Atomic & Jack Henry Collaborate for Banking Evolution with Banno

Lindsay Davis

Head of Markets

In December, we announced our direct deposit setup and switching solution, Deposit. It is now accessible through Jack Henry’s digital banking platform which will benefit Banno users.

To summarize, below are a few highlights from our joint press release on Business Wire including:

- How we built the Deposit plug-in

- What customers can expect

- How to start building with the Deposit plugin today

- And why collaborating in fintech is key to unlocking the next evolution in digital banking

How we built this

We built the Deposit plugin by leveraging the Digital ToolkitTM, the same set of APIs on which the Banno Digital PlatformTM is built, to embed our solutions into the digital experiences offered by community and regional financial institutions. For example, access to Jack Henry’s API, design, and authenticated frameworks was key in enabling our team to directly integrate into the digital banking platform and provide a seamless banking experience.

Additionally, our integration contributes to Jack Henry’s growing ecosystem of over 850 fintech firms. This provides approximately 8,000 financial institutions with relevant financial products and services for their account holders.

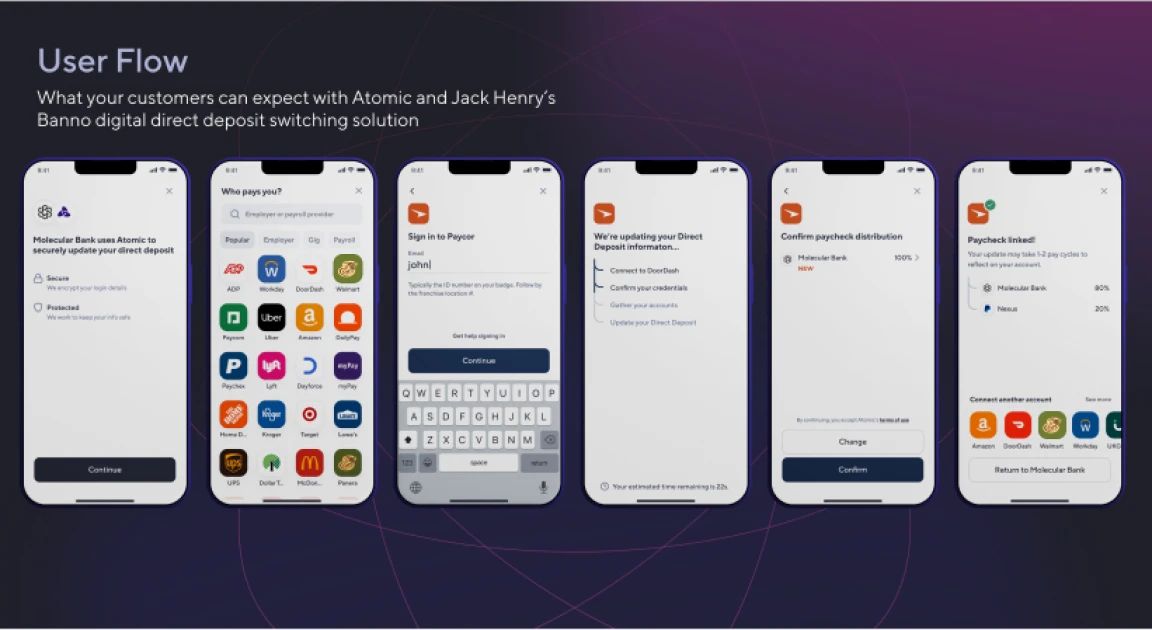

What customers can expect

We soft-launched our Deposit plugin on the Jack Henry digital banking platform this Summer which gave Banno users access to its first-to-market direct deposit switch and set-up solution. What’s more, using our Deposit plugin, financial institutions can enable their customers to digitally set up and switch direct deposits to fund accounts held with them.

How to start building with the Banno plugin

With our Deposit solution active on the Jack Henry digital banking platform, existing Banno customers can install and activate the Deposit plugin to their bank’s mobile app or online banking platform within hours. Furthermore, existing customers can learn how with our quick-start Banno Onboarding Guide in our API docs.

" We aim to help marginalized and underserved consumers. The same way, we strive to help financial institutions of every asset size differentiate and excel–often the regional and community banks are among the hardest to serve underrepresented populations. By partnering, customers are empowered to unlock direct access to account funding streams without needing to invest in modern technological infrastructure or build in-house APIs and integrations required to launch competitive, cutting-edge financial solutions. We’re thrilled about this integration with Jack Henry and the Banno digital banking platform. "

Jordan Wright

Co-founder and CEO of Atomic

This collaboration is a great example of conjoined fintech that creates stronger wins and greater opportunities for financial institutions of all sizes. Consequently, this will help in fostering a more competitive landscape. At Atomic, we look forward to deepening our collaboration with the Jack Henry team and with the financial services industry to unlock the next evolution in digital banking.

Want to start building with the Deposit plugin today?

Existing customers can use our quick-start Banno Onboarding Guide here . Learn more by requesting a demo with our team.