Leading Payroll API, Atomic, Announces $22 Million Series A To Build A New Generation Of Bank Accounts

Lindsay Davis

Head of Markets

Trusted payroll connectivity solution will use the funds to double down on talent acquisition while scaling its best-in-category product experience.

SALT LAKE CITY, Oct. 12, 2021 / PR Newswire / —Atomic, the market leading provider for payroll connectivity, announced today that it has secured $22 million in Series A financing to expand its payroll integration platform and grow its team. The funding comes as the firm’s solution is on pace to reach more than 120 million Americans, or 75% of the country, by year end. Atomic has raised more than $38.6 million since its founding in 2019. Core Innovation Capital and Portage Ventures co-led the investment with participation from Greylock.

" We created Atomic to help the most financially vulnerable members of our society access transparent financial services that they can trust. "

Jordan Wright

Co-founder and CEO of Atomic

" Our traction with customers is a testament to our product experience. This infusion of capital will be focused on continuing to deliver cutting-edge financial solutions. "

Scott Weinert

Co-founder and CEO of Atomic

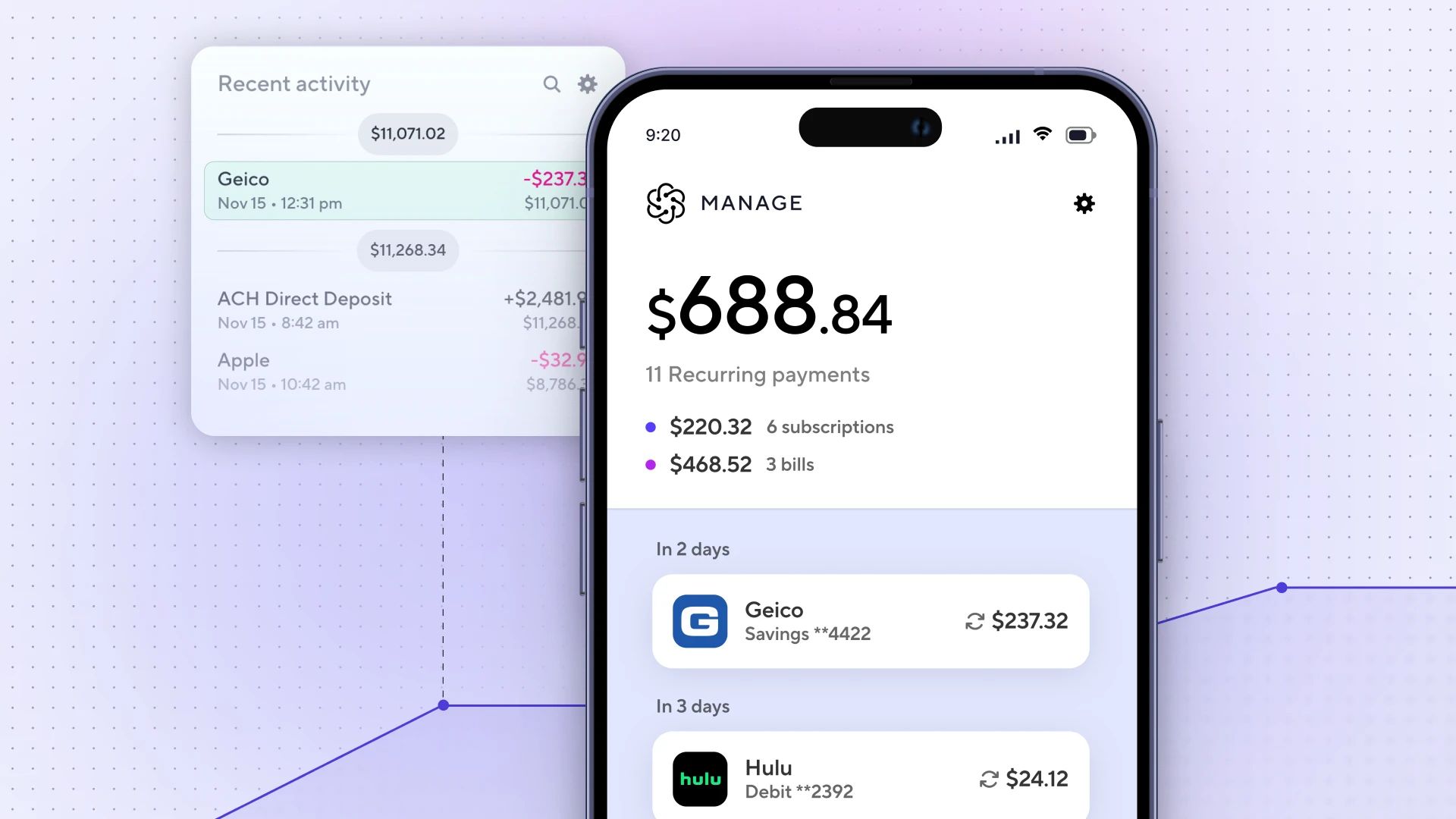

Atomic’s payroll APIs are the leading way for consumers to securely connect their payroll accounts to a third-party banking app to set up or switch direct deposit payments and to access financial data for income (VOI) and employment (VOE) verifications. Institutional customers leverage Atomic’s payroll connectivity to empower end consumers to harness the power of their paychecks and permit access to their financial data trapped in employer payroll systems. Atomic is trusted by more than 40 financial institutions, fintech and technology firms, including 11 of the largest consumer finance apps.

Atomic was created to build a new generation of bank accounts and transform banking applications into consumer-centric platforms. Its technology is enabling innovative fintech solutions that reach more than 1.5 million unique consumers a month through leading financial providers, including:

- Coinbase, to enable greater access to the cryptoeconomy, through trading, spending, saving, and earning;

- Dave, to help consumers avoid predatory overdraft fees on its mission to create financial opportunity that advances America’s collective potential;

