Build Stickiness: Driving Platform Dependency Through Payment Tracking

Atomic Team

The shift from active usage to true platform dependency is what separates fleeting engagement from lasting customer relationships. The more payment relationships customers link to your platform, the more essential your service becomes in their financial lives.

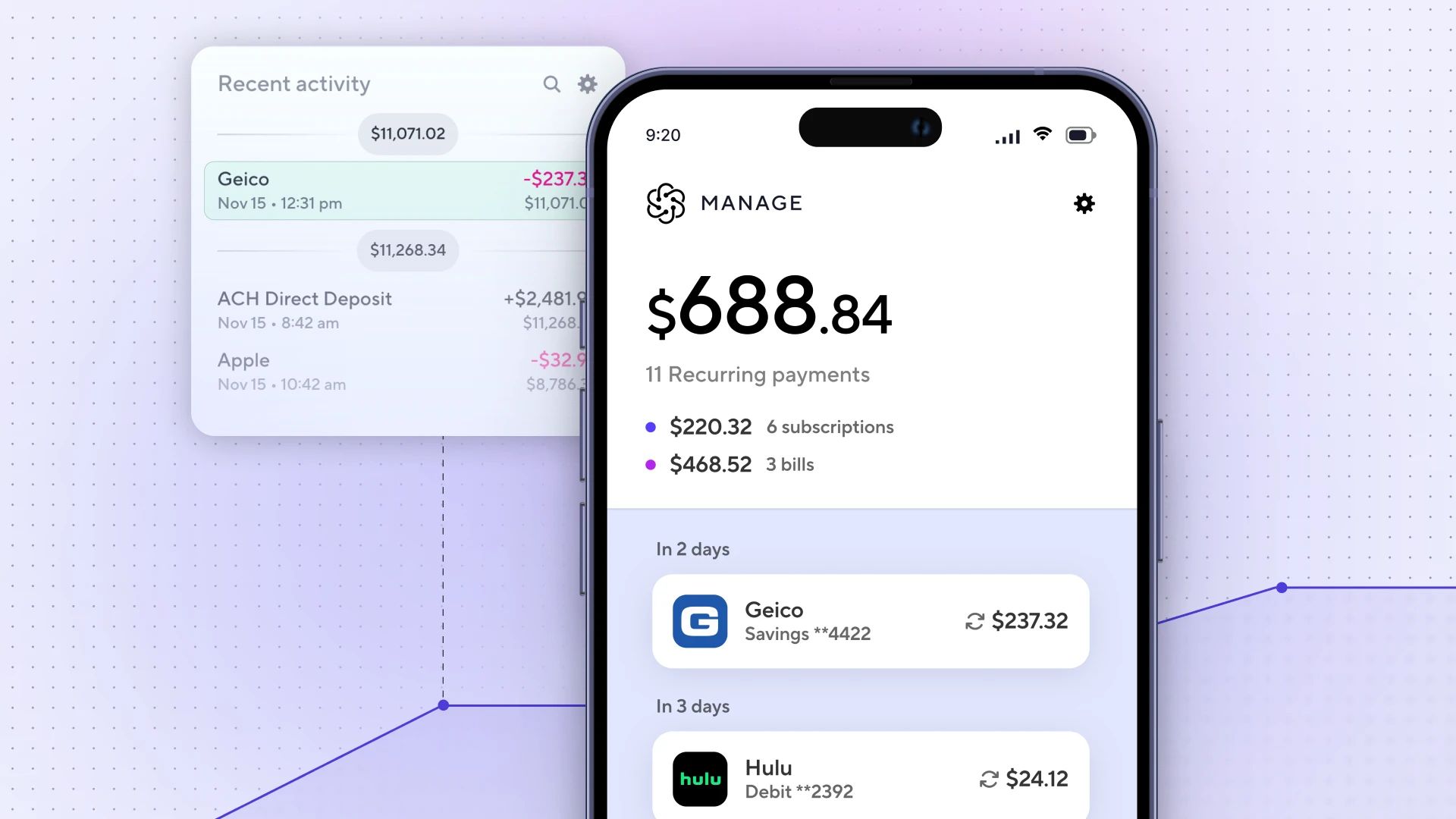

Payment Tracking: The Engagement Multiplier

Payment tracking turns occasional interactions into habitual engagement by providing ongoing utility between transactions—keeping customers connected to your platform.

