Earned Wage Access (EWA): Financial Wellness and Loyalty

Kaylee Veintimilla

Manager, Brand Marketing & Events

Financial challenges faced by employees in today’s world can significantly impact their overall well-being and productivity. Living paycheck to paycheck and struggling to cover unexpected expenses can cause stress and anxiety. This makes it challenging for employees to focus on their work. As a solution to these problems, employers are turning to Earned Wage Access (EWA) services to help their employees gain financial stability and promote employee loyalty.

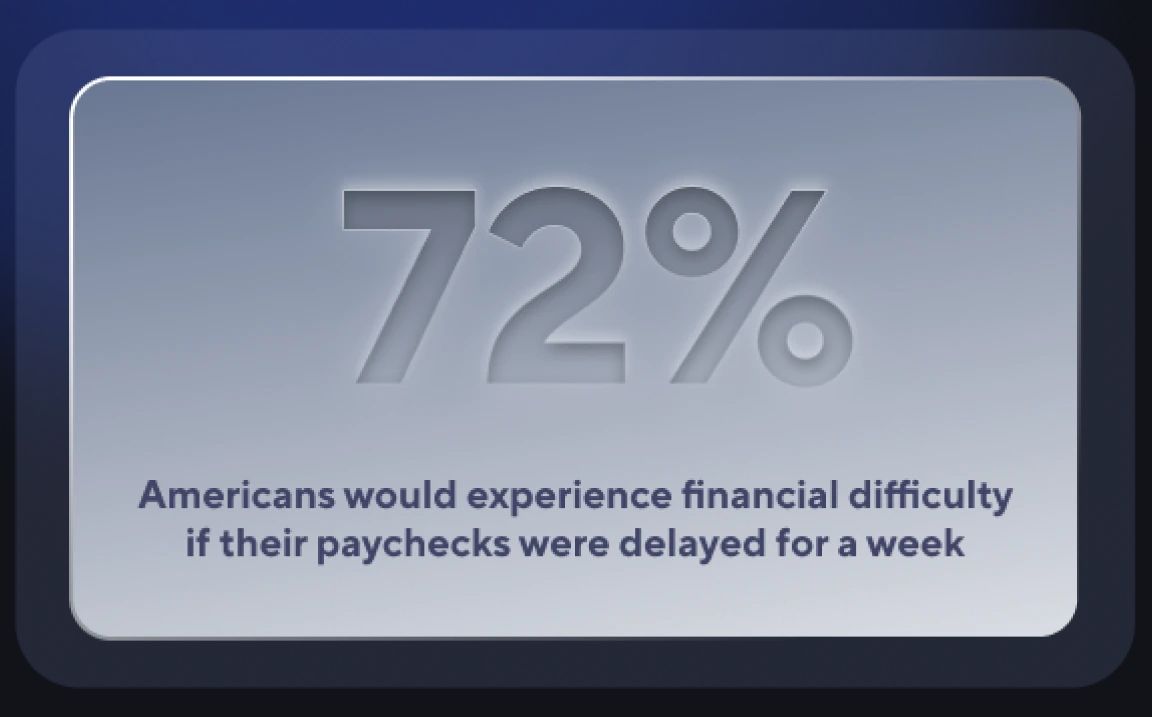

Recent surveys indicate that 72% of Americans would experience financial difficulty if their paychecks were delayed for a week, according to results from the 2022 “Getting Paid In America” survey conducted by the American Payroll Association (APA). This is a 9% increase from the survey they conducted back in 2021, highlighting a significant need for financial solutions such as EWA.

EWA allows employees to access a portion of their earned wages before payday. This helps them avoid costly payday loans and overdraft fees. This concept has gained popularity in recent years as a response to the financial struggles faced by many workers. The COVID-19 pandemic further accelerated its adoption.

Benefits of EWA for Employers

Employers can benefit from offering EWA services in several ways.

- Addressing financial stress: EWA meets the financial needs of employees, providing them with the resources they need to meet their financial obligations and alleviate the stress of living paycheck to paycheck. This, in turn, can improve employee satisfaction and morale, leading to increased loyalty and retention.

