Is a food bank a “bank?”

Lindsay Davis

Head of Markets

Hi,

I’m Lindsay Davis, Head of Markets here at Atomic.

Welcome to the first edition of Atomic Intelligence, the only newsletter dedicated to the intersection of fintech and the paycheck. Our goal is to share context on Atomic’s payroll APIs market, timely product updates, and insights on the future of payday.

You say neobanks, I say challenger banks, and regulators globally are saying if it’s not chartered, it’s not a bank. As Simple (RIP) learned the hard way in 2010, fintech companies without a bank charter cannot market their products as bank products according to California State regulators in the US, and the UK’s FCA, among others.

(Personally, I’m fascinated to hear why we’ve let food banks or blood banks go on misleading consumers for all these years, since everything allegedly is or becomes a fintech.)

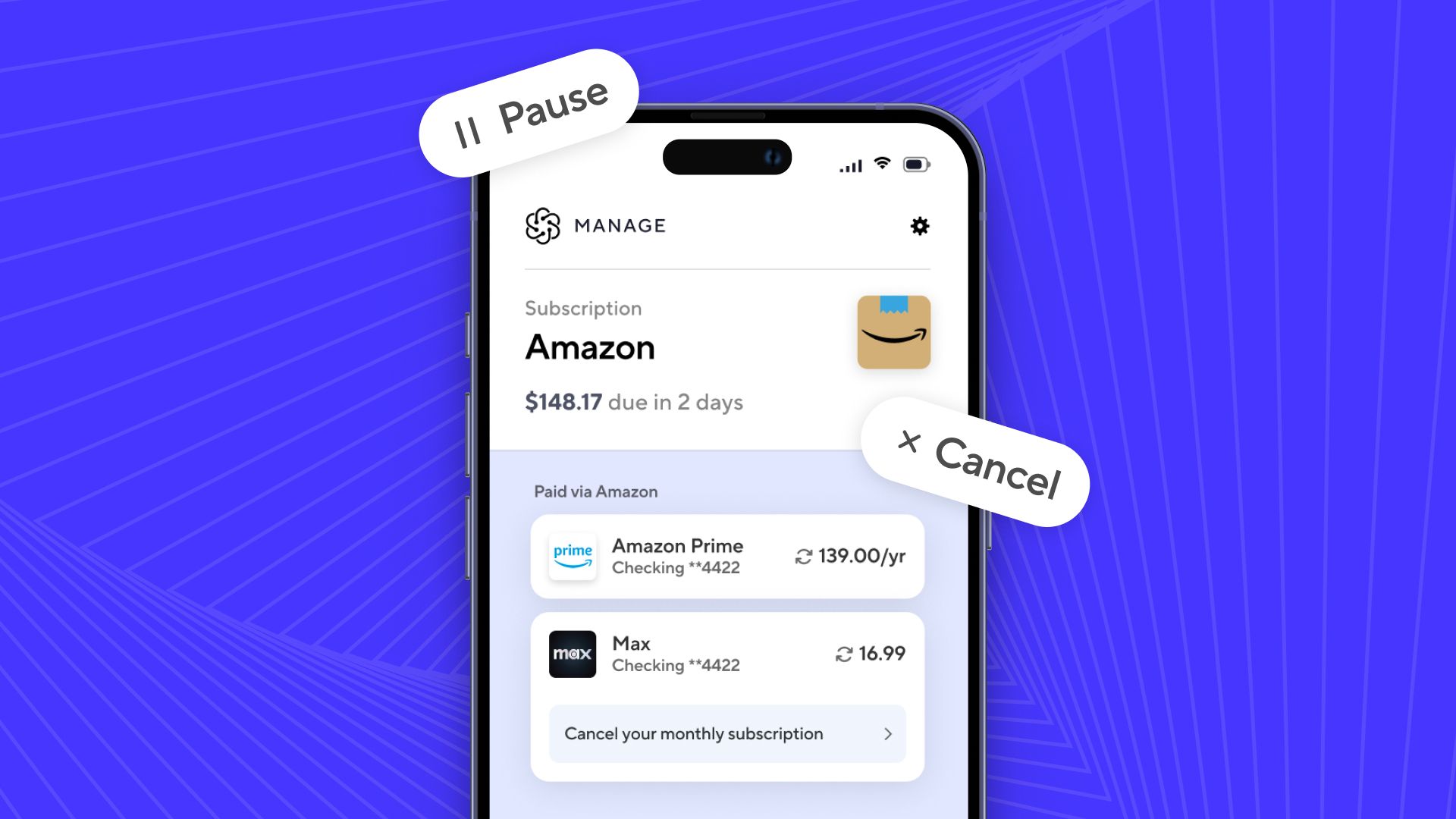

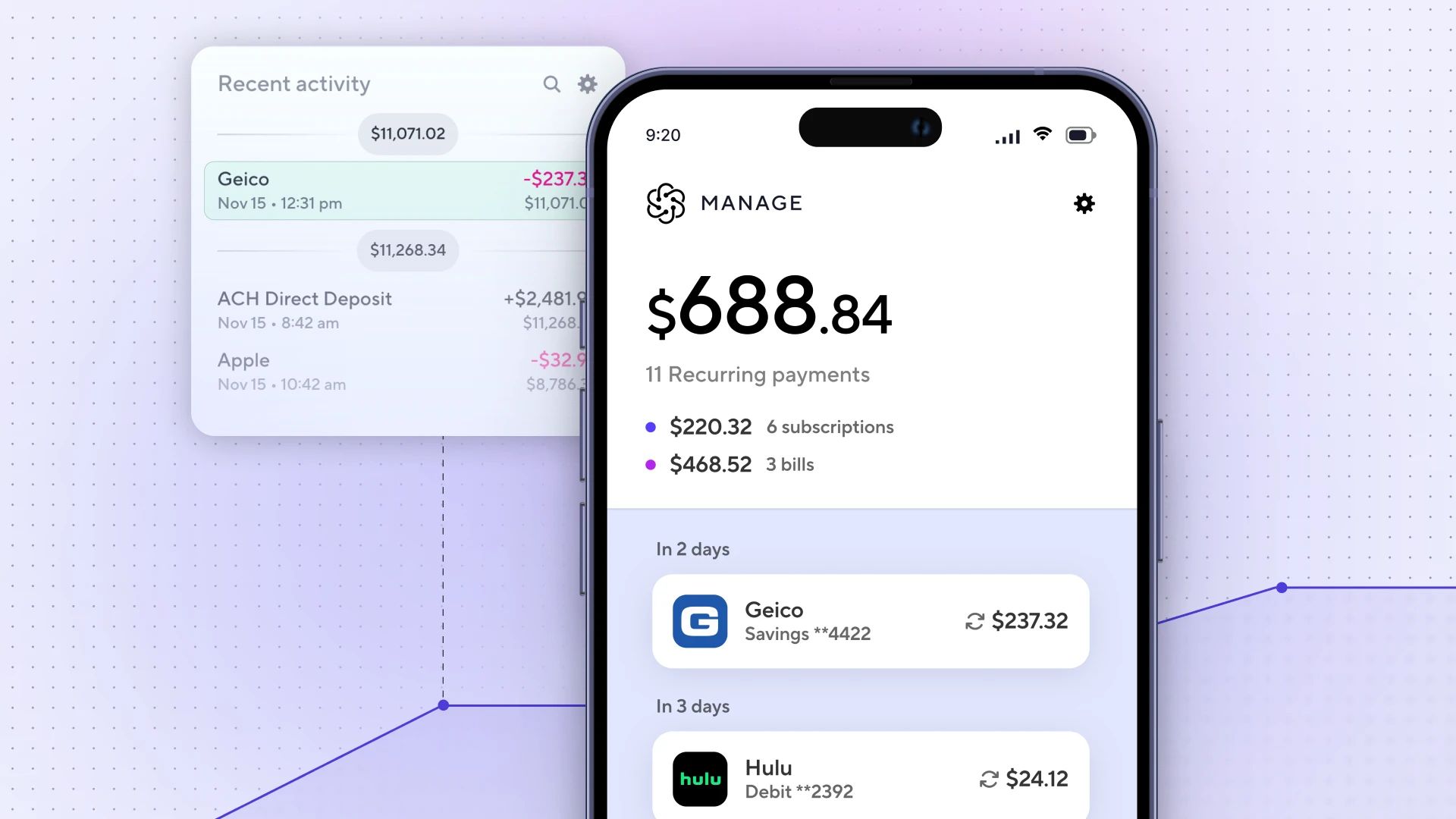

Meanwhile, fintech challengers continued to raise funding at record pace including, three Gen Z neobanks that collectively announced raising $580 million in a single day. (Listen to Episode II of our podcast for all the details). As we emerge from the pandemic, fintech challengers need to shift customer acquisition strategies from fully-digital to omnichannel, without burning fresh war chests on sales and marketing.

