Atomic’s payroll APIs connect consumers to their paycheck and financial data trapped in payroll systems.

This is one of the fundamental problems Atomic is solving for customers that we discuss with FT Partners in the state of Open Banking report. The conversation covers macro-economic drivers for open banking-type regulations, tailwinds for fintech, and how Atomic is rearchitecting the financial landscape, among other key topics below.

Key topics in the state of Open Banking report

- The fundamental problems Atomic is solving for fintech, financial services providers, and consumers by unlocking access to payroll systems

- How open banking-type regulations benefit payroll APIs by creating a pro-fintech environment

- How Atomic differentiates among the landscape of open finance and embedded finance companies

- Some learnings from launching a minimum viable product during a pandemic

- Our 5-10 year vision to build more onramps to financial services for consumers

The open banking and embedded finance landscape is booming

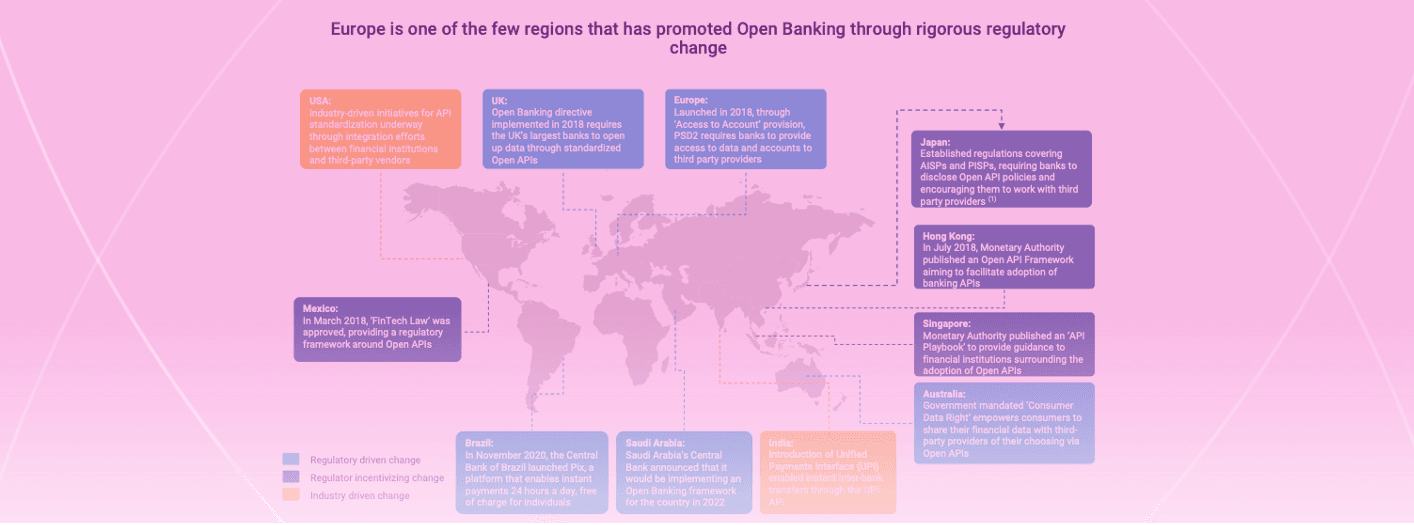

Open banking-type regulations have lowered barriers for new infrastructure technology companies to enter the financial services market. As regulations or frameworks spread globally, they are fostering innovation that has led to a robust landscape of open finance and embedded finance companies.

Open banking is a catalyst for fintech

A tailwind of open banking regulations that stands to benefit Atomic’s payroll API market is a pro-fintech environment. An open environment would be a catalyst for fintech formation, similar to what has happened in Europe with PSD2 and Open Banking regulations.

Regulation adjacent to open APIs that stands to benefit Atomic more is the CFPB’s final rule for Consumer Access to Financial Records authorized by Congress under Section 1033 of the Dodd-Frank.

Atomic submitted a comment letter supporting data access rights for consumers in response to the bureau’s Advance Notice of Proposed Rulemaking (ANPR). We also encourage including consumer’s payroll information in those rights because it impacts millions of “thin-file” and “credit invisibles.” Further, it produces concrete advantages for consumers.

Our outlook on the payroll API market

Our vision is to build more on-ramps to financial services as the infrastructure layer connecting fintech, consumers, and their paychecks.

Our traction with 10 of the top neobanks in the US is a positive signal we are building towards that vision. We crossed the first 100,000 consumer milestone for our direct deposit product ahead of our Q2’21 forecast and are focused on improving our employer and payroll coverage to empower millions more.

You can read the full interview in FT Partners Open Banking report and if you’d like to find out more about how Atomic’s payroll API can benefit your business, request a demo today.