- Welcome Tech,to provide unbanked immigrants with access to checking and savings accounts;

- Propel, to help consumers manage government benefits and money through its financial app, Providers;

- Lendtable, to empower employees to optimize their benefits and retirement planning;

- Klover, to help consumers improve their financial freedom and access their earned wages early;

- Unfimoney, to help next-gen investors achieve long-term investment and savings goals;

- Bond, to enable developers and brands to embed financial products and build the next generation of personalized fintechs;

- MX, to empower the world to be financially strong through data-driven money experiences.

" Today’s broken financial services infrastructure hurts everyday Americans, especially those living paycheck to paycheck. Atomic is at the forefront of creating a faster, safer and more inclusive financial infrastructure and shares Core’s mission of financial empowerment. "

Arjan Schütte

Founder and Managing Partner of Core Innovation Capital

About Atomic

Atomic is the market leading provider of payroll APIs, trusted by 11 of the largest fintech firms, including digital-first neobanks, alternative lenders, and digital brokerages. Atomic’s payroll integrations provide the infrastructure to connect end consumers to their financial data and automate setting up and updating direct deposits. Atomic is a member of the Financial Health Network, a nonprofit network of leading-edge financial services and financial technology providers committed to consumer- and employee-focused financial health innovations. Atomic’s vision is to enable wealth creation for consumers by building more on-ramps to financial services.

Atomic simplifies complicated payroll integrations with a single API that covers over 450 unique payroll connections. Including incumbent payroll providers, bespoke enterprise solutions, modern HR tech providers, gig-economy platforms and government systems, Atomic’s payroll APIs cover 75% of the U.S. workforce with a combined reach of 120 million workers. Atomic has raised $38.6 million from investors, including Core Innovation Capital, Portage, and Greylock.

Want to learn more?

If you are curious about the intersection of fintech and payroll, as well as Atomic’s latest Insights, we you can subscribe to our newsletter here or request a demo below. If you’re looking to join the team, we’re hiring!