Unifimoney is on a mission to empower millions of high-earning millennials to simplify money management in order to build their long-term wealth. Launched in 2019, the San Francisco-based, early-stage fintech offers a single mobile account—an “all-in-one” platform—that seamlessly integrates a high-yield checking account, a credit and debit card, and investing. The platform enables easy access to alternative assets, including crypto and precious metals, as well as commission-free trading of thousands of stocks and ETFs.

“Most people are not managing their money very well,” observes founder and CEO Ben Soppit. “We use automation and product design to help them to do better with minimum effort.”

“We need new platforms to be fully functional with no surprises or fixes once they go live with our customers. The Atomic integration was one of the most efficient we have done.”

Ben Soppit, Founder and CEO, Unifimoney

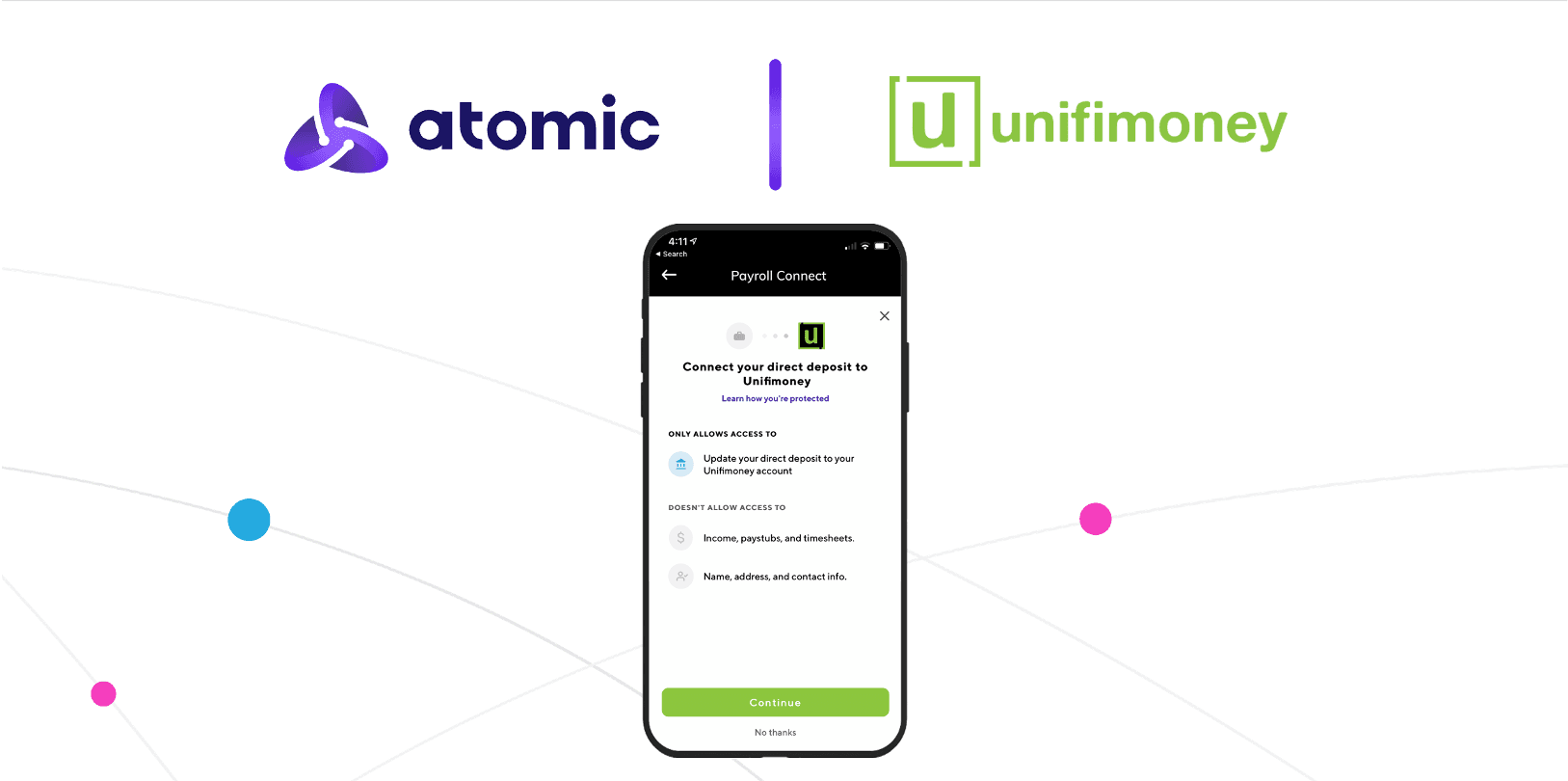

As part of its vision to deliver comprehensive money management capabilities through a single platform, Unifimoney integrated Atomic’s market-leading payroll connectivity solution into its offering. Among other features, the Atomic API-powered solution enables users to set up and modify payroll direct deposits quickly and easily, circumventing the cumbersome paper-based processes in place at so many employers and giving them more control over their earnings and paycheck data.

“We aim to provide customers with the tools to facilitate their ongoing journey in managing, protecting and growing their wealth,” Ben explains. “We also want to give them choices. Whether it’s ease in switching their salary deposit or a portion of it between their incumbent bank and Unifimoney, or setting up automated rules to move money between accounts, the Atomic solution enables us to give them that flexibility. New customers may want to try us for a while before consolidating all their assets into Unifimoney. We get that.”

Ben and his team reviewed other payroll connectivity options in the market, and ultimately determined Atomic was the best fit. “The time and effort required to integrate new platforms is an important consideration for us,” he says. “We need those platforms to be fully functional with no surprises or fixes once they go live with our customers. The Atomic integration was one of the most efficient we have done,” he adds. “Happy to say it worked right out of the box.”

Atomic and Unifimoney share the goal of simplifying money management for consumers through automation, whether that means instantly earning interest on their paychecks or sweeping loose cash into a robo-fund. “We don’t believe that the future is using 10 to 15 apps to manage your money,” Ben says. “We do believe technology is the best way to do the boring but essential repetitive tasks involved in money management, automatically and by default. Long-term our users can achieve a better return on their money with less effort. Solving for this alone could create $20 trillion in value for millennials as a generation over their working lives.”