Open Banking: CFPB’s Vision, Account Primacy, & New Solutions

Becky Ross

Head of Marketing

As the financial world continues to evolve, proposed regulatory changes, technological advancements, and consumer demands are merging to usher in a new era of open banking in the United States. The Consumer Financial Protection Bureau (CFPB) is leading the way, taking a proactive stance to create a consumer-centric banking system that is more transparent, equitable, and beneficial for the consumer. At this inflection point, Atomic has already been working to streamline the process of transferring one’s banking relationship while maintaining control of personal data through tools such as Paylink suite.

The CFPB’s Call for Open Banking

When CFPB Director Rohit Chopra declared the Bureau’s commitment to open banking in June 2023, he wasn’t just announcing a policy stance for his agency; he was challenging the industry to innovate. The cornerstone of this sweeping initiative is the proposed personal data rights rule. The new rule aims to break down barriers that have traditionally prevented consumers from gaining full control over their financial data. “The CFPB is working to accelerate the shift to open banking through a new personal data rights rule intended to break down these obstacles [to moving banks], jumpstart competition, and protect financial privacy,” Chopra stated.

Why does open banking matter for financial institutions (FIs)? Open banking isn’t merely a consumer-centric advancement; it’s a strategic decision for financial institutions as well. The transparency and interoperability that open banking fosters allow banks to better understand customer needs, thereby creating more targeted, value-added services that can differentiate them in a crowded market. The democratization of financial data enables more seamless interactions between different financial services, positioning institutions that adapt quickly as the desired financial institutions for consumers. Additionally, open banking opens the door for partnerships with fintech firms, creating synergies that can lead to revenue-generating products and services, and even cost reductions through shared technology investments. Open banking can offer financial institutions an opportunity to evolve, enhance customer relationships, and drive competitive advantage.

The Imperative of Account Primacy in a Competitive Landscape

As the industry grapples with these regulatory changes, the concept of account primacy has never been more pertinent. The question isn’t just about which bank a consumer uses, but which financial institution has earned the right to serve as the hub for a customer’s financial life. In a world of financial fragmentation, where users might have multiple accounts spread across various institutions, achieving account primacy has become an even more critical objective for banks.

The definition of primacy varies by each individual financial institution, however the criteria typically includes: recurring direct deposit, main account where monthly expenses are paid from, and the utilization of more than one product or service from the institution. Atomic’s industry leading direct deposit switch solution helps 200+ financial institutions and fintechs start the path to primacy. With Atomic’s new expanded solution suite, consumers can simplify their account opening, easily switch payment methods, and boost security—making Atomic essential for achieving account primacy.

