All The Single Lady’s Taxes

Lindsay Davis

Head of Markets

Hi there,

Welcome back and welcome aboard to our newest subscribers. I’m Lindsay, Head of Markets here at Atomic.

If you are single during the holidays, conversations with your family about who will travel where typically start with “since it’s just you,” and end with “send us your travel plans.” One might assume a silver lining of being born on Christmas day is leverage to argue the holidays should come to you. However, when the counterpoint is giving birth, the negotiations are over.

Holiday travels are among a handful of what I call “the single lady’s (or gentleman’s) taxes.” And like actual taxes, they fall disproportionately on individuals. (I will caveat that I am grateful traveling at current, is safe enough for many of us to reunite with family.)

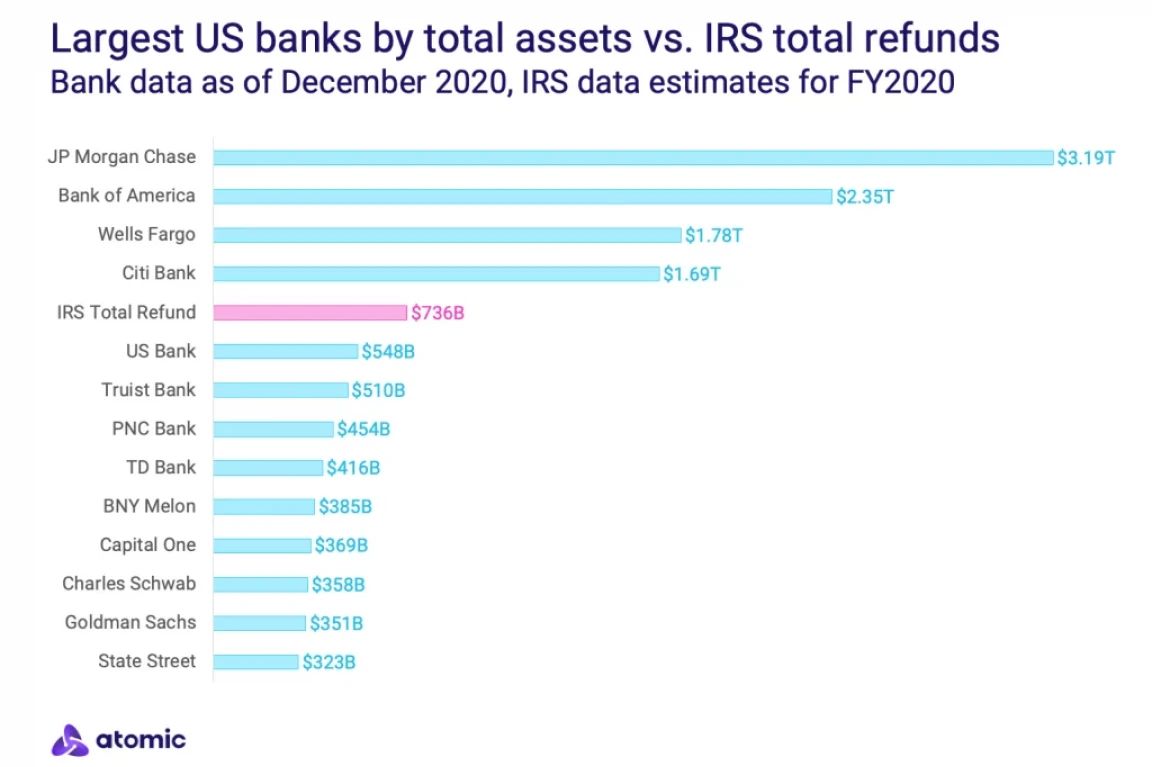

Institutionalized singledom is a broader, expensive, systemic problem. There are over 1,000 government incentives to get married. One of the largest is income tax. In FY2020, The IRS collected $3.49 trillion in gross taxes and issued $736.2 billion in refunds. The largest refund went to individuals collectively, totaling $391 billion across 141.4 million taxpayers, excluding the economic impact payments (EIP). In comparison to assets held at the largest financial institutions, refunds from the IRS would constitute the fifth largest “bank.” Unlike a bank, however, these “deposits” are liquid once a year during tax filing season and earn 0% interest.

Americans are overpaying in taxes, to put it bluntly. Taxes are complicated and consumers are terrified of owing, so they default to over-withholding. This is one of the problems a burgeoning crop of fintech companies are looking to solve, including Column Tax. This month we announced our partnership with Column Tax to unlock year-round refunds. Our partnership enables consumers to get on-demand advisory about their tax withholdings and automates setting up or adjusting withholdings directly in payroll systems, among other benefits.

The impact is potentially massive, as taxes are a rare, large, illiquid pool of capital that when unlocked, puts more money in consumers’ pockets when they need it most. Optimistically, when the day comes to change my filing status to anything other than single, there is now a way to seamlessly update withholdings and capitalize on the tax incentives of institutional marriage. Whether my family travel status changes is less certain, but the windfalls from tax credits and deductions could provide an additional financial buffer during the holidays.

In this edition of Atomic Intelligence we cover:

- How we’re living our cultural value to give back

- Our partnership with Column Tax to unlock $350 billion in tax refunds for millions of consumers

- Three fintech strategies for credit unions to take today

- Live from Las Vegas, it’s For Fintech Sake: Money 20/20 series

- Sneak peak of what we’re wearing to the Fintech Formal

- And recent features in the media and podcast episodes

Stay well and happy holidays,

Lindsay

P.S. If you’re unsure what to get your team this holiday season, we started a gift giving campaign for a local charity and share how you can contribute to this great cause or start your own below.

P.P.S. If you want to join our team we’re hiring