Digital Onboarding and Atomic pair up to modernize direct deposit acquisition

Lindsay Davis

Head of Markets

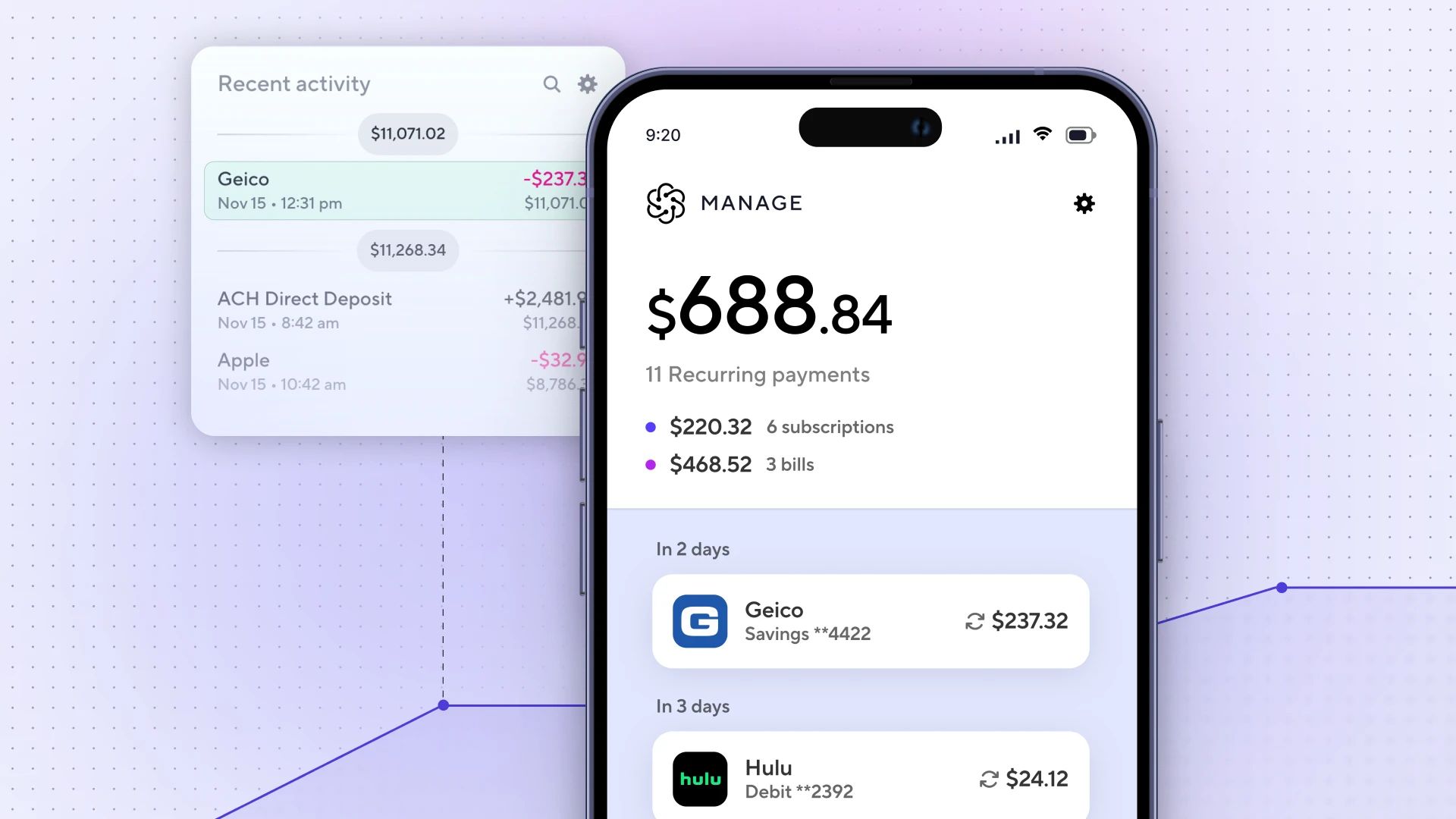

Digital Onboarding is integrating Atomic’s payroll connectivity to help banks and credit unions build loyal, deep, and profitable customer relationships.

The digital engagement platform provider for financial institutions launched a new feature that helps banks and credit unions attract more direct deposit enrollments. Customers and members can use the digital feature to instantly and easily setup and make changes to their direct deposits themselves, without filling out a PDF form or contacting human resources.

" Financial institutions have long known about the importance of direct deposit, but most still rely on PDF forms and manual processes to encourage customers and members to switch "

Ted Brown

CEO, Digital Onboarding

“We designed the Digital Onboarding engagement platform to eliminate friction and make it easy for consumers to adopt digital banking services that drive cost savings, satisfaction, and longevity. The release of our new automated direct deposit acquisition feature is just one more example of how we’re helping banks and credit unions turn account openers into engaged and profitable relationships.”