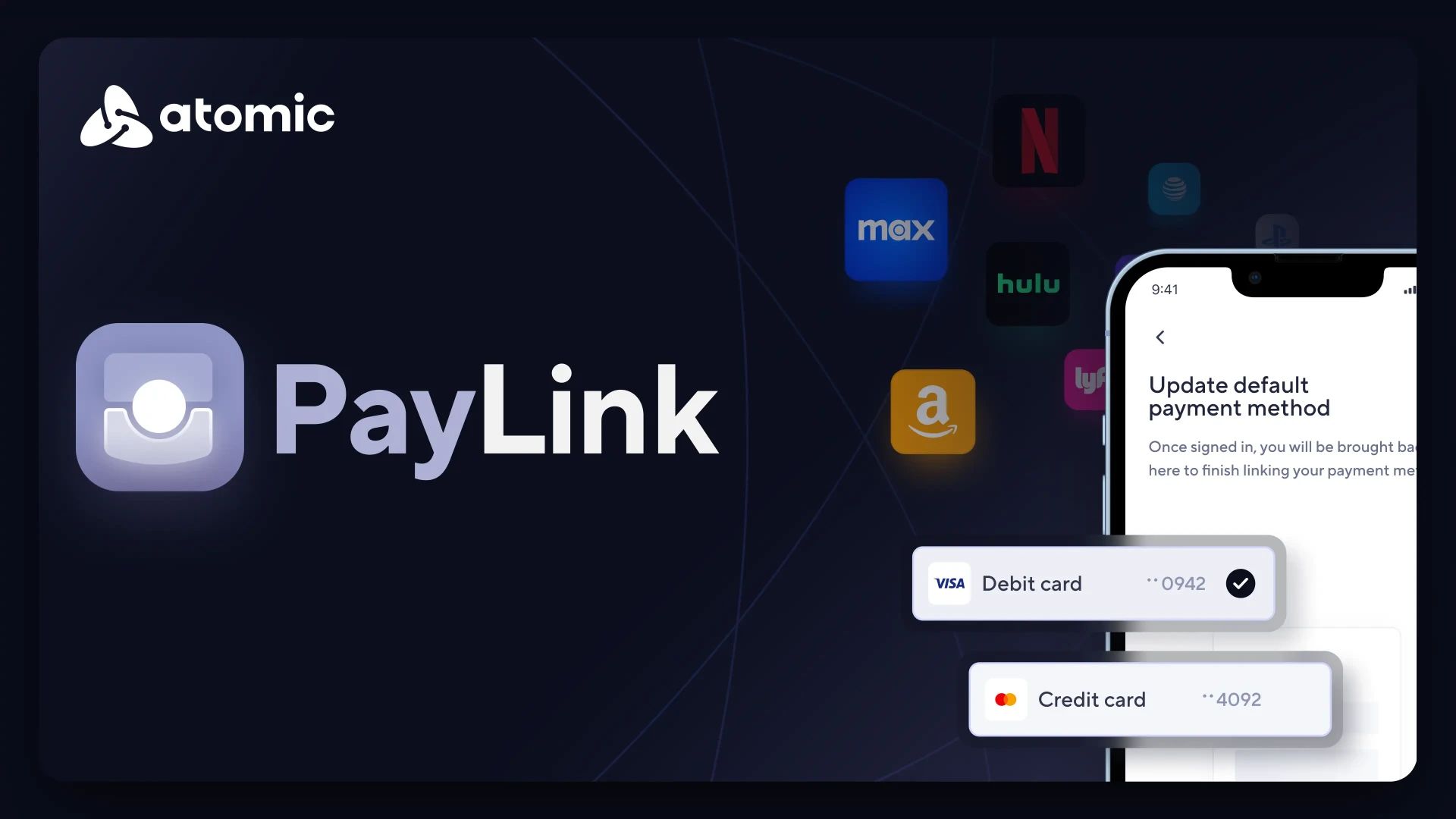

PayLink: An Advancement for Consumers and Financial Institutions

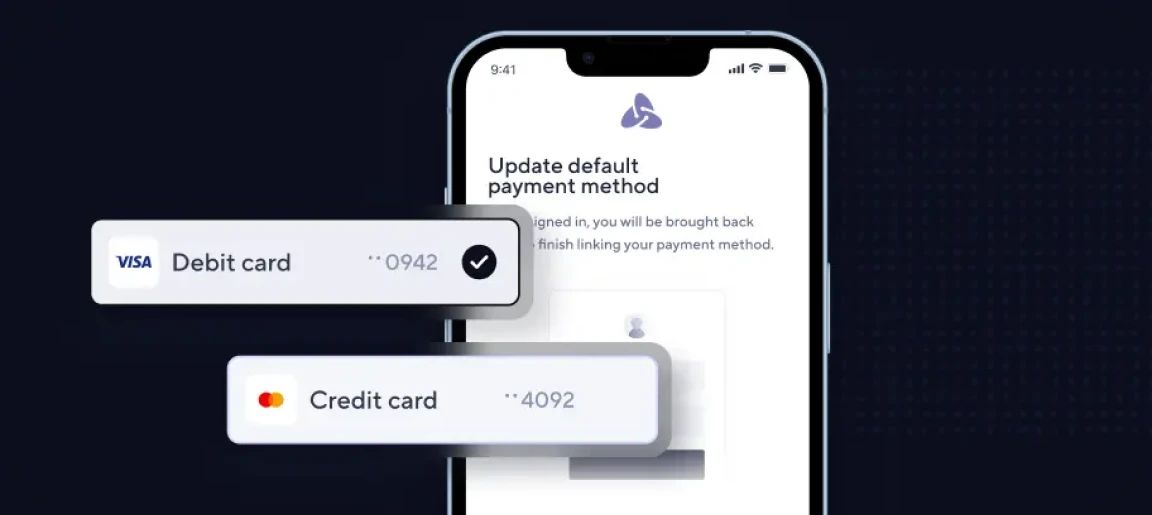

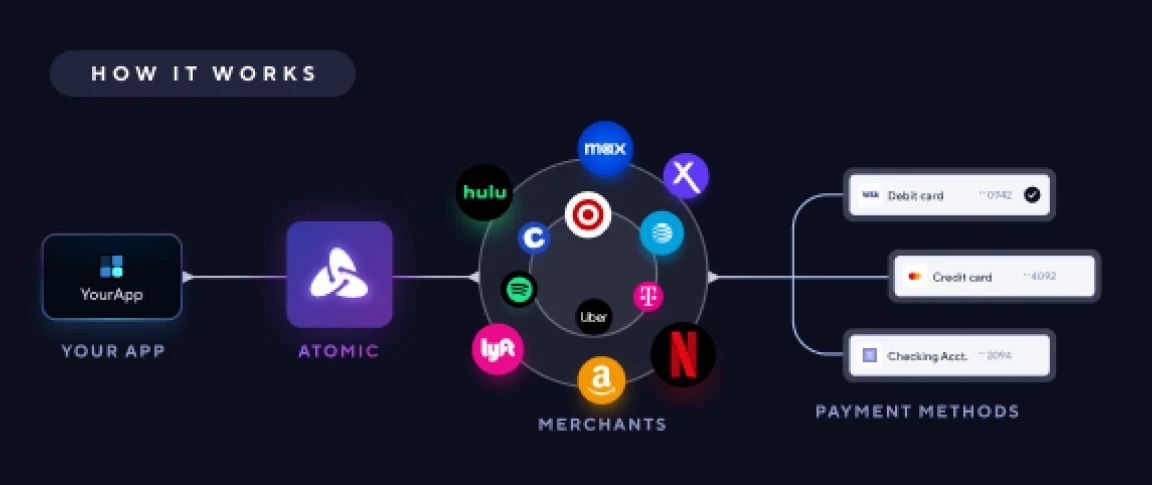

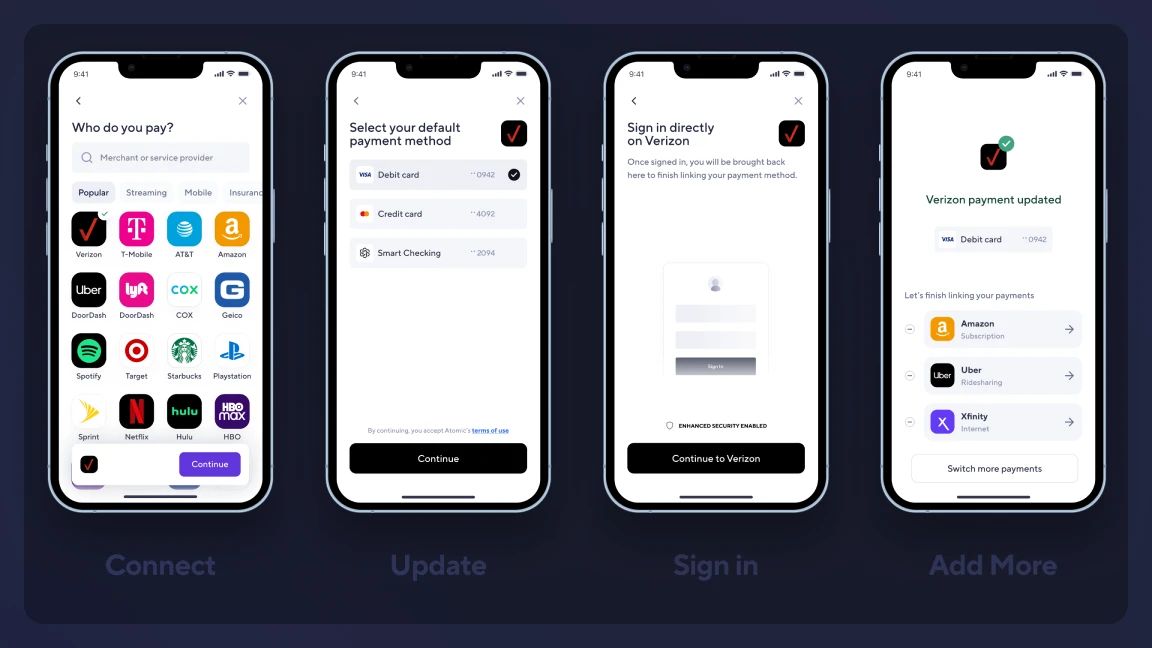

Atomic’s new PayLink suite is a set of financial tools that enable consumers to connect merchant accounts, streaming services, and recurring bills to their financial institution’s app. Paylink seamlessly updates their payment methods on file and enables a one-stop hub for reviewing upcoming expenses. By streamlining the account-switching experience, Paylink suite makes it easier to switch primary relationships, aligning with the CFPB’s open banking vision. Leveraging cutting-edge TrueAuth technology, PayLink ensures top-tier security by allowing users to authenticate directly on their devices, without ever sharing login credentials.

For financial institutions, this translates to quicker account primacy, higher revenue, and enhanced customer retention. For consumers, it means easy bank switching, batch updating payment methods, and assured data security. By offering multiple solutions in a single SDK, Atomic enables financial institutions to cut down on operational complexities and allows for a single new vendor onboarding process.