How It Works:

- Customer adds bills to a centralized tracking dashboard

- The system monitors payment due dates and amount changes in real-time

- Proactive notifications alert customers of upcoming payment obligations

- One-click access enables immediate payment action

The impact? Payment tracking and bill management don’t just streamline finances—they deepen customer engagement. According to J.D. Power, digital features like these can increase customer satisfaction scores by 25–40 points on their 1,000-point scale, reinforcing the value of frequent interactions.

Additionally, McKinsey research found that banking customers who engage across multiple digital touchpoints generate 2–4x more revenue than single-channel users. By embedding payment tracking into their platforms, institutions create stickier relationships, increasing engagement and long-term customer value.

Maximizing Stickiness: Capturing Diverse Payment Types

The most effective implementations ensure broad coverage across:

- Recurring bills - utilities, subscription services

- Variable payments -credit cards, loans

- Periodic obligations - insurance, memberships

By embedding payment tracking as a frequent form of engagement, institutions transform their platforms from transactional tools into essential financial hubs.

Transaction Clarity: Reducing Uncertainty and Fraud Concerns

Enhanced transaction data transforms ambiguous merchant names into clear, recognizable purchase details, building both utility and trust for customers.

How It Works:

- System enriches transaction data beyond basic merchant names

- Detailed purchase breakdowns clarify transactions for complex merchants like Amazon or Walmart

- Fraud alerts become frictionless—customers can instantly verify legitimate purchases

- One-tap verification replaces time-consuming calls to fraud departments

Both customers and institutions can benefit from greater transaction clarity:

- Increased Confidence: A McKinsey survey found that 70% of banking customers who were fraud victims felt anxious, stressed, displeased, or frustrated when warned about potential fraud. This underscores the importance of clear and accurate transaction information in maintaining customer confidence.

- Reduction in Support Call Volume: Implementing effective fraud detection and prevention strategies can lead to a decrease in customer disputes and related support calls. For example, Stripe reported that chargebacks have increased by 20% annually, representing billions in lost revenue, highlighting the need for improved transaction clarity to reduce such disputes.

For commonly misunderstood merchants, the ability to instantly confirm Yes, I made this purchase directly from a notification reduces customer anxiety, increases engagement, and cuts support call volume. By eliminating uncertainty, financial platforms can strengthen customer trust while significantly lowering operational costs.

Proactive Cash Flow Management: Beyond Basic Alerts

Forward-thinking institutions are leveraging payment tracking data to provide timely, contextual support—helping customers navigate cash flow challenges before they happen.

How It Works:

- Analyze upcoming payments—System analyzes upcoming payment obligations against projected account balance.

- Proactive notifications—Alerts warn customers of potential shortfalls: "Your balance may fall below $0 before your next deposit."

- Smart recommendations—Actionable solutions offer immediate relief: "Would you like to pause your Peacock subscription until after payday?"

- Guided intervention—Seamless workflows help customers take preventive action before problems occur.

This approach goes beyond overdraft prevention—it positions your platform as an active financial partner, not just a transactional service. Research from Forrester shows that customers with three or more financial products at a single institution churn 70-85% less than those with only one. Proactive cash flow management adds another layer of value, keeping customers engaged and strengthening their relationship with your institution.

The impact compounds over time: customers who engage with payment tracking, transaction clarity, and proactive cash flow management can gain greater control and transparency over their finances. At the same time, by anticipating financial needs and offering timely, personalized solutions, institutions can increase customer loyalty, engagement, and long-term value—turning their platform into a needed financial ally.

This post is the third in our four-part series exploring how modern payment management transforms banking relationships across the customer journey. Check out our previous posts on How Subscription & Bill Management Drive Lasting Customer Loyalty and Turning New Accounts into Primary Payment Hubs, or watch our latest webinar to see these concepts in action.