- Providing financial flexibility: EWA services allows employees to access their earned wages when they need them, which can help them manage unexpected expenses, avoid high-cost loans or credit cards, and avoid late fees or overdraft charges. This can provide employees with greater financial flexibility and reduce their reliance on debt.

- Demonstrating care for employees: By offering EWA, employers can demonstrate that they care about the financial and overall well-being of their employees. By actively demonstrating support for employees’ financial journey, employers foster trust and loyalty among their workforce.

- Encouraging financial responsibility: EWA services can also be used to encourage financial responsibility among employees by providing them with access to their earned wages in a responsible and sustainable way. This can lead to increased loyalty and trust among employees.

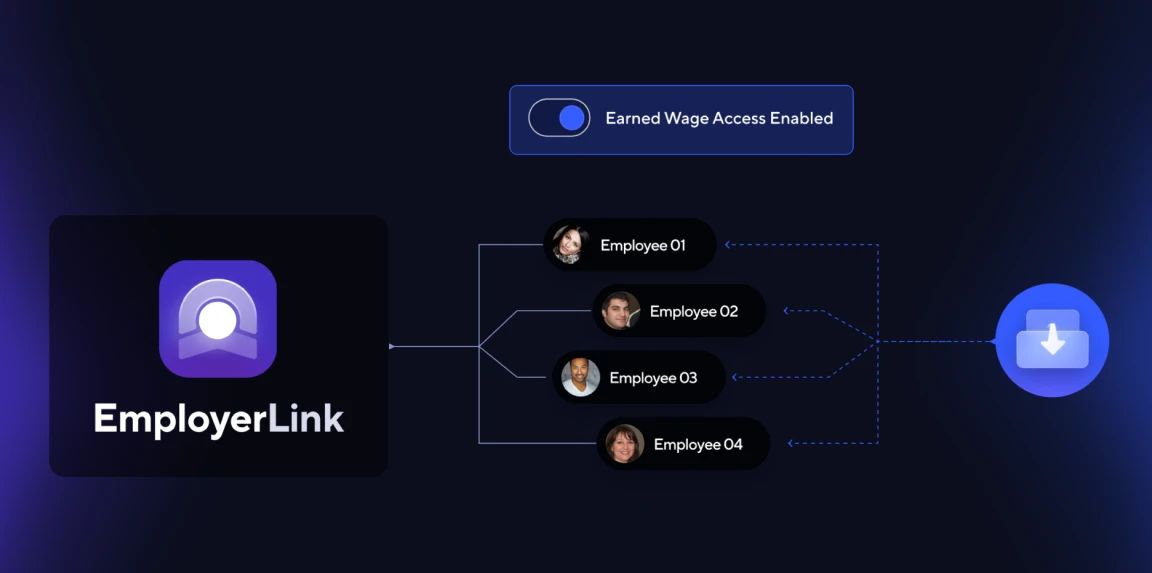

Atomic’s EmployerLink solution provides the robust infrastructure for EWA solutions, allowing other technology companies to implement a fully automated, secure, and scalable EWA program quickly and easily. Atomic’s SDK streamlines integrations with payroll, HRIS, and time and attendance systems, with employer-permissioned access. This enables EWA providers to onboard businesses in days, instead of weeks or months.

Atomic’s EmployerLink Solution: Empowering EWA Implementation

One downside of employer-sponsored EWA programs is customer churn when employees leave their supported employer. Atomic’s UserLink solves this by providing the option to connect time, attendance, and payroll data from their employer directly. This unique feature allows EWA providers to maintain relationships with consumers across job changes.

The EmployerLink EWA solution eliminates the need to build integrations with each payroll provider, providing instant access to Atomic’s entire network of connections. By utilizing Atomic’s SDK, EWA providers can focus on what matters. Reducing time to market, enhancing data security, and providing a developer-friendly interface become a priority. A user-friendly interface simplifies HRIS and time and attendance system integration for employers. This eliminates the need for complex software setup and IT involvement.

Interested in learning more?

To learn more about how Atomic can power your Earned Wage Access solution visit our solutions page or book time with our team here.