The TrueAuth Advantage: The Future of Authentication

What sets PayLink suite apart is its proprietary TrueAuth technology, a robust security protocol that enables consumers to maintain control of their login credentials. With TrueAuth, consumers can leverage Atomic’s Paylink automation to update the card on file or ACH info for recurring services without having to share their credentials with Atomic. Unlike traditional approaches, TrueAuth leverages an authentication method that ensures credentials never leave the user’s device by establishing a direct session between the user’s device and their vendor. This approach significantly reduces the risk of data breaches and unauthorized access, providing users with peace of mind regarding the security of their data.

With native support for on-device password managers and compatibility with various hardware authentication methods, TrueAuth is prepared to accept future developments in on-device authentication methods. As long as the end user can authenticate on their device, TrueAuth can securely connect.

Revenue Generation and Customer Retention

One of the benefits of PayLink suite is the potential to become a significant revenue driver. By streamlining the way consumers manage their payment methods within the banking application, PayLink facilitates an increase in interchange revenue through both debit and credit card transactions. When a consumer uses the same account for primary deposits as well as their go-to payment method, the value is compounded. Couple that with an enhanced user experience, and you have a recipe for building long-term customer loyalty.

Conclusion: The Road Ahead

The current evolution in the U.S. financial landscape, catalyzed by the CFPB’s advocacy of consumer-centric open banking, is a call for innovation and customer-centricity. Atomic, with its PayLink solution, is not just participating in this change; it’s pushing the boundaries of innovation. By continuing to focus on the consumer experience and innovation, Atomic is helping to define what the future of consumer-centric open banking in the United States could, and indeed should, look like. Read the full article in the American Bankers Association Banking Journal for more.