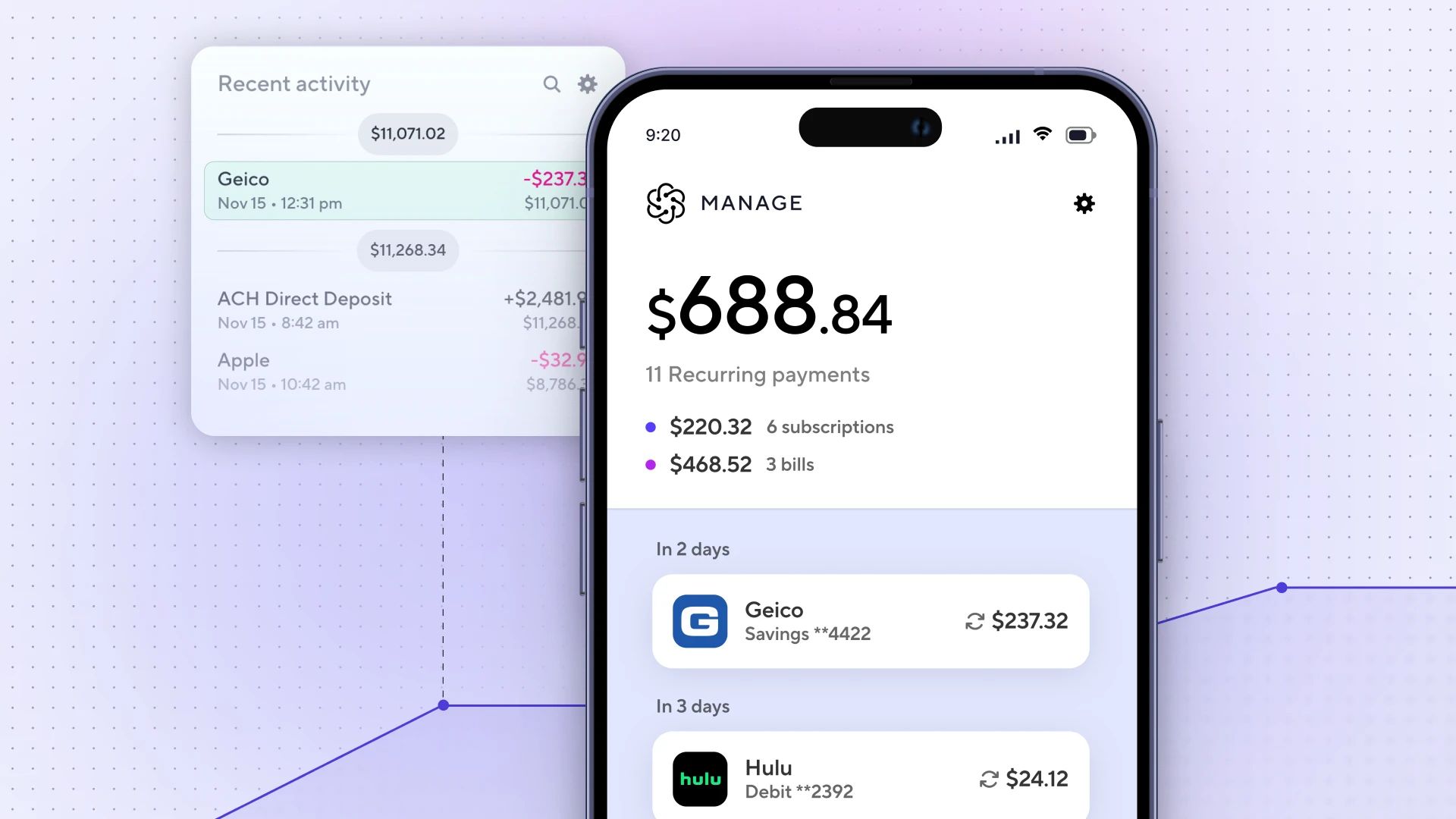

Fintech infrastructure have enabled lower customer acquisition costs (CAC), less overhead without branches, among other cost savings that render the punitive $35 overdraft fee useless. Atomic’s payroll APIs could also make overdraft fees unnecessary by streamlining the ability to acquire funds digitally.

Q: What do you think is keeping incumbent banks from innovating on their overdraft fee structures?

I mean, it’s no different than interchange fees or any of these other fee structures that exist in financial services — you initially start charging them to offset cost, but then, your whole revenue line is built around the fees so it’s very hard to take them away. You have to reengineer your entire business, which becomes very hard to do culturally, regulatory-wise, and emotionally.

Technology is a barrier, but it’s not the big barrier today. If the banks wanted to take out branches faster to change their cost structures faster, that’s very doable

The barrier is that you have inertia, you have revenue models, and you have shareholders as a public company, so you are basically hooked on a business model.

Q: What has been the most exciting technological or structural shift you’ve seen in fintech in the last five years?

One is the whole revolution of APIs, which is the basis of Atomic’s offering. APIs have been around for 20-plus years, but they were unusable. It was not until Stripe and so many other companies came along and just said: we’ll be API first and really API only — we don’t need these big fancy workflow screens and separate systems and all of that stuff. The focus on being able to embed a product very easily in the experience was what started the API revolution. That’s been a game changer and it’s just the early innings.

Then, on the more emerging side, is the whole blockchain crypto space that is starting to come about. That may absolutely change the whole way businesses interact with other businesses — but that, too, is still very early innings. There are many others, but those are a couple of examples.