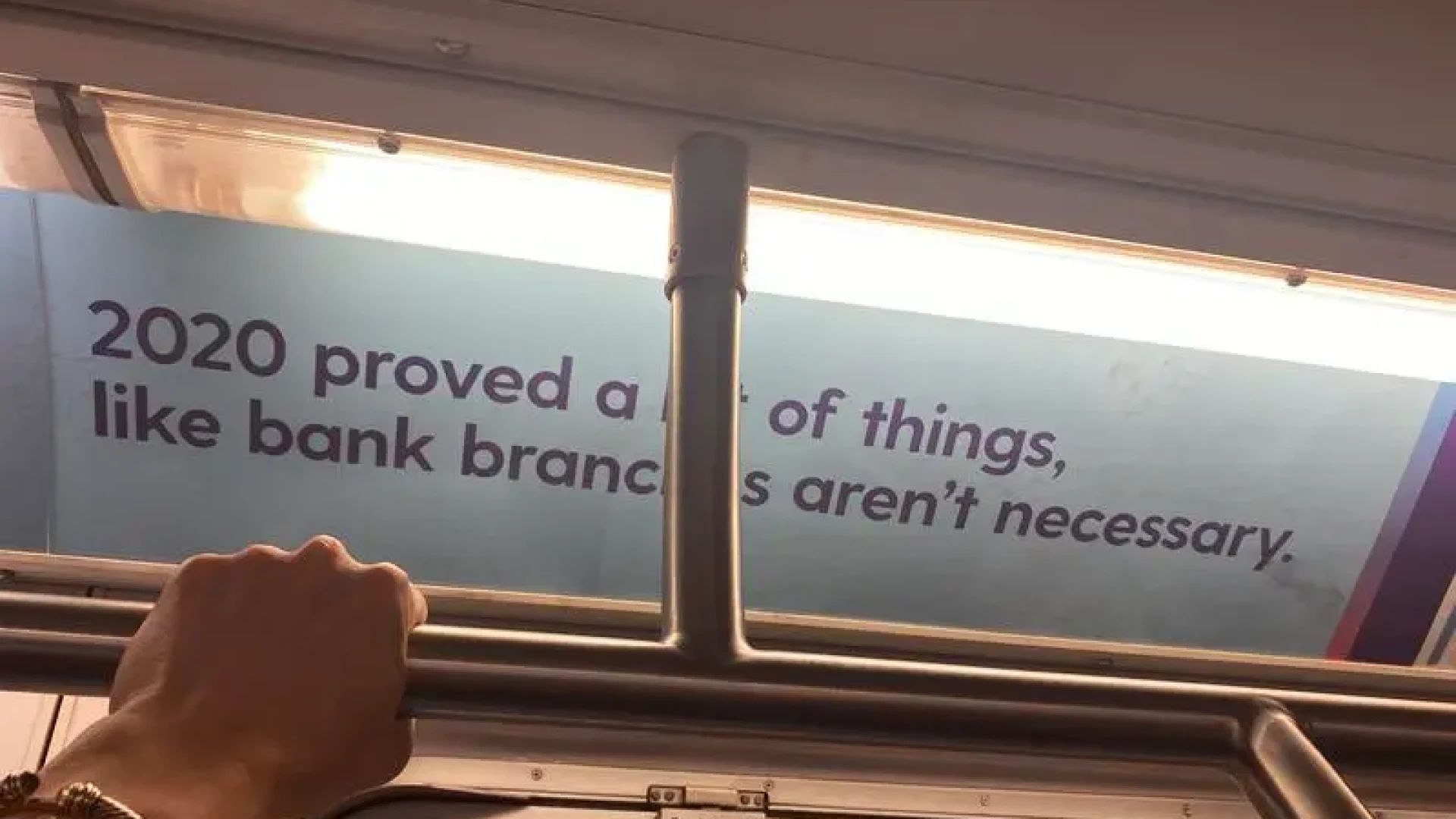

We believe the future is bankless accounts enabled by APIs, akin to Henry Ford’s horseless carriage, and it’s here now. 2020 rendered branches irrelevant and despite adapting to the “innovate or die” philosophy of fintech, banks are debating the past. In time however, we’ll evolve entirely from the branch-based model to mobile-first, as it’s already happening now.

In the first edition, we’re sharing our latest Insights briefs including:

- Meet the Atomic Advisory Board

- Our outlook on Open Banking in our feature interview with FT Partners

- Answer “What is payroll coverage and how Atomic built and maintains 165+ payroll integrations

- Our podcast on news(ish) fintech trends

- and market research we’re reading this Memorial Day Weekend

Stay well,

Lindsay

P.S Cheeky challenger bank subway campaigns are back, nature is healing.

P.P.S Want to receive these insights direct to your inbox?