" We all know direct deposits are a leading indicator of account profitability. Our partnership with Digital Onboarding is a win-win: it helps banks and credit unions attract direct deposits while making it easier for customers to set up and update accounts. "

Jordan Wright

Co-founder and CEO of Atomic

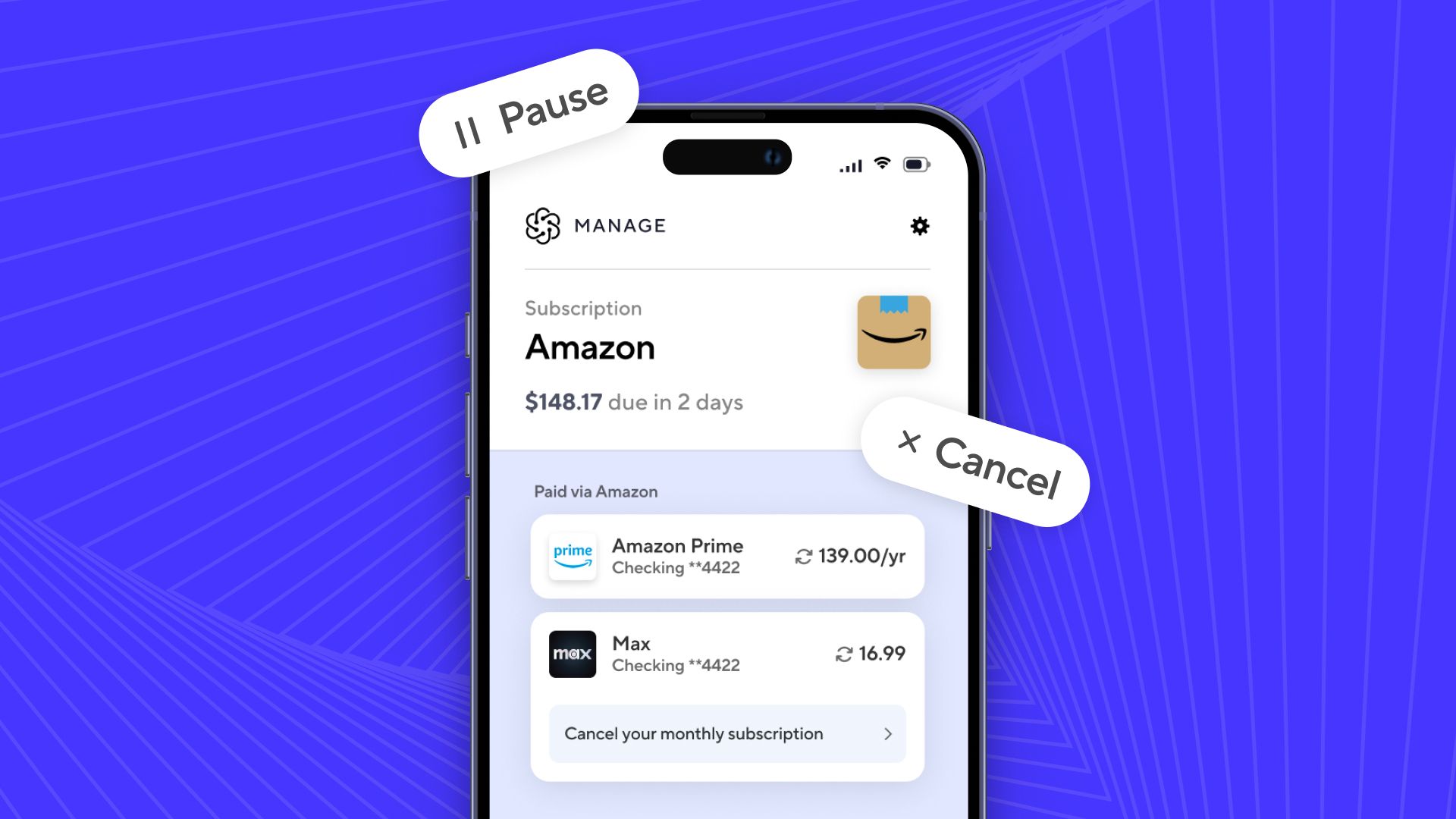

Direct deposit is a crucial driver of primacy and profitability, but manual work causes friction. The Digital Banking Report Account Opening and Onboarding Benchmarking Study revealed that a significant percentage of new checking accounts are closed within the first year due to lack of usage. Today’s consumers demand digital services that eliminate the friction often associated with new account activation processes. With Digital Onboarding’s new feature, customers and members simply need to select either their employer or their payroll provider to setup or update their direct deposits without leaving their financial app.

The Digital Onboarding platform also enables financial institutions to trigger instant text and email messages that encourage feature adoption. Messages link customers and members to their personalized microsites to access the new direct deposit self-service feature. Digital Onboarding’s digital suite supports marketing and engagement goals throughout the customer lifecycle, including new account activation, cross-sell, and education.