Q: The API revolution and blockchain are really innovations in the infrastructure and plumbing versus consumer-facing viral products such as the Black Card. How can the plumbing impact the way funds flow to mass market consumers?

Don’t get me wrong: there is also a lot of innovation happening closer to the consumer. Many of the leading fintech apps today, like Chime, are pretty incredible in their simplicity and ease of use.

But you’re right to say that much of the most game-changing innovation is happening behind the scenes.

It is the plumbing — the middleware that had been built out 25, 30, or 40 years ago — that was holding back and still continues to hold back lots of innovation. So, I think there’s still a lot of opportunity in that plumbing: whether it’s speeding up or reducing the risk in the interconnectivity between companies or between the consumer and companies, whether it’s APIs or new networks or something else completely. I believe those will continue to develop along with the new business models that are also coming about, which are putting more of a premium on transparency, and reducing friction.

Q: Before your time at Fiserv, RevSpring, and eFunds, you were at Fidelity Investments. How has seeing both the fintech and incumbent side of the financial space shaped your view on what will and will not work as fintech continues to grow?

When I was at Fidelity Investments in the 90s, I was a pretty young man — I was a product manager and then became a general manager. And while Fidelity is an incumbent, it’s a very innovative incumbent.

They did not mind disrupting themselves all the time. They had a very long view and still do; being privately owned helps them do that.

That was really a valuable learning experience. They pioneered the mutual fund, they pioneered the 401k, they pioneered all kinds of things, and yet they would routinely disrupt their own channels. They actually encouraged one part of the business to compete with other parts of the business if they had more innovation. So, for me, that became really the foundational element of my career.

From there, I focused less on financial incumbents and more on technology companies. But eFunds and Fiserv — both of which were fintech leaders — would be considered incumbent tech players in today’s terms. Both were very early pioneers in terms of the technology markets they were building, in the case of core banking, risk management or payments processing. So, that was a great learning experience for me.

The challenge is that you realize that they all become big companies and start getting inertia, and start becoming wedded to their way of doing things and their business models, which leaves themselves open to disruption. It’s the classic Clayton Christensen problem, right? You’re seeing the effect of that in spades with the new fintechs coming on board today that are attacking incumbents.

It’s been a great evolution for me to watch — it’s been fascinating to see this tech movement continually improve financial services for the last 25 years. The consumer is the winner!

Q: At Fiserv and eFunds, you worked with companies helping traditional industries move finance online. Were there any lessons that you learned from your time at Fiserv and eFunds that can be helpful as online finance becomes the standard across all industries?

Yeah, I think some of the principles haven’t changed, right? Focus on the experience and always do right by the customer. But then, I also learned the value of scale. It’s all well and good to be innovative, but you have to think about markets and submarkets where you can get scale. Because to make a difference, you really need to make it at scale.

The businesses I was at would use innovation, but also would scale up through acquisition and through partnerships — it was in a race to make sure that they were not just the best, but the biggest.

So, I predict even for the current set of players that are out there today — and there are many, many more players now because of the acceleration of the Fintech Revolution — the value of scale will start to show up.

Right now, you’re seeing lots of valuations for innovative companies that are almost ignoring scale. But scale will matter soon. There’s just too much clutter out there for every one of these companies to make a real difference in the market.

Q: How important will security become as more industries move transactions and personal data online?

Hugely important! As you remove friction and increase the speed of interactions, security needs to be built-in to the flow. Atomic is working to eliminate risk and fraud, and they need to remain committed to continuing to scale up and make sure that you can solve 100% of the fraud and verification risks that are out there, in order to get the commerce moving even faster. This innovation and reliability is a crucial part of the ecosystem and it’s a challenge but Atomic needs to work tirelessly to gain and retain its customers’ trust.

For any new player to come along, the bar is incredibly high. That’s the only way to push through the clutter and win the trust of all the parties in your ecosystem.

Q: What drew you to want to join the Atomic advisory board?

There were a couple of factors. One, Arjan Schutte introduced me to Jordan and Arjan is a friend and also a very smart man. So, I listened when he told me about this cool company doing great and interesting things.

Then, I talked to Jordan, and I was very impressed by not only his experience, but also what he was building. On top of that, I just love the use cases — I think there is such a need out there.

I’ve watched the incumbent tech companies and, certainly, the incumbent financial companies not really changing their process for so long, because the plumbing issues had not been solved. I saw right away that Atomic is trying to solve the plumbing in a critical area.

So, it was a combination of the mission, the people, and the products that the team is building.

Our last question is one we ask every interviewee: what book or podcast do you recommend to younger founders in fintech to better understand this moment?

I listen to about 25 different podcasts. It’s important to keep up with what’s going on inside of fintech, but there are a number of really great ones I would recommend listening to outside of fintech.

I’d definitely recommend Invest Like The Best. Patrick O’Shaughnessy is just an incredible host. Another that comes to mind is Tech Buzz China. It’s very interesting what’s happening in China tech. It’s hard to believe that there’s a nation ahead of the US in tech, but the business models and technology are evolving faster in China than they are evolving here.

In terms of books, I’m reading an incredible book right now called The Infinite Machine by Camila Russo. It’s about the early days of Ethereum and the amazing things happening there. I’d recommend those podcasts and that book to broaden people’s minds.

Want to get to know the rest of Atomic’s advisory board?

Check out our conversations with Mike Ferrari and Susan Ehrlich.